IonQ CRO Alameddine Rima sells $4.6m in shares

When it comes to the financial markets, investors have a litany of investment vehicles to choose from. The choices are nearly unlimited, from brokered certificates of deposit to complex derivative instruments.

Of course, investment vehicles’ proliferation comes from investors’ demand for everything from excess benchmark returns to income generation to downside protection.

Of course, every investor wants “all the upside, with none of the downside.” While there are vehicles, like indexed annuities, that can provide no downside risk, they cap the upside return. If you buy an index fund, you can get “all the upside” and “all the risk.”

However, an email from a reader last week got me thinking about the perfect “investment vehicle” and the search for the “holy grail” of investing.

“My wife and I are looking for a place to position some of our ’emergency funds’ for a better return. Our requirements are pretty simplistic:

- Guarantee at least a 4% rate of return.

- Allow me to withdraw cash without penalty when needed.

- Reinvest all income

- If bond yields decline as expected, the value of the investment increases.

At this point, I was confident in just suggesting purchasing a 10-year Treasury bond. At current rates, the investment would yield greater than 4% and guarantee the principal. If yields decline, the bond rises in price, reinvestment of income is an option, and the investment is highly liquid.

Theoretically, this would be the “perfect investment” vehicle for their needs. I said “theoretically” because they added one more requirement just as I was about to spout off my terrific idea.

“Oh, and one more thing, the dollar value of the account must remain stable at all times.”

And that, as they say, quickly ended the “perfect investment” vehicle for their needs.

Why did the addition of “price stability” make their request impossible?

The 3 Components Of All Investments

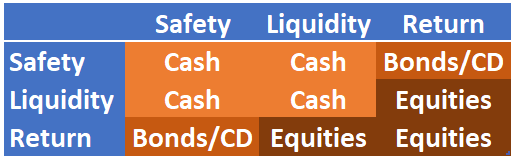

In portfolio management, you can ONLY have two of three components of any investment or asset class:

- Safety – The return of principal without loss due to price change or fees

- Liquidity – Immediately accessible without penalties or fees

- Return – Appreciation in the price of the investment

The table below is the matrix of your options.

The takeaway is that cash is the only asset class that provides safety and liquidity. Safety comes at the cost of return. Equities are liquid and provide returns but can suffer a significant loss of principal. Bonds can offer returns through income and safety if held to maturity. But in exchange for that safety, investors must forego liquidity.

In other words, no investment can provide all three factors simultaneously. While the table above uses only Equities, Bonds, and Cash, those three factors apply to any investment vehicle you may consider.

- Fixed Annuities (Indexed) – safety and return, no liquidity.

- Certificates of Deposit – safety and return, no liquidity.

- ETFs – liquidity and return, no safety.

- Mutual Funds – liquidity and return, no safety.

- Real Estate – safety and return, no liquidity.

- Traded REITs – liquidity and return, no safety.

- Commodities – liquidity and return, no safety.

- Gold – liquidity and return, no safety.

You get the idea.

Let’s revisit our email question.

While I initially focused on the cash requirements, these were also funds set aside for an “emergency.” In other words, these funds must be readily available when an unexpected event arises. Since “unexpected events” tend to happen at the worst possible time, these funds should never be put at risk. The need for “safety” and “liquidity” eliminates the third factor: Return.

No matter what investment vehicle you choose, you can only have two of the three components. Such is an essential and often overlooked consideration when determining portfolio construction and allocation.

8 Reasons To Focus On Liquidity

Liquidity is the most essential factor in making any investment. Without liquidity, I can not invest. Therefore, liquidity should always remain a high priority when managing your portfolio.

I learned a long time ago that while a “rising tide lifts all boats,” eventually, the “tide recedes.” Over the years, I made a straightforward adjustment to my portfolio management, which has served me well. When risks begin to outweigh the potential for reward, I raise cash.

The great thing about holding extra cash is that if I’m wrong, I simply make the proper adjustments to increase the risk in my portfolios. However, if I am right, I protect investment capital from destruction and spend far less time ‘getting back to even.’ Despite media commentary to the contrary, regaining losses is not an investment strategy.

Here are 8-reasons why you should focus on liquidity first:

1) We are speculators, not investors. We buy pieces of paper at one price with hopes of selling at a higher price. Such is speculation in its purest form. When risk outweighs rewards, cash is a good option.

2) 80% of stocks move in the direction of the market. If the market is falling, regardless of the fundamentals, the majority of stocks will decline also.

3) The best traders understand the value of cash. From Jesse Livermore to Gerald Loeb, each believed in “buying low and selling high.” If you “sell high,” you have raised cash to “buy low.”

4) Roughly 90% of what we think about investing is wrong. Two 50% declines since 2000 should have taught us to respect investment risks.

5) 80% of individual traders lose money over ANY 10-year period. Why? Investor psychology, emotional biases, lack of capital, etc. Repeated studies by Dalbar prove this.

6) Raising cash is often a better hedge than shorting. While shorting the market, or a position, to hedge risk in a portfolio is reasonable, it also merely transfers the “risk of being wrong” from one side of the ledger to the other. Cash protects capital and eliminates risk.

7) You can’t “buy low” if you don’t have anything to “buy with.” While the media chastises individuals for holding cash, it should be somewhat evident that without cash you can’t take advantage of opportunities.

8) Cash protects against forced liquidations. One of the biggest problems for Americans is a lack of cash to meet emergencies. Having a cash cushion allows for handling life’s “curve-balls,” without being forced to liquidate retirement plans.Layoffs, employment changes, etc. are economically driven and tend to occur with downturns that coincide with market losses. Having cash allows you to weather the storms.

Importantly, I want to stress that I am not talking about being 100% in cash.

I suggest that holding higher cash levels during periods of uncertainty provides both stability and opportunity.

With the political, fundamental, and economic backdrop becoming much more hostile toward investors in the intermediate term, understanding the value of cash as a “hedge” against loss becomes much more critical.

Chasing yield at any cost has typically not ended well for most.

Of course, since Wall Street does not make fees on investors holding cash, maybe there is another reason they are so adamant that you remain invested all the time.