Bitcoin price today: struggles at $111k as trade tensions, risk aversion weigh

- Stocks prices have risen sharply over the past few trading session

- Seems investors expecting Fed to pivot to a more dovish stance

- This time is different because growth isn’t the issue; inflation is

Markets have recently moved up from their lows as some investors seem to think that inflation has peaked and slowing growth will cause the Fed to pivot. That may or may not be the correct interpretation. It is too early to make that determination.

The Fed's policy changes have yet to prove they have had a significant impact on US inflation. While it takes time for the Fed rate hikes and the removal of accommodative policy to filter through the economy, there has been no sign that inflation has even slowed materially. Indeed, there is no significant change to suggest that the Fed is winning the war.

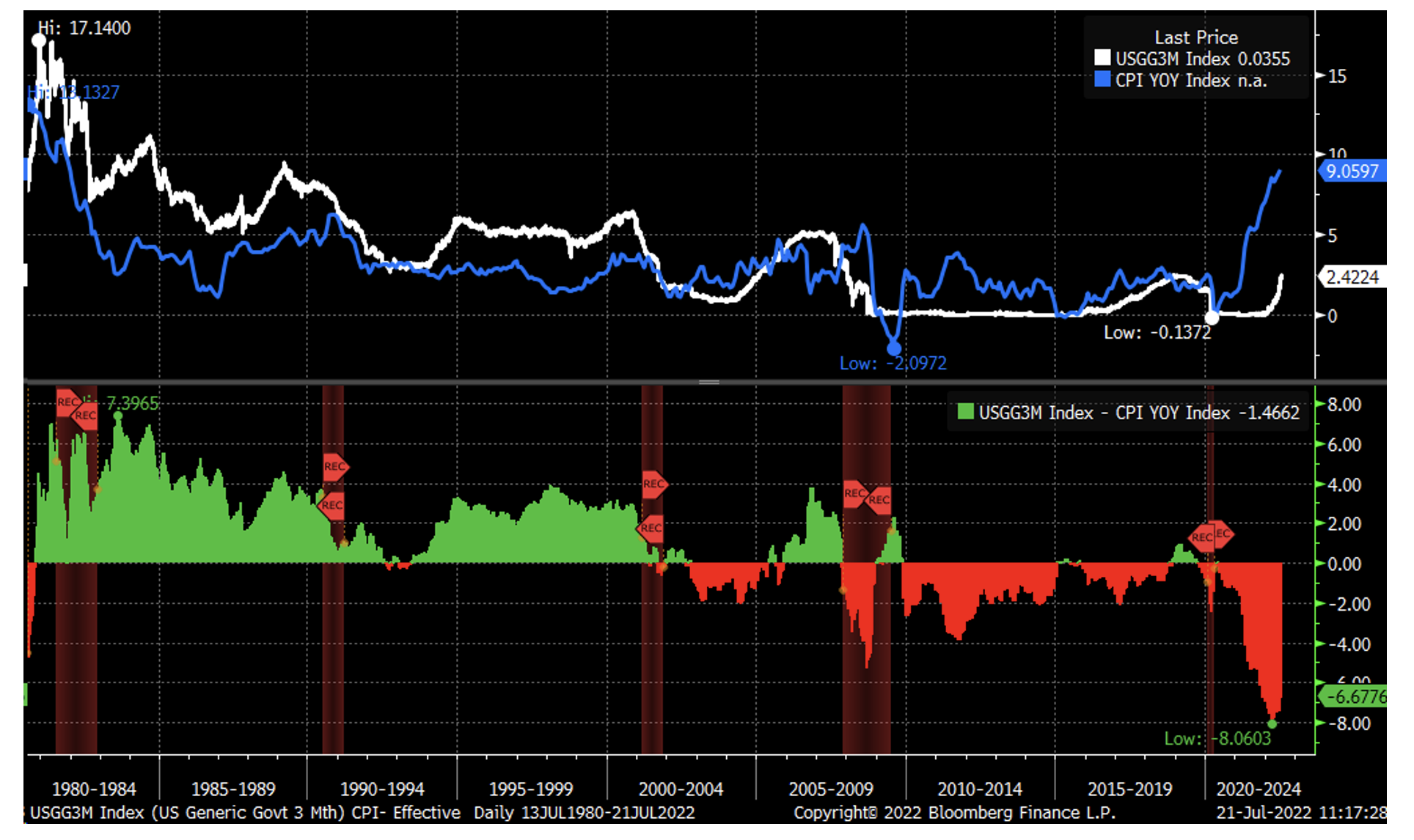

At this point, the three-month Treasury bill rate is trading at a significant discount to the current yoy pace of the consumer price index, a spread of nearly 6.5%. The only time that spread was more considerable came in 1980, when the CPI climbed at more than 14% yoy, and the three-month bill rate plunged to around 6.75%. Historically, when inflation was falling from 1980 through early 2000, the three-month bill rate was consistently over the yoy inflation. Even if inflation trends begin to soften, it is too early to say that the Fed pivot will result in a rate cut.

