Nvidia’s desktop AI supercomputer now available to the general public

Rates fell sharply yesterday following a weaker-than-expected ISM services report. The quarterly refunding announcement showed no significant shifts in how the Treasury plans to issue debt.

With that, the 10-year fell to support at 4.4% and has bounced off that support level for now. The fantastic thing is the symmetry in the chart.

In fact, on December 18, the 10-year broke out and rose above 4.4%; 16 bars later, it hit the high, and 16 bars from the midpoint, we were back at 4.4%.

The low yesterday also marked the 61.8% retracement level on the 10-year from the move higher that started on December 9. Maybe the algos want us to think the symmetry continues and the 10-year returns to 4.15%. I guess we will find out.

With the 10-year rate down, it is unsurprising that the Japanese yen strengthened, falling below support at 154. The daily chart shows that the next significant test level is probably around 149.50.

For some time, an argument has been made that the USD/JPY and the Nasdaq 100 are highly correlated.

However, that has not been discussed for some time now because the USD/JPY has been weakening while the NASDAQ has been rising.

I do not think there is enough evidence yet to support the case; there hasn’t been a meaningful and long enough divergence. But we may soon find out.

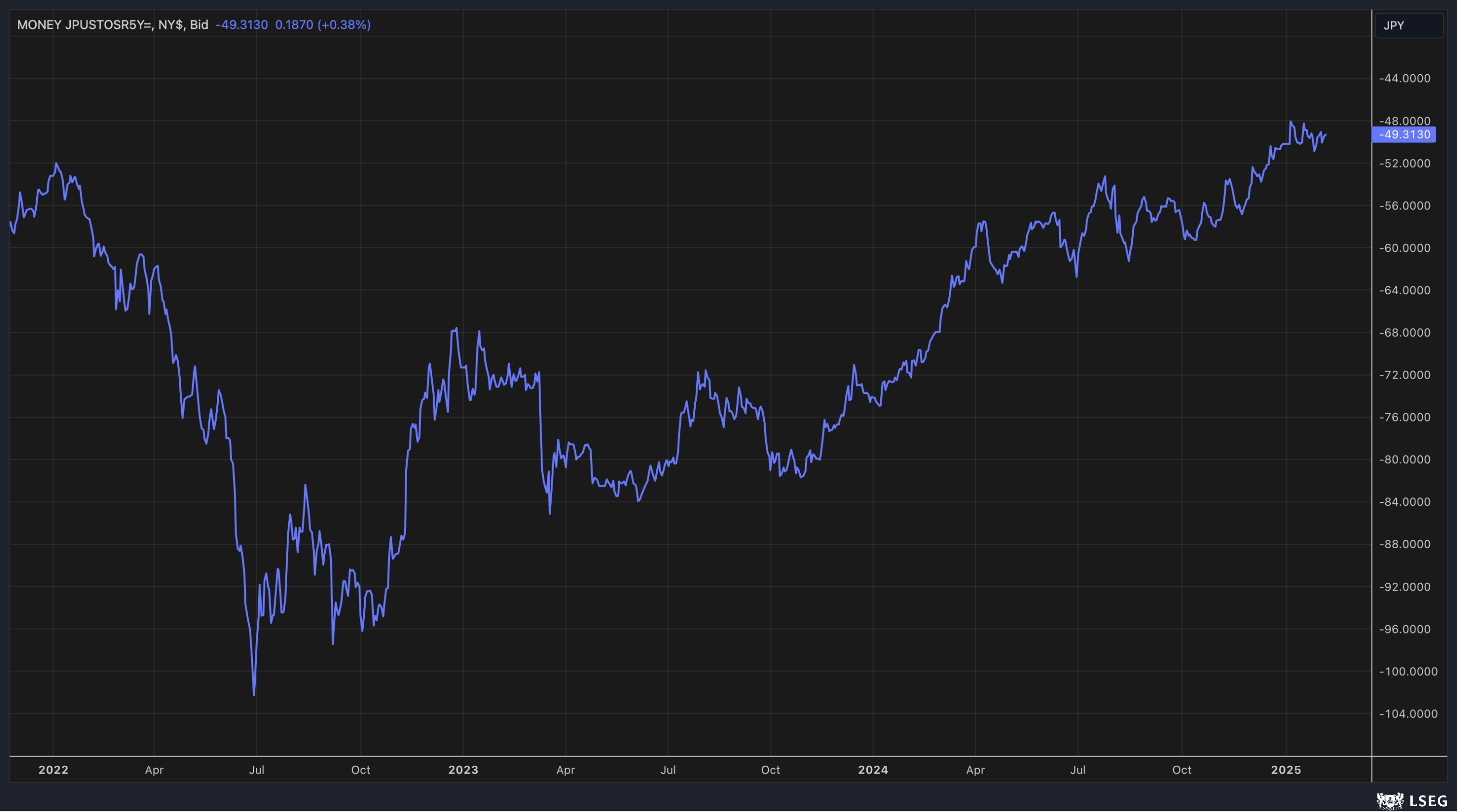

The 5-year USD/JPY cross-currency basis swap spread has narrowed significantly over the past few weeks. This would suggest that the USD/JPY carry trade is probably less attractive.

