Tyson Foods to close major Nebraska beef plant amid cattle shortage - WSJ

Chairman Powell spoke on Tuesday, addressing several topics. Of note was the following quote:

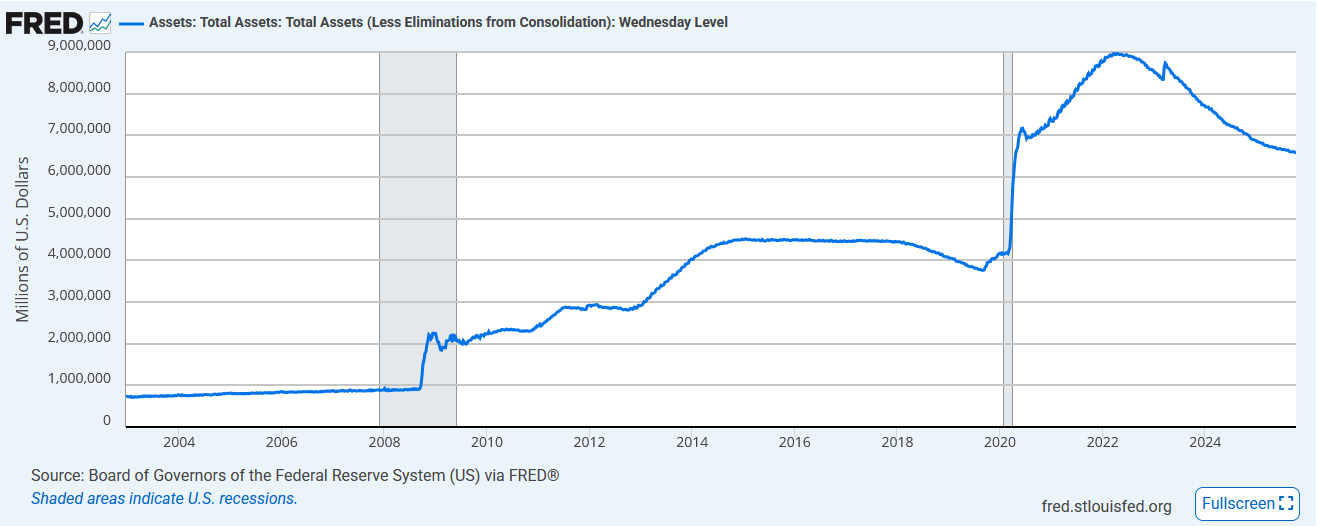

“We may be approaching the end of our balance sheet contraction in the coming months.” The market interpretation is that QT is ending soon. As a reminder, QT, also known as quantitative tightening, has been in effect for over three years.

Since starting QT, the Fed has shaved its holdings by nearly $3.5 trillion. The graph below shows that the Fed’s current holdings of Treasury, mortgage, and agency assets stand at approximately $6.6 billion, still more than 50% above pre-pandemic levels.

Powell made this somewhat surprising statement in a speech to the National Association of Business Economics in Philadelphia. To explain why QT could end, he pointed to the liquidity strains that emerged in the fall of 2019. At that time, short-term lending rates for some borrowers were spiking despite the borrowers having ample and pristine collateral to support the loan.

The Fed feels they were late to address those liquidity strains. As a result, they cut rates by 0.75% despite a relatively strong economy. While Powell doesn’t claim to see similar problems, he is noticing some recent tightness in the lending markets. Not surprisingly, as we recently noted, Powell’s comments come as the Fed’s overnight reverse repo program balances are near zero, signifying the market no longer has excess reserves. So, is QT resulting in tighter market conditions? Powell must think so.

On the margin, ending QT is beneficial for the bond markets. In addition to absorbing higher-than-normal Treasury debt due to fiscal deficits, the market is also having to absorb about $40 billion monthly due to the Fed’s shrinking balance sheet. Of the $40 billion, $5 billion is in US Treasuries, and the remaining $35 billion is in mortgage-backed securities.