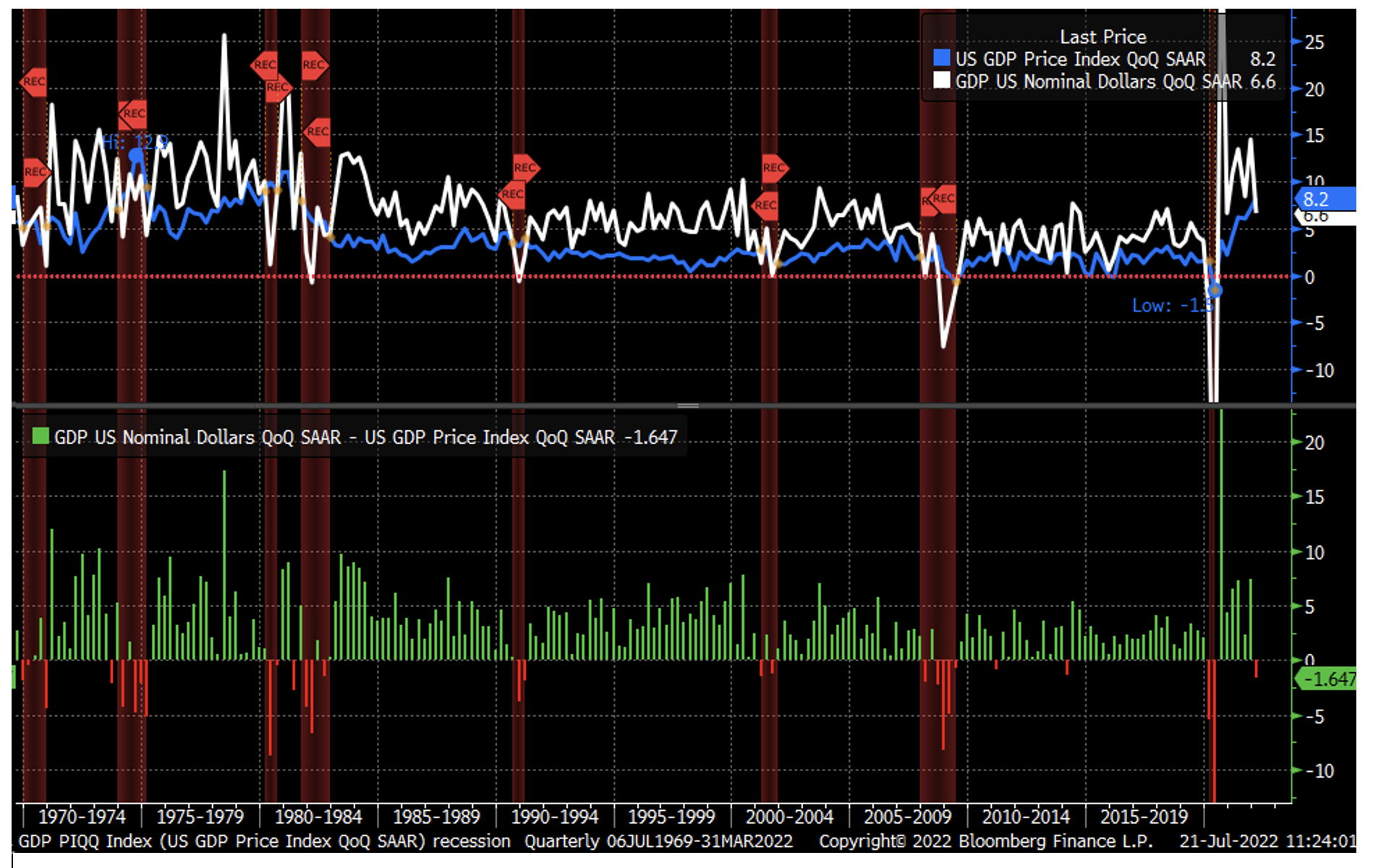

But investors have been trained over the past decade to associate slowing growth, or the risk of recession, to mean the Fed pivots to rate cuts and QE. The problem this time isn't growth; it is inflation. It is killing growth. The GDP price index ran higher than the GDP nominal growth rate in the first quarter, and the odds are high that the same thing happened again in the second quarter. Nominal growth in the first quarter was robust, running at a 6.6% seasonally adjusted annualized rate; the GDP Price index ran at 8.2%, which resulted in the real GDP growth rate turning negative.

The odds of another real GDP print turning negative seem very high in the second quarter, especially given that the CPI ran over 8% for the second quarter and that the Atlanta Fed's GDPNow tool is projecting a 1.6% decline. That would imply that nominal GDP growth was probably more than 6% in the second quarter, which is basically in line with the nominal GDP growth rate of the first quarter.

Even if real GDP is negative for two quarters in a row and the economy shows signs of softness, the Fed may not be so quick to pivot. In the past, this formula of slowing growth has derailed the Fed's hawkish stance because inflation was never the problem. It is different now, inflation is the problem, and growth isn't a problem just yet, in nominal terms.

Additionally, the latest forecast from the Cleveland Fed Inflation Nowcasting suggests a July CPI yoy rate of 8.9% and is forecasting a third-quarter CPI rate of an annualized 9.1%. So, while the pace of inflation may slow at some point down the road, it seems premature to try to front-run it. The Atlanta Fed 12-month Sticky CPI reading is currently at 5.6% and is trending sharply higher, and it looks tough to gauge where that peak lies.

To start pricing in a Fed that will stop hiking rates or even start cutting rates seems not only early but extremely dangerous. After all, very few have been able to project the path of inflation to this point, which means trying to pick the top is nothing more than a guessing game.

