AI-picked stocks now up 150%+; an 111% outperformance vs. the S&P 500

Summary:

- Intel has been a dead investment over the past 5 years as the chipmaker struggles to compete with smaller rivals.

- Intel’s new direction has merits, but it’s a heavy investment commitment which could keep margins depressed for years.

- The majority of analysts are advising to adopt a wait-and-see approach and not buy Intel shares.

The U.S.'s largest chipmaker, Intel (NASDAQ:INTC) has been a dead investment over the past five years.

Comparing the semiconductor giant with its peers, the obvious conclusion is that investors have lost confidence in the company’s growth potential when there are som many, better options available in the semiconductor industry.

Shars of Intel rose just 45% during the past five years, even as the benchmark Philadelphia Semiconductor Index (SOX) gained more than 328% over the same period. During this time, INTC's disappointing growth and production missteps, allowed smaller competitors to make major market inroads into the sector, gaining larger portions of market share as they continued to bring their most advanced chips to customers while Intel was unable to deliver.

NVIDIA (NASDAQ:NVDA), for example, surged more than 1200% in the last five years, boosting its market capitalization to $549 billion, more than double that of Intel.

Shares of Advanced Micro Devices (NASDAQ:AMD—a company which just a few years ago was struggling—have gained more than 15,00% during the same period.

Intel had climbed to the top of the more than $400 billion-a-year chipmaking industry by designing sophisticated processors that powered the world’s computers and data-centers. And they did it all that in-house.

But that strategy unravelled when much smaller and efficient chip producers outsourced their products to Asia. During the past decade, Intel failed to improve its ability to bring faster to chips to the market ahead of its competitors.

Strategic Shift To Rectify Underperformance

To deal with this crisis, the company's new CEO, Pat Gelsinger, came up with an ambitious plan. His strategy, a mix of in-house production and outsourcing, comes after years of underperformance that allowed competitors to leave Intel behind.

While outlining his plan to analysts in March, Gelsinger said Intel will rely more on outside manufacturers to produce some of its most cutting-edge processors, starting in 2023. He also announced a $20-billion investment to build two new chip-fabrication facilities in Arizona, called Intel Foundry Services (IFS), which will make chips designed by other companies.

By doing this, Intel aims to service and supply the world’s largest cloud-computing customers, such as Amazon (NASDAQ:AMZN) and Microsoft (NASDAQ:MSFT), which are now designing more of their own processors and need facilities in which to manufacture them. According to Gelsinger, who was formerly CEO at VMware (NYSE:VMW), this hybrid model is a winning combination.

During a recent presentation, he told analysts, “Intel is back. The old Intel is the new Intel.” He added:

“We’re going to be leaders in the market and we’re going to satisfy the new foundry customers because the world needs more semiconductors and we’re going to step into that gap in a powerful and meaningful way.”

This shift makes it clear Intel is entering a major turnaround period. But the move carries a lot of uncertainty.

Many analysts believe Intel’s plans to revive growth have merit, but it will be extremely difficult for the American giant to compete with Asian rivals who are already way ahead of the game.

Cultural Decay

Bloomberg, in a recent analysis of Intel’s future, said the company's predicament didn’t come about overnight. It’s been the result of a decade’s worth of missteps—including a failure to break into chips for smartphones—and cultural decay that blinded the company to serious shortcomings.

The piece adds:

“It’s also a function of global shifts that gave rise to Asian manufacturing giants such as Samsung Electronics Co. (OTC:SSNLF) and Taiwan Semiconductor Manufacturing Co. (NYSE:TSM). These companies increasingly sit at the center of the industry, and it’s their chips that are increasingly finding their way “inside” the most advanced devices.”

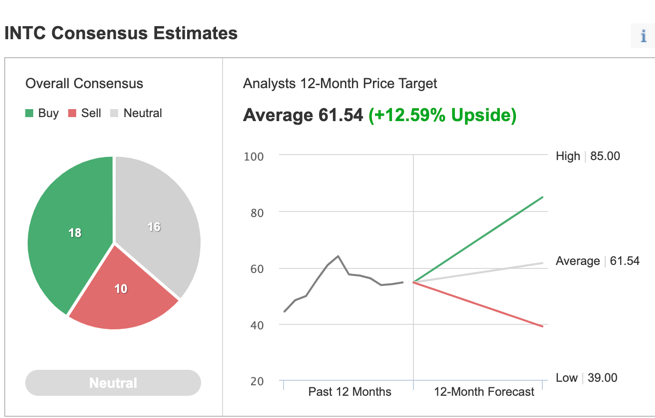

The analyst community, on the other hand, remains divided on the future prospects of Intel. Among the 44 analysts surveyed by Investing.com, the overall consensus is Neutral, with 18 polled giving the stock a buy rating, 16 remaining neutral and 10 providing a sell rating.

Chart: Investing.com

In a recent note, Goldman Sachs reiterated its sell rating on the stock, noting that the $20 billion to build the company's new factories could hurt free cash flow and create conflicts of interests with competitors. As Goldman said in a note, cited by CNBC.com:

“Even if IFS is set up to be a stand-alone business separate from core Intel, we believe many of the large fabless consumers who compete with core Intel will be hesitant to work with IFS.”

Chip Shortages and Geopolitics

Still, conditions on the ground are quite fertile for Intel if the company can succeed at executing its plans.

Global chip shortages and China’s massive investments to become a leader in chip manufacturing have made the industry a component of the geopolitical tussle. US President Joseph Biden signed an executive order early this year requiring a 100-day review of key supply chains, including semiconductors. He also said he would seek $37 billion in funding to help the domestic chip industry boost capacity.

With political and financial backing, demand for chips is likely to remain strong even after the pandemic, as people spend more on smartphones, games and connected devices that all require chips. The amount of time it’s taking for chip-starved companies to get their orders filled stretched to 21 weeks in August, indicating the shortages that have crippled auto production and held back growth in the electronics industry are escalating, according to a Bloomberg post.

Evercore ISI analyst C.J. Muse said in a recent note that Intel is doing and saying the right things, but executing this road map is a multiy-ear process fraught with challenges. Muse advised investors to stay on the sidelines.

Jefferies analyst Mark Lipacis, who has a hold rating and a $52 price target on the stock, said that Intel is a “show me” story following the announcement that it expects to regain leadership in 2025.

“Given its poor transistor execution over the past 5 years, which led to loss of transistor leadership in 2018, we think investors will be skeptical until INTC delivers on this plan,” Lipacis said.

Bottom Line

Intel is long-term turnaround play fraught with many execution risks. Investors with spare cash to invest have much better options in the semiconductor industry right now.

It’s better to stay on the sidelines as far as the Intel stock is concerned.