China’s Xi speaks with Trump by phone, discusses Taiwan and bilateral ties

- Historical trends reveal that certain sectors thrive during wartime.

- A balanced portfolio focused on defensive assets can mitigate risks while capitalizing on growth.

- Understanding which sectors perform well during conflicts can guide smart investment decisions.

War often brings uncertainty to global financial markets, but savvy investors can find hidden opportunities in the chaos. By analyzing historical trends, we can uncover the best investment strategies for navigating conflicts.

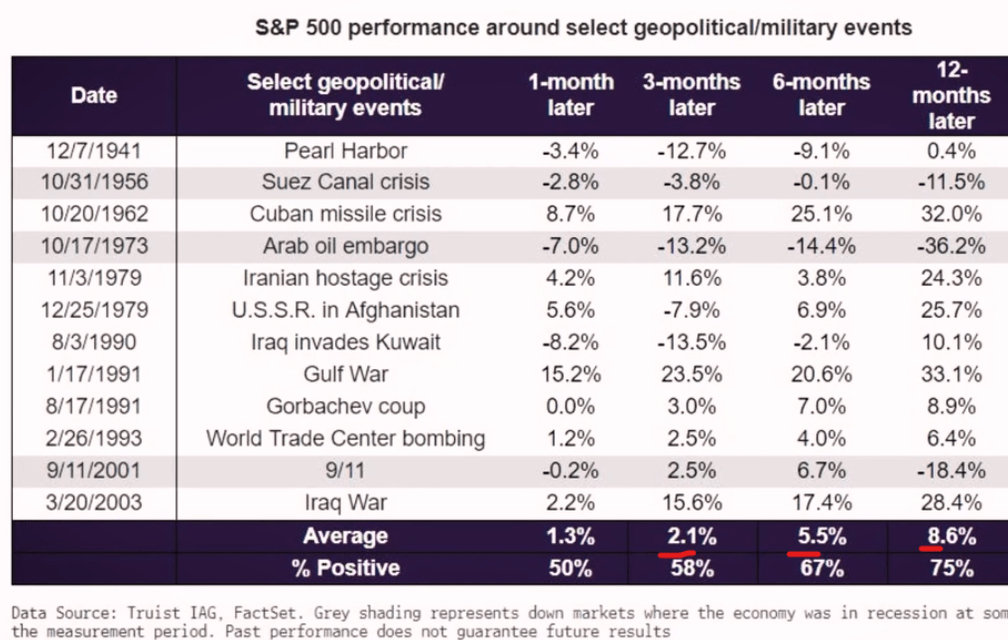

First, let’s debunk a common myth: markets don’t always decline during wars. In fact, history shows that S&P 500 often performs well during these turbulent times. As illustrated in the chart below, wartime markets have delivered surprising resilience.

Best-Performing Sectors During Conflict

Certain sectors consistently shine during conflicts. Gold, the ultimate safe-haven asset, sees notable gains during geopolitical instability. For instance, it surged 70% during World War II (1939-1945) and spiked 16% during the 2014 Crimean crisis.

The defense sector also tends to outperform, fueled by increased military spending. During the Gulf War (1990-1991), defense stocks outpaced the S&P 500 by 30%. More recently, following the 2022 conflict in Ukraine, the S&P Aerospace & Defense Select Index rose 12%, while the broader S&P 500 fell by 19%.

Energy prices, particularly in oil and gas, frequently surge amid conflicts due to supply disruptions. The Yom Kippur War in 1973 triggered a 400% spike in oil prices, while energy stocks outperformed the S&P 500 by 25% during the Gulf War’s first six months.

Commodities, especially essential goods like food and pharmaceuticals, tend to remain stable during wars. Consumer staples (NYSE:XLP) returned an average of 5.3% per year during World War II and outperformed the market by 15% during the 2008 financial crisis, which coincided with regional conflicts.

Government Bonds: A Safe Bet

Government bonds from stable nations become especially appealing during times of war. During the Korean War, U.S. Treasuries offered an annual yield of 2.5%, providing investors with a reliable haven. In 2022, as tensions in Ukraine escalated, demand for German Bunds surged by 22%, underscoring their appeal during geopolitical turmoil.

Which Sectors Tend to Outperform?

Historical data shows that defensive sectors outperform the broader market by 8.5% during conflicts, with market impacts lasting 6 to 18 months.

Building a Hypothetical "War" Portfolio

Based on historical trends, a balanced wartime portfolio might include:

- 30% in government bonds

- 25% in defensive stocks (e.g., consumer staples, healthcare)

- 15% in gold and precious metals

- 10% in energy stocks

- 10% in defense stocks

- 10% in cash for liquidity

This allocation balances safety with growth potential, positioning investors to capitalize on wartime opportunities.

Bottom Line

While war presents challenges, it also opens unique opportunities for those who understand historical patterns and market behavior. A cautious, well-diversified approach is key, and while investing in times of conflict, never lose sight of the ultimate driver of economic growth: peace and stability.

***

Disclaimer: The information provided in this article is for educational purposes and does not constitute financial advice. We recommend that you consult a professional before making investment decisions.