Marvell shares spike amid report SoftBank explored possible takeover

- Markets rallied as inflation continued to decline

- Fed is expected to pause today and hike in July

- CPI could drop in July because of the base effect, and it makes more sense for Fed to raise now and pause later

As expected, inflation showed no surprises, and as I predicted earlier, the base effect once again contributed to the decline in the headline CPI (+4.9% previous survey, +0.1% monthly change, -1% base effect = 4% total).

Naturally, markets rallied as S&P 500 broke above 4300. However, today's focus is on the Federal Reserve. Since March 2022, Powell has consistently raised rates.

So, what can we anticipate from this meeting?

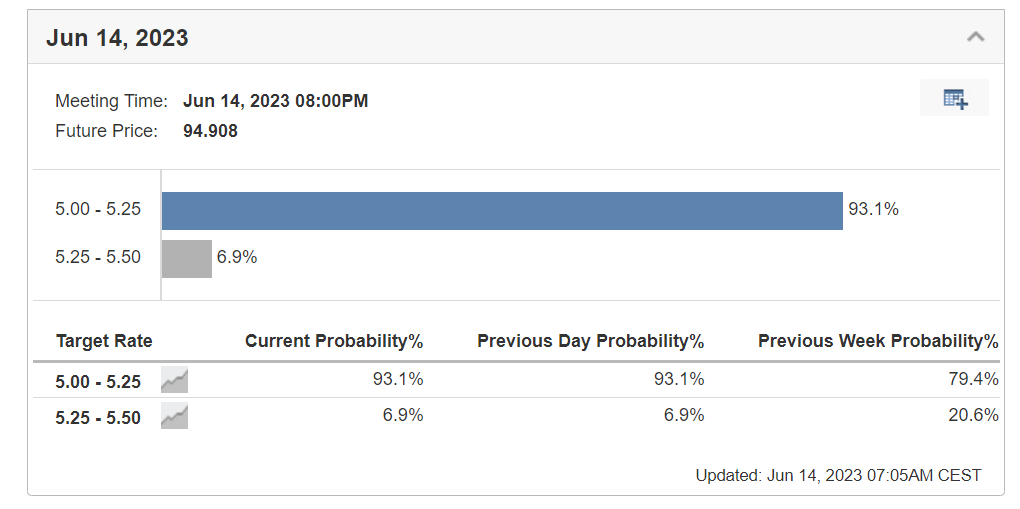

Source: Investing.com

Investing.com's Fed Monitor Tool indicates a 93% probability of a pause. So it seems that markets are pricing that in as an almost certain outcome, since inflation is continuing to fall.

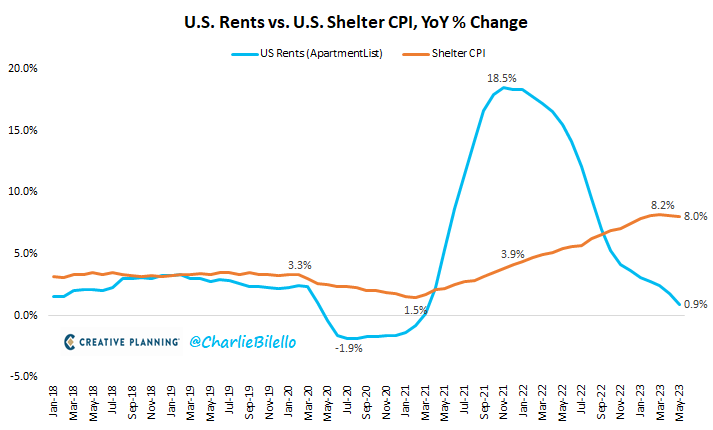

It's worth noting that the Shelter component of the CPI, which makes up approximately one-third of the total, has seen a decrease for two months in a row. This is a positive sign for July.

And, thanks to the base effect next month, which will be 1.3%, we should have a CPI of 2.9%. (+4% (last figure) +0.2% (assumption of the monthly change in July) - 1.3% = 2.9%)

Surprisingly, in July, we may witness a CPI that is even below 3%, edging closer to the Fed's target of around 2%.

So at this point, I'm going to go against the trend and ask you: Why are numerous media outlets and analysts suggesting a halt in June followed by a 0.25% hike in July when the CPI is expected to continue heading lower?

Doesn't it make more sense to raise now and then pause in July?

In this situation, it will be fascinating to see the market's reaction tonight, regardless of the Fed's decision. It's advisable to wait for the entire week to get a clear picture.

However, the assets that need to be monitored won't be the stock markets but:

An Intermarket analysis will help us see the situation more clearly. The markets have been going up, and if you remember, I am one of the few who has been optimistic in my previous analyses.

Going against the crowd can be tough emotionally, and we may see some significant declines along the way. But as long-term investors, we don't have any other choice if we want to be successful in the end.

The InvestingPro tools assist savvy investors in analyzing stocks. By combining Wall Street analyst insights with comprehensive valuation models, investors can make informed decisions while maximizing their returns.

You can conveniently access a single-page view of complete and comprehensive information about different companies all in one place, saving you time and effort.

Start your InvestingPro free 7-day trial now!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. As a reminder, any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remain with the investor. The author does not own the stocks mentioned in the analysis.