So, the USD/JPY strengthening may not have the same impacts it had over the summer.

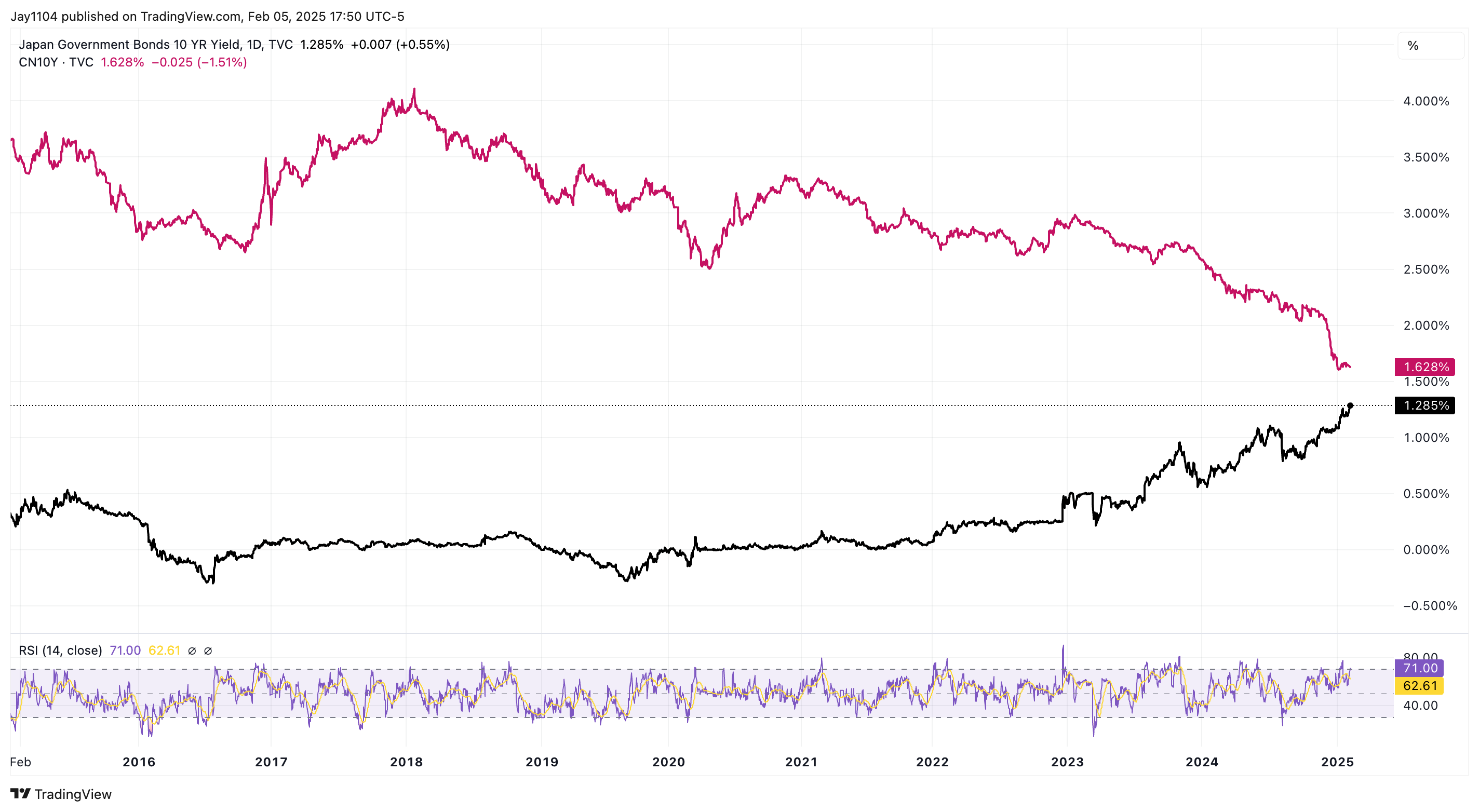

Speaking of Japan, the 10-year yield has risen as the market adjusts to a world where the BOJ hikes rate further, removing the global anchor off the zero bound.

