Tyson Foods to close major Nebraska beef plant amid cattle shortage - WSJ

I was recently honored to be a featured speaker, as well as a gold market panelist, at the 50th anniversary of the New Orleans Investment Conference. So, what follows is a slightly modified version of the presentation I gave during my featured speech.

For those of you who do not know me, my name is Avi) Gilburt, and I am what you would call an Elliott Wave analyst.

What that means is that I view markets as being fractal, with the fractals representing overall societal sentiment. It also means that I believe that societal sentiment is what drives markets, rather than the exogenous factors that most investors and analysts follow.

While I know that may sound quite controversial, I will simply note that there have been many empirical and market psychology studies conducted over the last 30 years that support the claim I just made.

I won’t bore you with citing the many studies which support my assertion, but I will cite one study entitled “Large Financial Crashes,” published in 1997, wherein the authors concluded the following:

Now, I want to also note that my analysis has led to some crazy market calls. In fact, quite a number of my market calls have been called such things as “voodoo,” “absurd,” “crazy,” and “insane” during the last 13 years in which I have been making public market calls.

While I will not be citing them all, or else we could be here for quite some time, I do want to present two of such calls simply to illustrate why many have viewed some of my market calls as sounding outright crazy.

I would like to start with the Covid Crash. On November 24th of 2019, I published an article entitled Sentiment Speaks: Early 2020 Will Signal A 30% Stock Market Move.

My primary expectation, which was presented to my clients at the time, was for the S&P 500 to drop down to the 2200SPX region from the low 3000 region. Now, consider that this was before anyone considered or even heard the word Covid. That alone was considered quite crazy by many.

As we now know, the SPX topped in early 2020, and we saw a 36% decline in the SPX. While I was calling for the 2200SPX region as our bottoming target, the market actually bottomed at 2187SPX. I was 13 points off.

But, the kicker was when we were approaching the 2200SPX target region, I outlined to our clients that it was time to load up on the long side, as I was looking for the market to rally north of 4000SPX from there.

Now, consider how truly crazy this was at the time. The world was falling apart, the highest death rates were being reported at the time, we were seeing economic shut-downs world-wide, and unemployment was hitting record highs - and a major market rally would begin imminently.

As you can see from this slide, when the market began to rally from our support point – most of the market did not understand what was happening. In fact, my own wife was questioning my sanity when I told her to put our children’s money in their 529 plans back into the market after I told her to take their money out at the end of 2019.

I am now going to show you two public comments which were posted in reaction to my article calling for that rally from 2200 to 4000+ - describing my analysis with various choice adjectives.

I am not going to read out the entire quote, but, as you can see from this slide, I highlighted his calling my rally expectation “silly” “absurd” “magic” and “insane.”

Now, this next comment was posted by another analyst on Seeking Alpha. The main lines I want to focus on in this quote are in bold.

“Here is the 2200 exactly that you said the S&P would bottom at before taking the trip back up to 4,000... The bull is dead, and so it can NEVER take us to 4000. What you predicted can NEVER come true now... So, you have [my] common sense view, or you can believe Avi (JO:AVIJ)'s chart magic will get you through all of that and is right about a big bounce off of 2200 all the way back up to 4,000.”

I think we all know how this crazy call eventually turned out.

I want to show you another crazy call, but this time in the gold market. For those that may remember 2011, gold was seeing a parabolic rally during the summer of that year. And, the only argument heard between investors and analysts at the time was how far beyond $2,000 gold was going to go.

Yet, I published the following market call on August 22 of 2011: A Different Perspective On A Top For Gold

“Again, since we are most probably in the final stages of this parabolic fifth wave “blow-off-top,” I would seriously consider anything approaching the $1,915 level to be a potential target for a top at this time.”

Now, in the comments section of my gold articles at the time, I was vilified and ripped to shreds for making such a crazy call. However, one person asked me where I see gold dropping to should it top at my target. My answer was the $1,000 region, and that call was made DURING the parabolic rally and before gold even topped.

As we now know, gold topped at $1,921 – within $6 of my target, and then bottomed a little over 4 years later at $1,050.

In fact, on December 30th, 2015, I urged investors to be moving back into the metals complex, as we were looking for a long-term bottom to be struck imminently due to the significant bearishness evident in the market:

Again, I want to basically explain that these types of prognostications can be made using Elliott Wave analysis due to its fractal means of tracking market sentiment, which is the underlying driver of markets. In fact, I made the gold market call for a top and the target for a low all based upon a 100-year Elliott Wave analysis I calculated.

Now, I am about to show you our 100+ year Elliott Wave analysis on the S&P 500, which will outline my next crazy market call as to where I foresee the S&P going.

But, before I show you the 100-year chart, I want to give you some very basic background on how to apply Elliott Wave analysis.

As I mentioned before, it is based upon market fractals which provide analysis of market sentiment. Now, when I say it is a fractal analysis, it means that it is variably self-similar at all degrees of trend.

