Nvidia shares pop as analysts dismiss AI bubble concerns

The government has reopened and the task of piecing together the missing economic data points has started. Early clues suggest that hiring slowed in October. Meanwhile, the Labor Department will release its delayed payrolls report for September tomorrow.

Reviewing a bit of new continuing claims data from the Labor Department, Reuters reports:

“The number of Americans on jobless benefits surged between mid-September and mid-October, government data showed on Tuesday, suggesting an elevated unemployment rate in October as an uncertain economic environment discourages hiring.”

Fed Governor Chris Waller weighed in this week and cited “eye-popping” lay-offs from major companies and a slump in consumer confidence. He added:

“I am not worried about inflation accelerating or inflation expectations rising significantly. My focus is on the labor market, and after months of weakening, it is unlikely that the September jobs report later this week or any other data in the next few weeks would change my view that another cut is in order.”

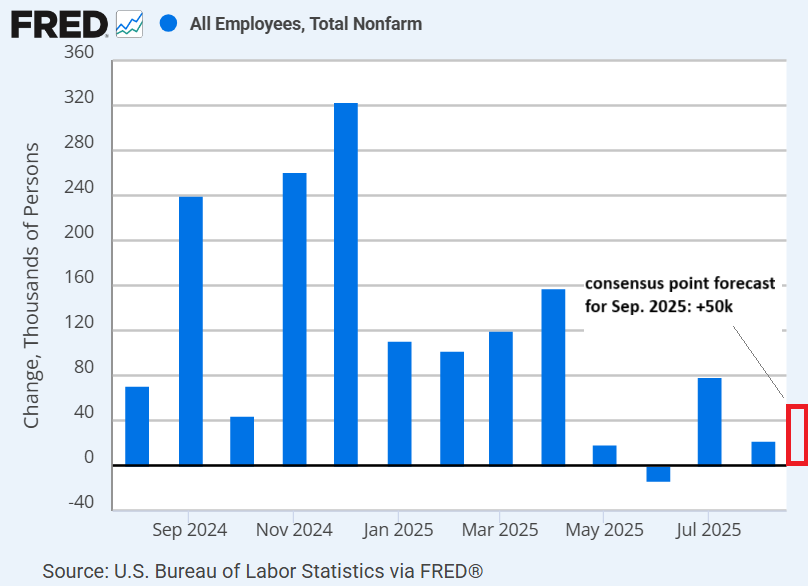

The view of economists for Thursday’s release of payrolls data for September indicates that hiring picked up modestly, albeit from a sluggish level. Econoday.com’s consensus point forecast calls for a 50,000 increase in non-farm payrolls. That’s an improvement from August’s weak 22,000 increase, but not by much. If correct, the September update will slign with signs of a slowing labor market in October via other sources.

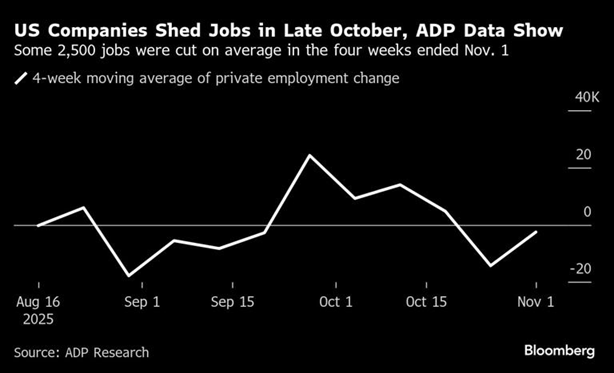

ADP’s weekly employment report, for instance, shows that US companies cut 2,500 jobs per week on average in the four weeks through Nov. 1.

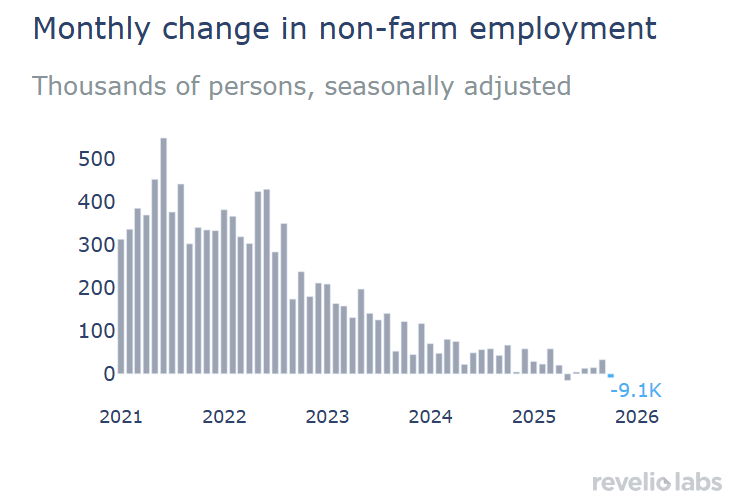

Revelio Labs says payrolls for October fell by 9,100, according to its estimate.

Although the Fed’s Waller has been leaning in favor of additional cuts, disagreement among Fed officials has widened lately as concerns about inflation persist.

“It’s reflective of a ton of uncertainty,” said Luke Tilley, chief economist at M&T Bank. “It’s not surprising at all that there’s a wide divergence of opinions.”

Fed Chairman Powell signaled the fuzzy outlook for policy recently, noting:

“A further reduction in the policy rate at the December meeting is not a foregone conclusion—far from it,” he said late last month. “Policy is not on a preset course.”

Markets will be keenly focused on Thursday’s payrolls report for deciding if Powell’s guidance is due for an update.