Disclaimer: Charts used with the permission of Bloomberg Finance L.P. This report contains independent commentary to be used for informational and educational purposes only. Michael Kramer is a member and investment adviser representative with Mott Capital Management. Mr. Kramer is not affiliated with this company and does not serve on the board of any related company that issued this stock. All opinions and analyses presented by Michael Kramer in this analysis or market report are solely Michael Kramer's views. Readers should not treat any opinion, viewpoint, or prediction expressed by Michael Kramer as a specific solicitation or recommendation to buy or sell a particular security or follow a particular strategy. Michael Kramer's analyses are based upon information and independent research that he considers reliable, but neither Michael Kramer nor Mott Capital Management guarantees its completeness or accuracy, and it should not be relied upon as such. Michael Kramer is not under any obligation to update or correct any information presented in his analyses. Mr. Kramer's statements, guidance, and opinions are subject to change without notice. Past performance is not indicative of future results. Neither Michael Kramer nor Mott Capital Management guarantees any specific outcome or profit. You should be aware of the real risk of loss in following any strategy or investment commentary presented in this analysis. Strategies or investments discussed may fluctuate in price or value. Investments or strategies mentioned in this analysis may not be suitable for you. This material does not consider your particular investment objectives, financial situation, or needs and is not intended as a recommendation appropriate for you. You must make an independent decision regarding investments or strategies in this analysis. Before acting on information in this analysis, you should consider whether it is suitable for your circumstances and strongly consider seeking advice from your own financial or investment adviser to determine the suitability of any investment.