Uxin shares drop 45% as predicted by InvestingPro’s Fair Value model

Late November, see here, we were based on the Elliott Wave Principle (EWP) looking for the Nasdaq 100 to put in a local top, drop to ideally $15,750, while holding above $15,738 on a daily closing basis. The next step would then be

“A daily close above $16,120 [will] allow us to be more confident [to] look for $16,315-620 for the green W-5 of the red W-v of the black W-c/3.”

The index reached $16,166 on November 29 intra-day but closed at $15,987. Since we work on daily closing prices, which are the essential price of the day, it was close to $ 16,120, but there was no cigar for the Bulls. It was a B-wave. Similarly, on December 4, the index bottomed out at $15,695 but closed at $15,839. Also, close ($15,738 was the cut-off), but no cigar for the Bears this time.

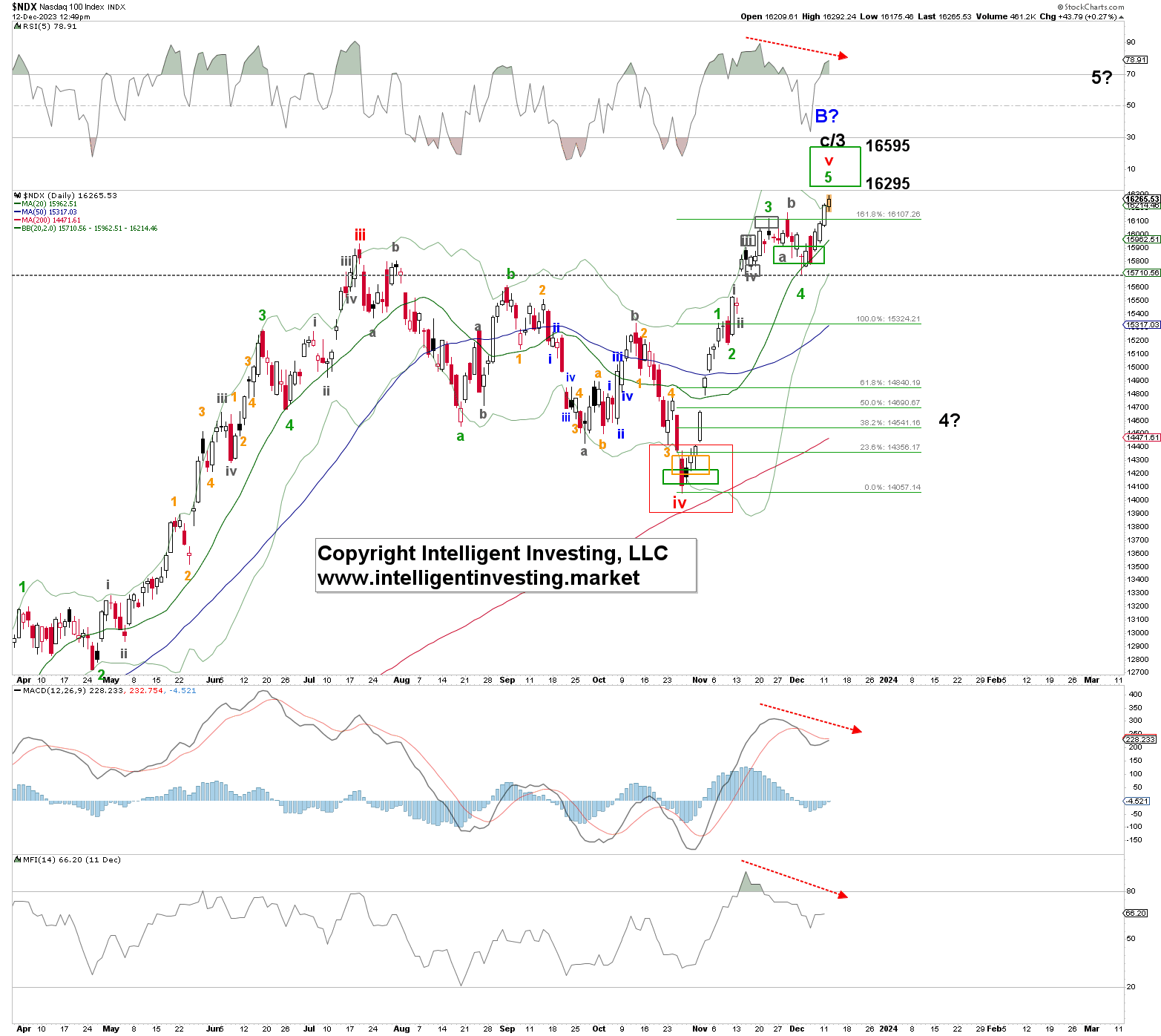

From that low, the index rallied to new uptrend highs: green W-5 of red W-v of black W-c/3. See Figure 1 below. Thus, our assessment was -overall- correct, albeit the green W-4 became a bit more complex than anticipated.

Figure 1. NASDAQ 100 daily resolution chart with technical indicators and detailed EWP count.