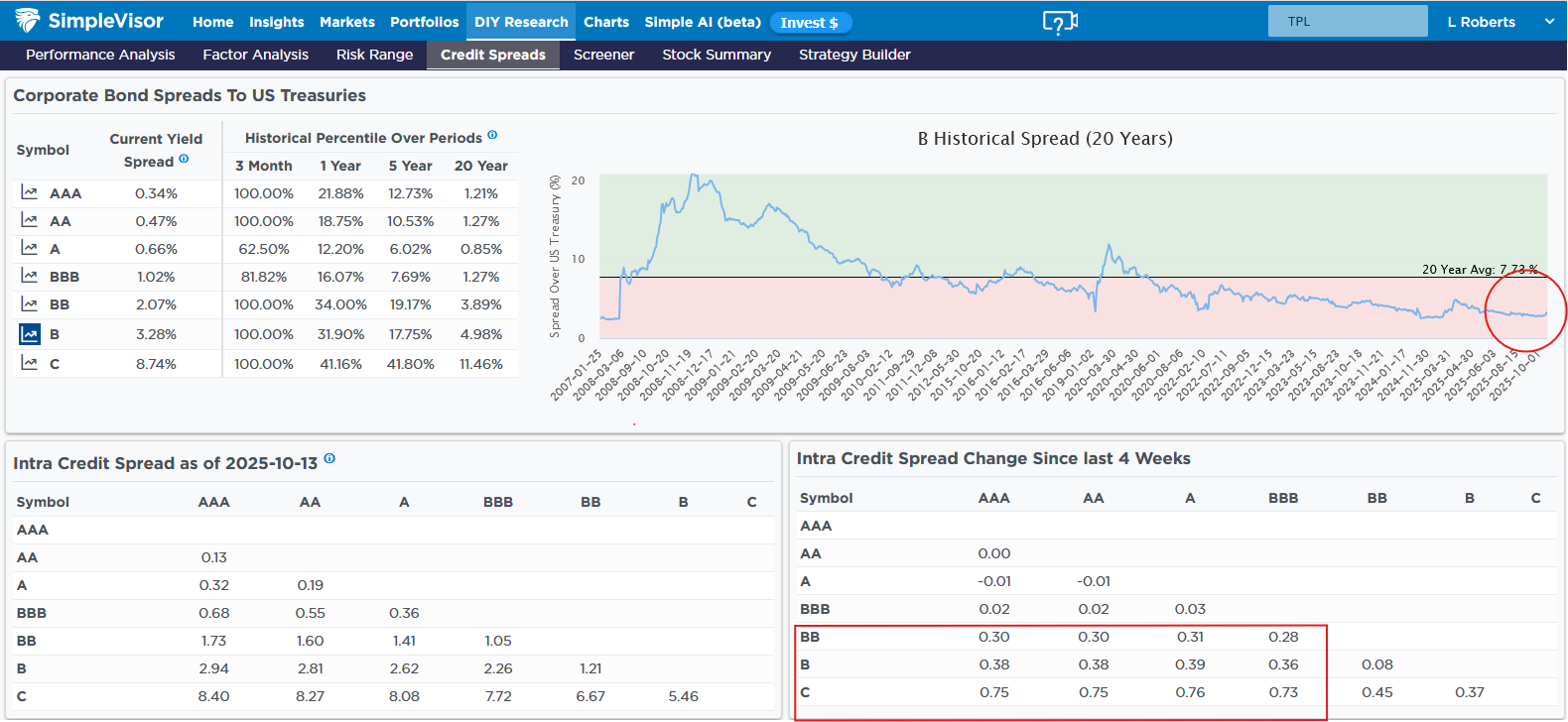

Some Distress In The Junk Credit Markets

The graphic below tracks corporate credit yield spreads. Even if you are not a corporate bond investor, corporate credit spreads (vs US Treasuries) can be a good leading indicator of the equity markets. Tight, or low, spreads indicate bullish sentiment in corporate bonds and often the stock market. Widening, or higher, spreads indicate some credit concerns that can leak into the stock market. The page below helps us track whether spreads are tightening or widening.

Of note, the lower right-hand box shows that the yields on junk bonds (less than BBB) have widened over the last four weeks versus investment grade bonds (BBB or higher). While the amount of widening, when quoted in basis points, may seem decent, the graph in the top right corner shows that the spread widening is barely perceptible in a longer-term context. We will continue to track the recent widening. A continuation within junk bonds and, importantly, in lower-rated investment-grade bonds would be more concerning.

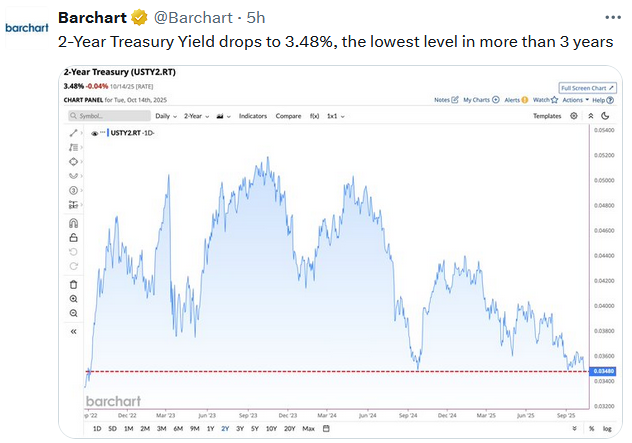

Tweet of the Day