Bill Holdings jumps amid reports payments firm is exploring potential sale

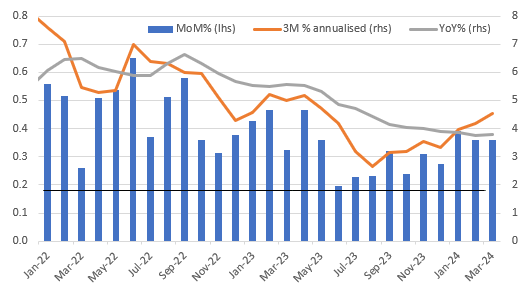

US inflation came in at 0.4% MoM for the third consecutive month, more than double the rate we need to consistently hit to bring inflation down to 2% YoY. Expectations for a June Federal Reserve interest rate cut have collapsed with the higher-for-longer narrative on rates firmly in place. September is going to be the earliest opportunity for any policy-easing.

US Inflation Remains Too Hot for Comfort

US core consumer price inflation came in at 0.4% month-on-month, above the 0.3% consensus – only one forecaster predicted such an outcome so just like last Friday's jobs report this is another significant upside surprise that should quash expectations of a June Federal Reserve interest rate cut. 15bp of cuts were priced ahead of time, but this has now collapsed to just 5.5bp. We have two more jobs reports and two CPI reports, but to deliver a June cut we would likely need to see payrolls growth drop closer to 100k and both core CPI prints to come in at 0.2% MoM – the latter of which is on the day of that 12 June FOMC meeting.

The details show the 0.4% MoM core increase was 0.359% to three decimal places so we weren't a huge distance away from 0.3%, but this is still far too hot for the Fed. We need to ideally hit 0.17% MoM each month to bring us down to 2% year-on-year over time, so we are still running at double the pace we need to be at.

Core CPI MoM%, 3M Annualised and YoY% Changes

Source: Macrobond, ING

No Rate Cuts Before September

The strength was caused by the supercore services (services ex energy, ex housing), which rose 0.65% MoM with medical care services jumping 0.6% MoM and transport services increasing 1.5% MoM (led by a 1.7% jump in maintenance and a 2.6%MoM/22.2%YoY increase in vehicle insurance). The cost of shelter rose 0.4% while a 1.1% increase in energy costs and a 0.1% increase in food meant headline inflation also rose 0.4% MoM (0.378% to three decimal places). There was better news for car buyers with new and used vehicle prices both falling while recreation prices and airline fares both fell for the first time since November.

Given this situation, a June rate cut is not happening, barring a rapid reversal of fortunes for the economy. July is also doubtful, meaning September is the more probable start point of any easing, which would limit the Fed to a maximum of just three rate cuts this year.

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more