US stock futures edge lower after Wall St hits record highs on rate cut cheer

- Ford stock is surging after Q2 earnings beat

- Ford's ambitious plan to become a serious contender in the electronic vehicle market is gaining pace

- The shift to electric vehicles may take a big bite out of the company's profits

After enduring a 50% share-price slump in the year's first half, auto manufacturing giant Ford Motor Company (NYSE:F) is beginning to show tangible signs of a sustained rebound. The Dearborn, Michigan-based company surged more than 20% during the past month, massively outperforming its close rival General Motors (NYSE:GM).

The reversal picked up steam after the carmaker released better-than-expected earnings for its fiscal second quarter, helped by increased sales and higher prices. On Wednesday, America's second-largest carmaker said its adjusted earnings per share rose to $0.68, surpassing analysts' $0.45 consensus projection.

Adjusted earnings before interest and taxes more than tripled to $3.7 billion, well above the $2.37 billion analysts expected. The company also reiterated its 2022 earnings guidance of $11.5 billion to $12.5 billion before interest and taxes. That would represent a gain of 15% to 25% over 2021's profit.

In another sign that shows that the company is in a comfortable cash flow position, Ford raised its quarterly dividend by 50% to $0.15 a share.

Beyond the quarterly numbers, Ford's ambitious plan to become a serious contender in the electronic vehicle market is also taking shape. According to a recent report in Bloomberg, the company is preparing to cut as many as 8,000 jobs to save money and invest in its EV venture.

$50 Billion Investment

Job reductions are part of a comprehensive turnaround plan that Chief Executive Officer Jim Farley laid out early this year. In March, Farley radically restructured Ford, dividing its carmaking into "Model e" to scale up EV offerings and "Ford Blue" to focus on traditional gas burners like the Bronco sport-utility vehicle.

Ford plans to spend $50 billion to make two million EVs annually by 2026, a steep ramp-up from the 27,140 it sold last year and requires deep cost cuts.

Undoubtedly, Ford has created some excitement around its turnaround plans during the past year. After many years of missteps, Farley has been able to craft clear messaging on the company's ambitions in the fast-growing electric vehicle market.

However, succeeding amid the current challenging macroeconomic backdrop is easier said than done.

The persistently high raw material prices, intensifying competition in the EV market, and a threat of a global recession may make it difficult for Ford to raise cash to fund its transformation. In addition, Ford continues to struggle in China, the second largest car market, and Europe. Ford sales plunged 22% during the quarter in China to about 120,000 vehicles as pandemic-related restrictions and lockdowns disrupted business.

According to Wells Fargo, the shift toward electric vehicles would take a big bite out of the profits for legacy automakers even as they make their next-generation cars. In a note, the company added:

"Battery electric vehicle costs have massively risen & raw material supply is tight, yet tough US regulations are likely to require more BEV sales. The raw material increase adds ~$4.8K and ~$8.5K in unplanned costs to the Ford Mach-E & Lightning, respectively."

The note also warned that 2022 could be "peak profits" for Ford, pointing out that the internal combustion engine pickup trucks are massive earnings generators in a way that the electric versions may not be.

These lingering uncertainties are perhaps the main reason that most Wall Street analysts aren't yet ready to bet on Ford stock and give it a valuation that a growing EV carmaker deserves.

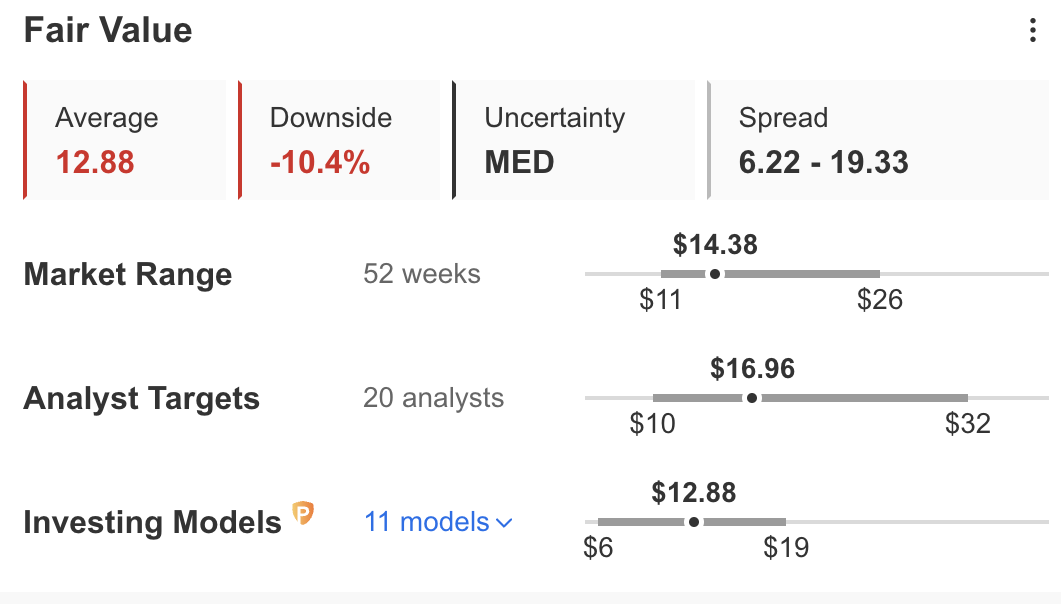

In several valuation models, like those that might consider revenue or P/S multiples or terminal values, the average fair value for Ford stock on InvestingPro stands at $12.88, representing a 10.4% downside.

Source: InvestingPro

Bottom Line

Ford stock is a long-term bet that could pay off if the company succeeds in the EV market and becomes one of the major players. But that journey is full of risks and uncertainties. Furthermore, the Ford brand is not synonymous with EVs like Tesla (NASDAQ:TSLA) and other startups, and thus its transformation may take a long time to pay off.

Disclosure: The writer doesn't own shares of Ford

***

Interested in finding your next great idea? InvestingPro+ gives you the chance to screen through 135K+ stocks to find the fastest growing or most undervalued stocks in the world, with professional data, tools, and insights. Learn More »