UnitedHealth tests AI system to streamline medical claims processing - Bloomberg

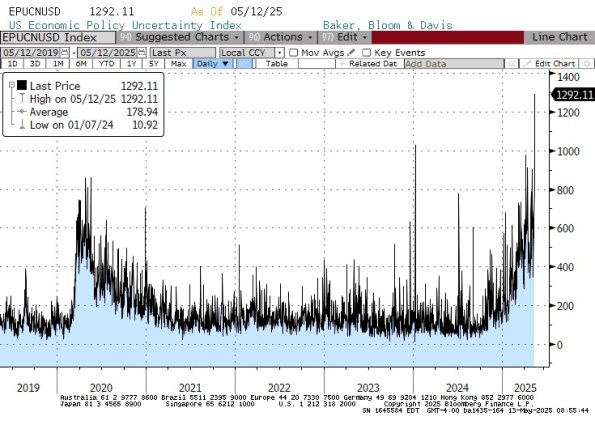

Before the CPI analysis, I always try to give some context for where we are in the ‘story’ about the evolution of inflation right now. It’s really difficult to do that, though, because of all of the massive policy changes that are happening – and often in opposite directions with respect to the effect on inflation. Here is the Baker, Bloom & Davis Economic Policy Uncertainty Index, which is derived by scraping news sources. Even strong supporters of President Trump’s have to admit that his Administration has been a whirlwind on economic policy (for many of them, of course, that’s a feature and not a bug).

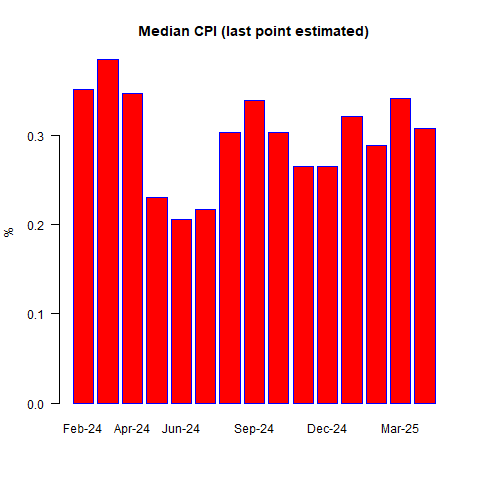

Here goes, anyway. Remember that last month, core CPI crashed but Median CPI actually accelerated. This kept us from actively celebrating the great inflation news; we knew that the good news was concentrated in a few one offs. In particular, Airfares (-5.3% for March), Lodging Away from Home (-3.5%), Used Cars (-0.69%), Car and Truck Rental (-2.66%), and Medicinal Drugs (-1.30%). But, as Median showed last month, there was really no reason to think that inflation was behind us…even before any effect from tariffs.

Speaking of tariffs, prior to this month we hadn’t really expected to see any effect yet and most economists thought that we shouldn’t see that much impact in the April figures either since the big tariffs on everyone went into place early in that month. However, remember that Mexico, Canada, and China had all faced escalating tariffs prior to April, so if there is going to be an impact we should expect to see something soon. I don’t expect a lot in most categories, but some impact in a few. It will be hard to discern how much of any monthly price change is tariffs, of course. We will look at Apparel, where demand elasticity in the short run is not terribly low.

Broadly, though, remember that demand elasticity and foreign content percentage are both important…and foreign content in most goods is pretty low. I’d also look to Medicinal Drugs, since a lot of APIs are China-sourced and the demand for many drugs is pretty inelastic in the short-run, but I didn’t expect a lot of impact there (pharma companies will have had inventories), and going forward it will be muddied by Trump’s announcement of the Most-Favored-Nation policy in pharmaceuticals.

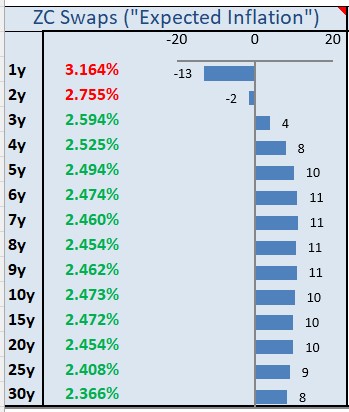

Speaking of that announcement, this month’s review of changes in inflation swap levels is seriously polluted because that announcement combined with the 90-day pause on China tariffs caused a massive crash in 1-year inflation expectations.