However, at the same time, the China 10-year rate appears to be heading in the opposite direction and is on a collision course with the 10-year JGB.

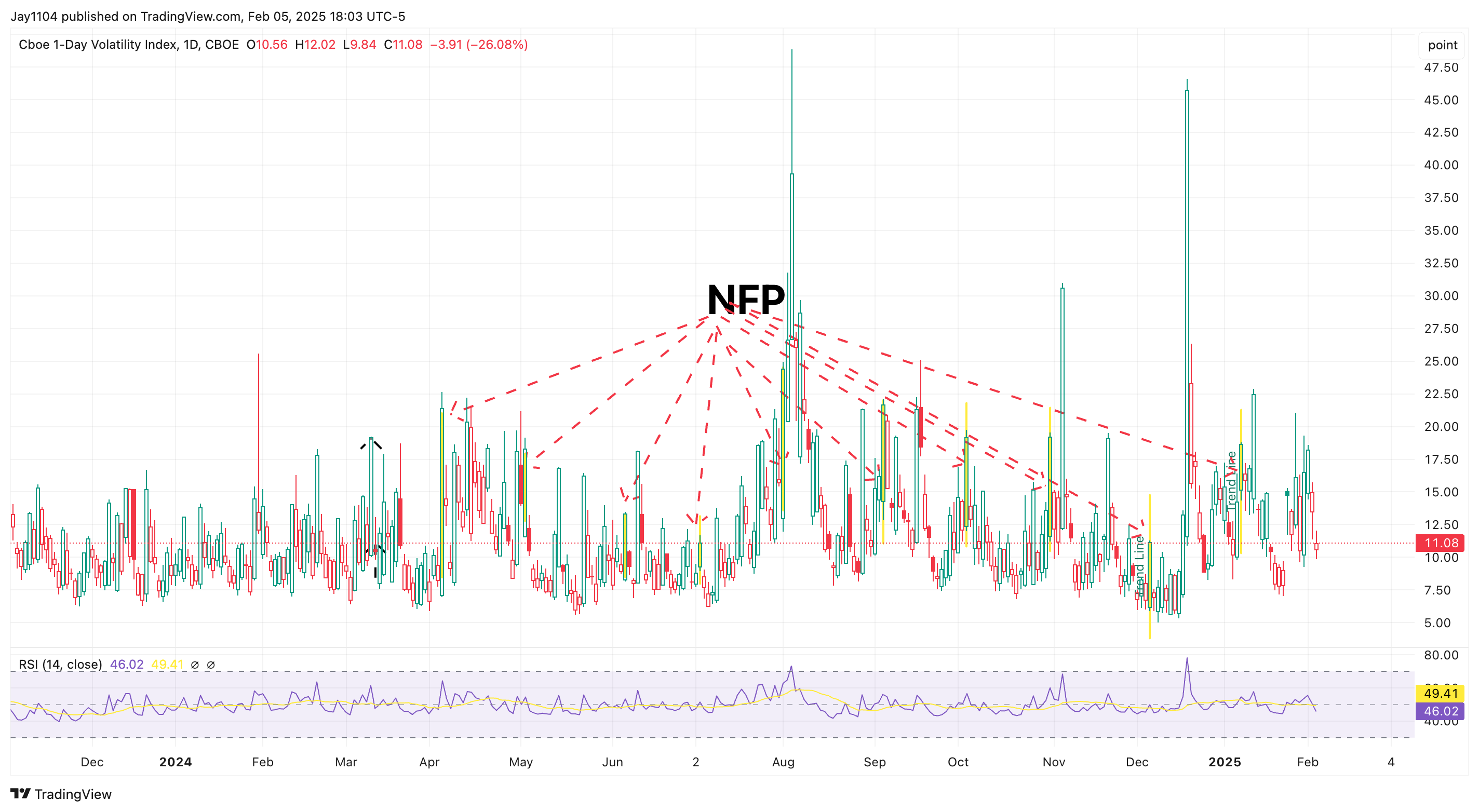

Finally, history suggests implied volatility should rise today before Friday's jobs report. This report will be unusual because the BLS is expected to adjust its calculation methodology.

We already know that revisions were 818,000 lower than previously estimated from April 2023 to March 2024, averaging around -68,000 jobs per month. We will learn the remainder of the revisions on Friday, which could impact the headline nonfarm payroll number.

I think there could be a good deal of hedging flows going into the news, and given that the VIX 1-Day closed yesterday at 11, we see that rise significantly today.