So, what does that mean? Well, as you can see from the basic Elliott Wave construct, Elliott theorized that markets move in 5 wave structures. Three waves move in the direction of the trend, and two waves are counter-trend.

This is where the fractals come into play. As you can see from the chart, waves i, iii and v move in the direction of the trend. But, you can further break down waves i, iii and v into substructures of 5 waves each as well. As you can see from the chart, I used wave iii as an example, and show how that breaks down into a 5-wave structure itself.

But, we can do the same with waves i and v as well, and we can even do the same within waves 1, 3 and 5 within wave iii as well. In fact, you can do this ad-infinitum, as you scale down to the smaller and smaller degree structures.

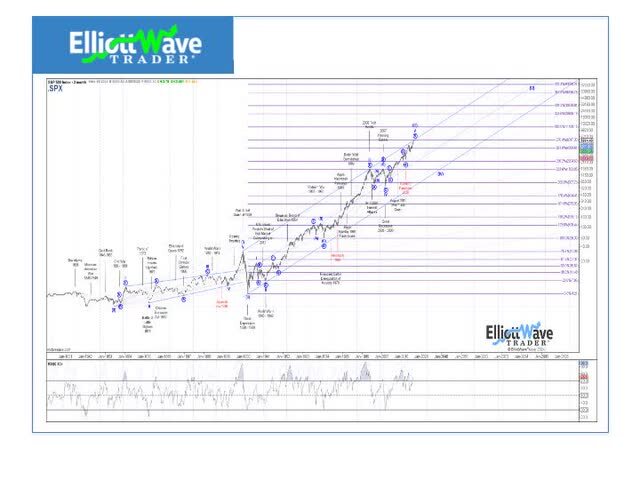

So, now that we have a basic understanding of Elliott Wave analysis, let’s look at the 100+ year chart of the S&P 500.

There are a few points I want to make about this chart.

First, take note of us approaching the completion of a 5-wave structure off the low struck after the 1929 market crash. That was a 2nd wave low, whereas we are now completing a 5-wave structure which culminates a multi-decade 3rd wave bull market structure. In fact, back in 1941, Ralph Nelson Elliott called for a 70+ year bull market, which is the best market call in history, bar none, as World War II was raging around him when he made this call. And, we are now completing that bull market as we approaching completion of the multi-decade wave [III].

Second, since I passed the CPA exam and have advanced legal degrees as a tax attorney, I know what comes after the number 3. That means that I am soon expecting a wave 4 counter-trend move to begin.

Third, since the consolidation between 2000-2009 was a 4th wave of one lesser degree, which took 9 years, I am expecting this larger degree 4th wave to likely take longer than that. Therefore, I expect this next major market correction to take between a Fibonacci 13-21 years.

Lastly, Elliott provided us with the theory of alternation. This theory compares the 2nd wave to the 4th wave within a 5-wave structure, and suggests that they will take shape differently. Since the 2nd wave was a straight down 80% correction which only took 3 years, it would suggest that the impending 4th wave will likely be a long and drawn out event, which also supports my expectation for a 13-21 year time-frame.

Now that I have explained my crazy stock market perspective, I will now explain my crazy gold perspective.

I want to start by explaining that the 4-year pullback we experienced between 2011 and the end of 2015 represented a 4th wave correction. That means we are likely within a 5th wave rally currently. And, due to time constraints, I am going to fast forward to the last segment of that 5-wave rally which began late in 2022. You can see my expectation presented to my clients at the end of 2022 from this chart:

As you can see, I was expecting a bottom in gold and the start to the next rally phase.

Then in late 2023, I outlined the strong rally I was expecting in 2024, and the market has followed through on that expectation quite nicely. Let me show you the chart as it looks today.

As you can see, I am still expecting this 5th wave rally to continue over the next 12-18 months before we complete the current 5-wave structure which began at the start of 2016.

I am also expecting the last segment of this rally to be parabolic in nature, as that is often how commodities complete their cycle. But, first, I am expecting to see a multi-month pullback/consolidation in 2025 before that final parabolic rally takes hold, and it may not complete until 2026.

Ultimately, my target now is the 3300-3400 region in gold for that final parabolic rally. But, as the pattern develops over the coming year, I will be able to refine that target.

But, I want to warn you. During that last parabolic rally that I expect in the coming 18 months, many will be calling for $5000 gold or maybe even more. But, when these 5 waves complete it will complete the cycle from the 2016 low, and then I am expecting at least a 5-8 year correction.

Since the 2011-2015 correction was a 4th wave of one lesser degree, then it is reasonable to expect the upcoming correction to take longer than that 4-year correction, based upon the principles I just noted about the S&P500 impending correction.

So, while I know you are hearing many that are looking for 5000, 7000, and even 10,000 in gold in this rally, I strongly doubt that potential at this time