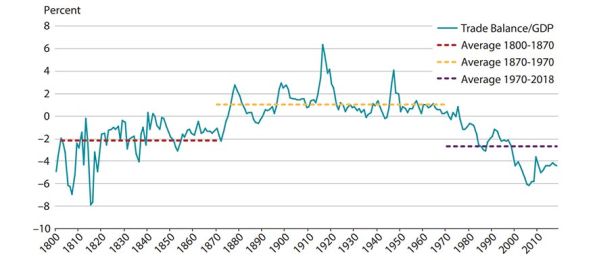

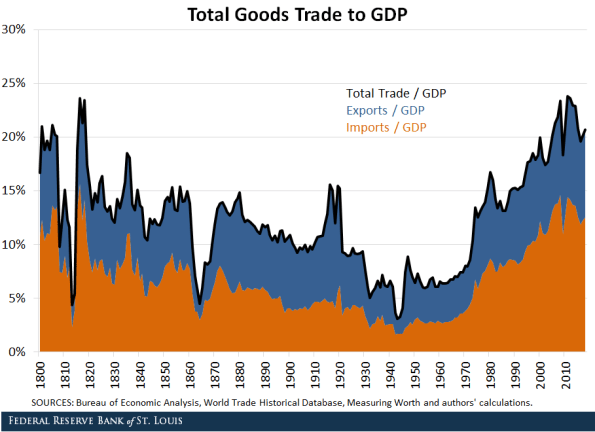

Despite the drop in tariff rates on China (for now), remember average tariffs remain the highest since the Great Depression (ominous music)! Of course, back then the US was a significant net exporter, so reciprocal tariffs were a bigger problem. Imports were only about 2-3% of GDP.

Source: Stlouisfed

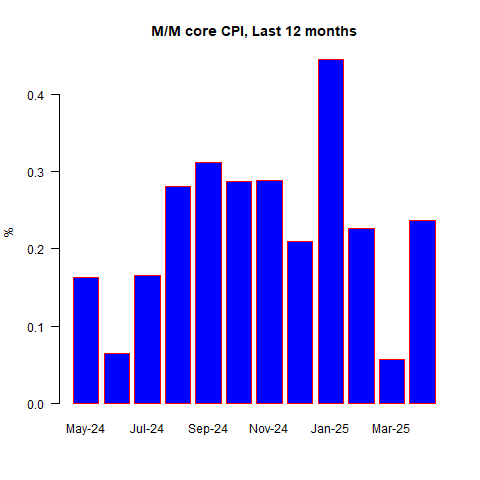

CPI for April was expected to be +0.25%, and +0.27% on Core. The actual prints were 0.221% and 0.237%, respectively, so a mild surprise lower (although it turned the +0.3%/+0.3% rounded expectations to +0.2%/+0.2%, looking more dramatic a surprise than it actually was). Core is right about where it has been for the last 6 and 12 months (0.244% and 0.229% average, respectively) with the big January spike and the March plunge basically offsetting each other.

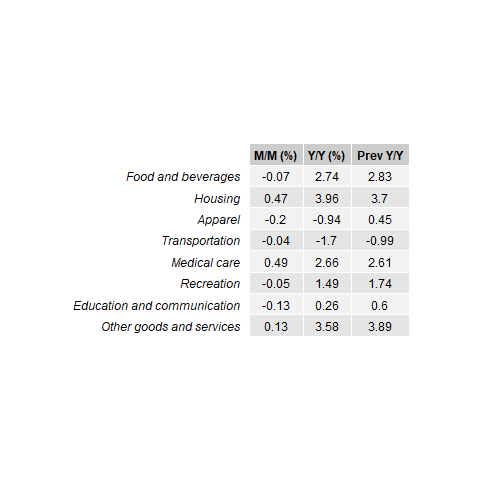

Amazingly, of the eight major subgroups only Housing, Medical (TASE:BLWV) Care, and “Other” increased on a m/m basis. What is especially surprising in that light is that Apparel – where the tariff canary in the coal mine lives – was down on the month.

