InvestingPro’s Fair Value model captures 63% gain in Steelcase ahead of acquisition

The stock market forever surprises investors, but in the realm of risk, the future’s a bit less uncertain, at least sometimes. That’s hardly a silver bullet, but it helps manage expectations, especially when deciding when and if market sentiment has gone too far in one direction or the other.

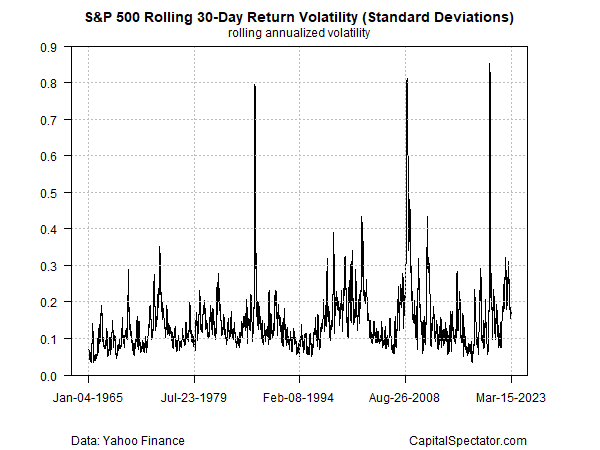

This line of analysis starts with two key empirical facts for one widely followed dimension of market risk: Return volatility has a periodic tendency to cluster and also cycles from high to low and back again through time. Consider how the S&P 500 Index’s 30-day return volatility ebbs and flows over the decades.

Periods of relatively low vol. are periodically interrupted by surges, which are almost always linked with market declines. The vol. spikes cluster – that is, episodes of high vol. often persist before cycling down to something approximating a “normal” state. The timing of this back and forth is hard to predict, although market history offers at least one useful piece of information on this front. The longer the market remains calm, the higher the probability that a surge is near.

The challenge is that the timing can vary, sometimes dramatically, so caution is always necessary to read the tea leaves in this corner. That said, it’s still useful to track vol. history in the search for perspective on how the current regime stacks up and what it implies or doesn’t about the near-term risk outlook.

On that point, market volatility has recently spiked and briefly clustered but has been sliding over the last several weeks and is currently approaching a normal range.

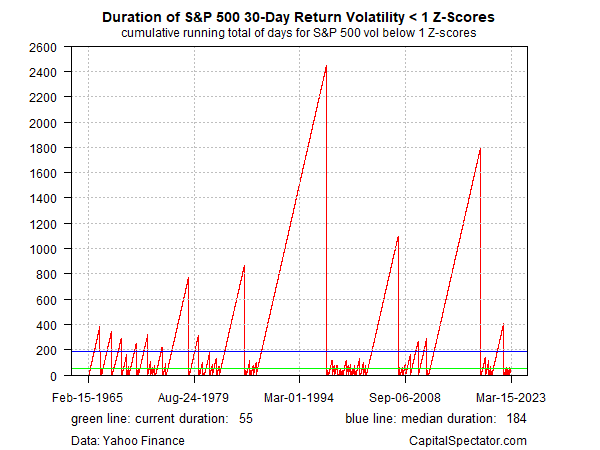

The trouble is that it’s hard to interpret the raw data for volatility in the cause of managing expectations for risk. For a deeper perspective, let’s graph the running sequence of days when vol. is below Z-scores of 1, a somewhat arbitrary proxy for identifying low-volatility regimes.

Note how the periods of low vol. vary with a key quasi-recurring feature that’s prevailed in recent decades. Namely, relatively short runs of low-volume regimes are periodically broken by relatively long runs of low-vol. The latest extended low-vol. regime ran for just over 400 trading days and ended in early 2022, just as last year’s market correction/bear market started.

One practical insight is the start of a new low-vol. regime – loosely defined in the chart above as durations above the long-run median of 184 trading days (blue line) – indicates that the market is increasingly vulnerable to a vol. spike, i.e., a sharp decline in stock prices that may endure over months or even years.

Most low-vol. regimes end soon after they extend above the median, but not always. The extreme outlier was the decade-long run that ended in 1998 — more than 2,400 days.

But let’s be clear: Monitoring vol. regime duration serves up imperfect information. Par for the course in modeling financial markets. But this much is obvious: When a low-vol. regime is above its median, it’s prudent to look for signs that period of calm is reversing, which is probably a sign of trouble ahead.