The red dotted arrows show building negative divergences on the technical indicators, typical for the W-4, 5 set up we are tracking. For example, the daily MACD has yet to produce a new buy cross after giving a sell signal for W-4. And Money Flow is lagging. Since liquidity drives markets, this is important. However, although divergence must always be noted, it is only divergence until it is not. It is a condition, not a trigger. In the end, price is always the final arbiter and trade trigger. For example, after the index bottomed out on December 4, we informed our premium members on December 6 that as long as the index would hold the $15695 low, we would be on our way to $16295+. The blue dotted arrow in Figure 2 was our symmetry and EWP-based trade trigger: a break above $ 15,990 would target $ 16,250+.

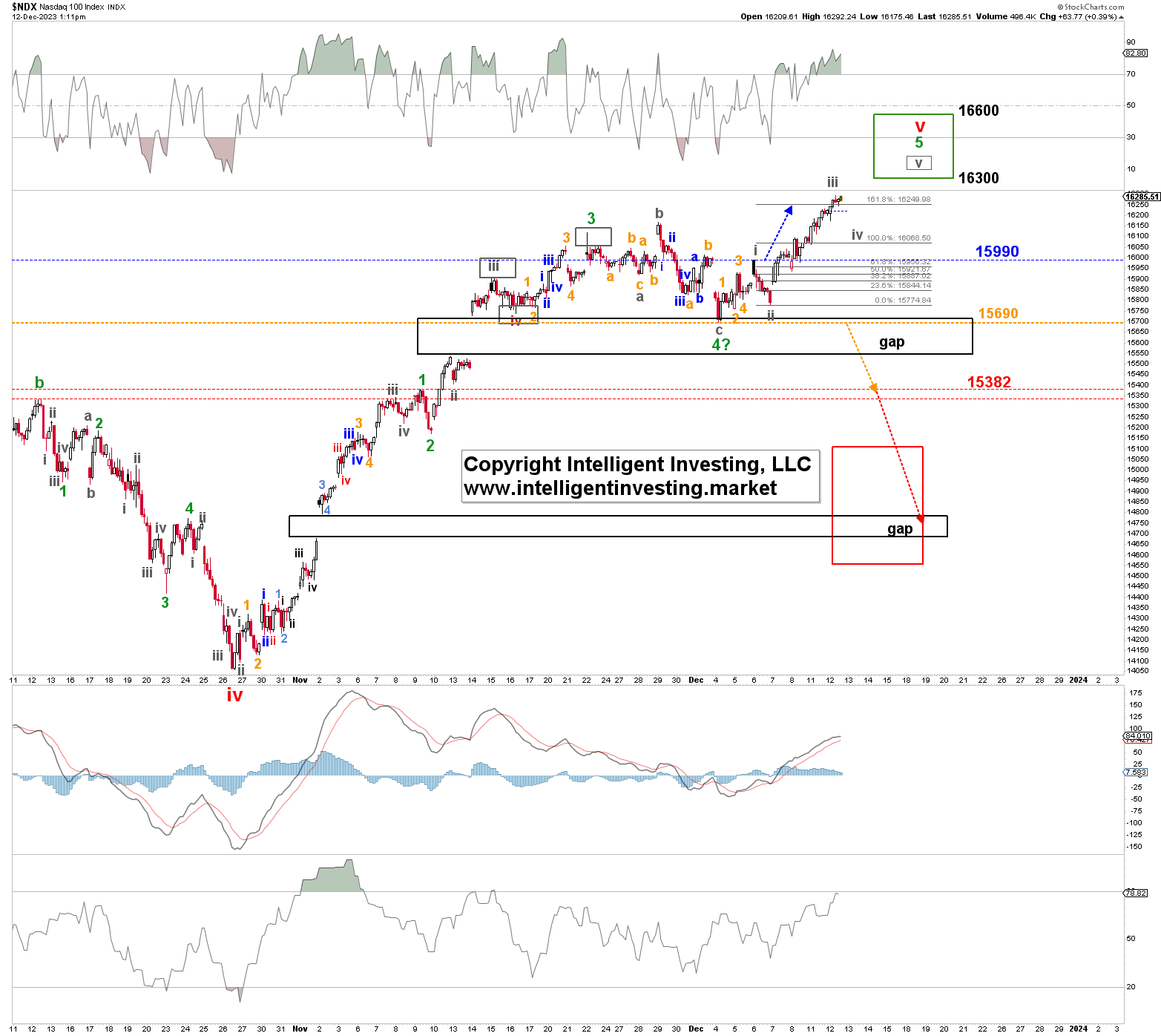

Thus, the NDX should now wrap up the smaller waves (grey W-iii, -iv, and -v) of the green W-5. See Figure 2 below. From Figure 2 we deduce the first level the Bulls must hold is $ 15,990. Below that is a severe warning the more significant top has been struck because 1st and 4th waves (grey W-i, iv in this case) are not allowed to overlap in a standard impulse. The next level to hold is $15,690. Below that, the green W-5 cannot subdivide anymore, and the Bears can target $15,382, possibly as low as $ 14,700.

Figure 2. NASDAQ 100 hourly resolution chart with technical indicators and detailed EWP count.