Speaking of Median CPI, my early estimate is +0.308% m/m, putting the y/y at 3.43%. That’s about where we’ve been, and where we’re likely to be going forward.

Looking at some of those one-off categories from last month, Airfares fell another -2.83% m/m after that -5.3% prior decline. Some of that is jet fuel, some is tourism I suspect. Lodging Away from Home went flat (-0.1% m/m) from -3.54% prior. I think we’ll see continued downward pressure in that category, as hotels in some big cities are gradually emptied of illegal migrants and get added back to the stock of available rooms, but March’s drop was just too big. Used Cars’ decline (-0.53%) surprised some people, because the private surveys showed that prices advanced last month, but the seasonal assumption was a decent hurdle this month that wasn’t cleared. However, if you were worried about how the spike in car parts tariffs would cause car prices to spike…because that’s what the news was hyperventilating about…you needn’t have. New Car prices were also slightly down, -0.01% compared to +0.1% last month.

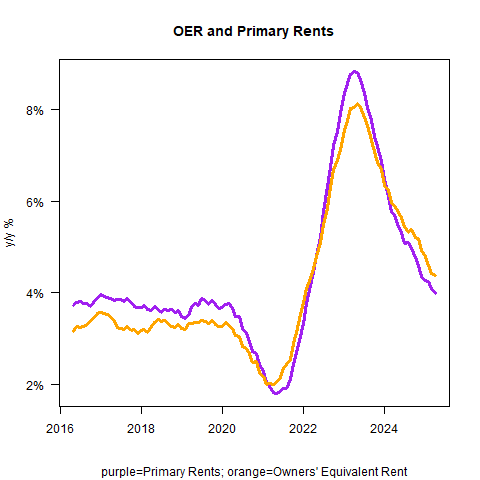

As for shelter, it continues to flatten out, with Primary Rents 3.98% y/y and OER at 4.31% y/y. Actually, Primary Rents were flat on a y/y basis compared to the prior month, and have basically converged with our model, which is around 3.7%. From here we should expect very slow deceleration, but rents should stay above 3.25% or so on a y/y basis.

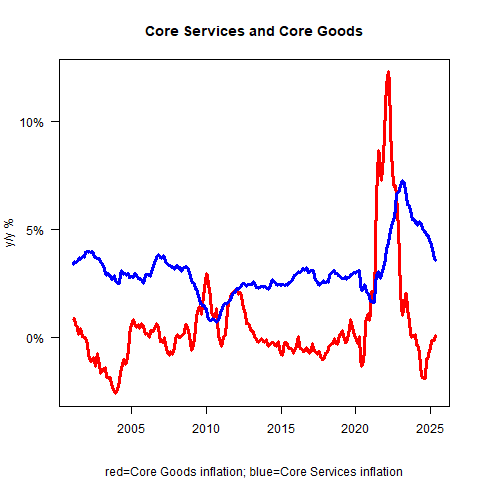

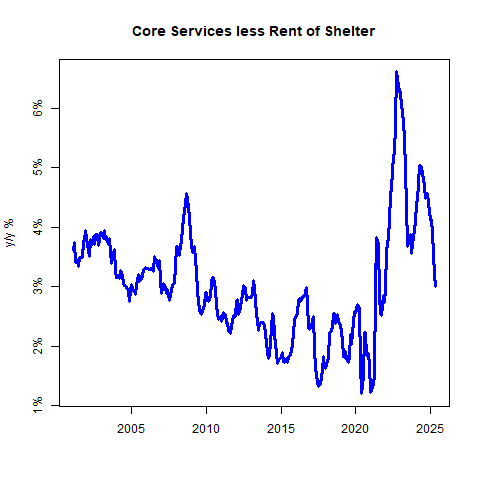

Supercore is looking great. This is about the best news in the report, because if Shelter is just about tapped out and Core Goods is trending just above zero we’d need Core Services to continue to dive.

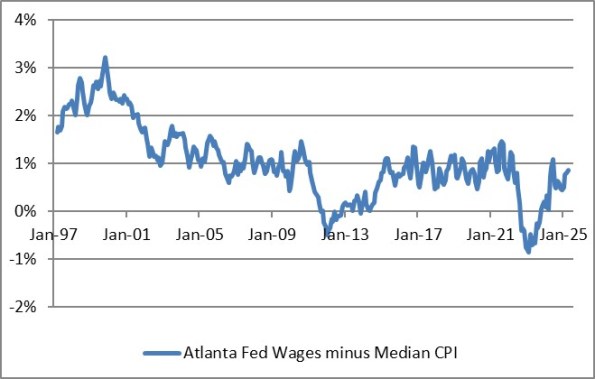

Outright, the Atlanta Fed Wage Growth Tracker – the best measure of wages in my opinion – is at 4.3% y/y. That’s right where it was in November. It’s going to be very hard to squeeze services prices lower if wages don’t decelerate further.

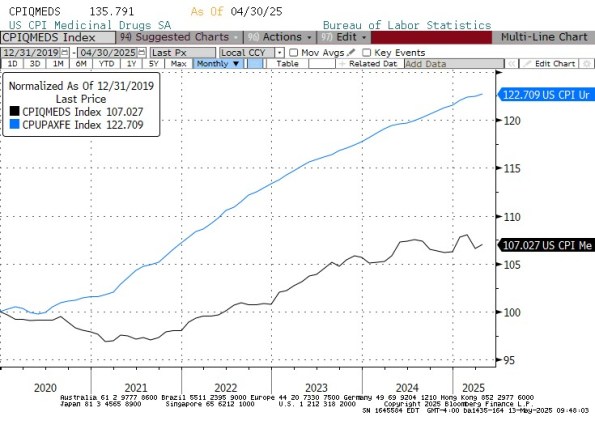

Finally, let’s circle back to pharmaceuticals. I’m going to point you again to my article from 2020, which is the first time that the President mooted the idea of a Most-Favored-Nation clause affecting the pharmaceutical industry. The upshot is that even if the MFN policy takes place exactly as the President states, retail drug prices are unlikely to decrease anything like as much as he has said. In fact, there could even be some circumstances in which drug prices rise because companies stop selling in foreign countries at levels lower than in the US (because they face a more-elastic demand there) but which contribute to the total profit of the drug company. There may be others in which the drug company stops selling the drug at all in the US. Furthermore, drug prices overall have only risen 7% since pre-COVID, compared to 23% for core prices generally (the black line in the chart below is the overall CPI for Medicinal Drugs; the blue is the core CPI price level – both normalized to December 2019).

By the way, if I was concerned about importing APIs from China and wanted the US to start producing more of them, I don’t think I’d be trying to crush end-product prices and reduce the incentive to spin up production of the APIs. So there will be a lot of exceptions to the MFN policy, and you can tell from the performance of pharma companies yesterday after the news (big up with the market, not down!) that investors don’t expect any important impact on the bottom lines of pharmaceutical companies. I agree. I think Medicinal Drugs going forward will probably decline a bit for some celebrated cases, but not in a big way that pushes CPI lower significantly.

The big conclusion here is that inflation continues to run at about 3.5% or so (Median), and there is no sign of a significant further deceleration to come. As long-time readers know, this has been my theme for a couple of years, that we will end up in the ‘high 3s, low 4s’ on median inflation, because the overall backdrop of deglobalization and demographics argue for a higher floor. If the Fed keeps money growth very low, my opinion could change (and I’d already amend my target to ‘mid to high 3s’ as the mode), but I am not very optimistic on that.

However, I also don’t think there is anything about the inflation picture that argues the Fed has a lot of room to drop rates significantly. I said last month “The right answer to uncertainty from a policymaker perspective is to increase the hurdle for taking action. The right answer is to make no changes to policy. I am not confident that the Federal Reserve will correctly separate the ‘price of risk’ effect from the ‘economic growth’ effect. They are correct to note that tariffs by themselves are not inflationary in that they are one-off effects. If they believe that, and they think there’s a big recession coming, they’ll cut rates. That would be a mistake, especially given the uncertainty.” I still think that’s the case. At the moment, there is no reason to cut rates any further than the ‘let’s help Biden’ cuts did, except to appease the President and I see little urgency from this Fed to do that. I wouldn’t expect any big moves from the Committee, any time soon.