AlphaTON stock soars 200% after pioneering digital asset oncology initiative

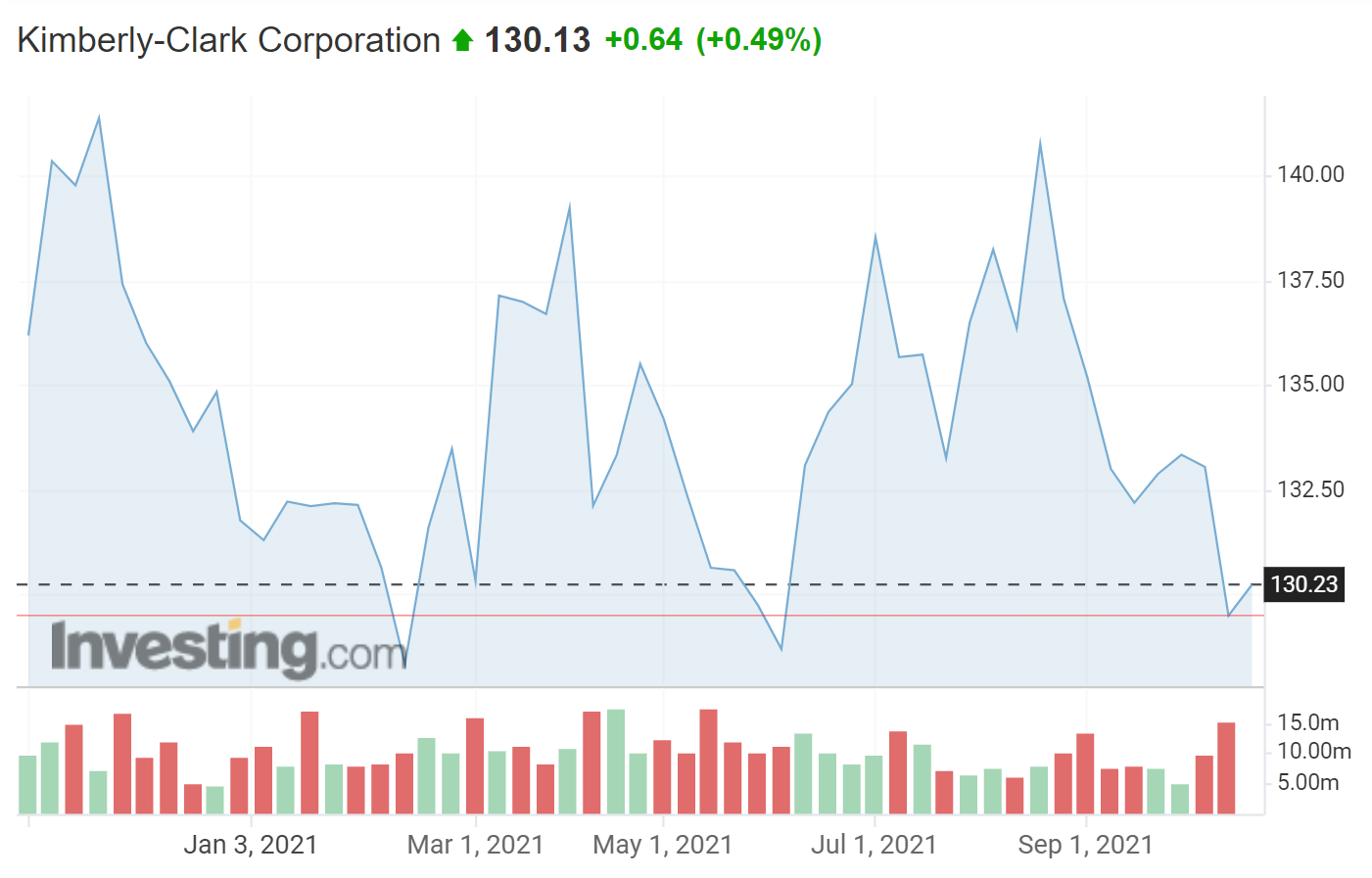

Consumer products giant, Kimberly-Clark (NYSE:KMB)—a favorite of income investors—is trading slightly above 52-week lows following disappointing Q3 results, released on Oct. 25.

Management attributed the earnings miss to inflation and supply chain problems, noting that both issues were likely to persist for some time.

The total return over the past 12 months is 1.05% and the shares are 8.5% below the 52-week high close of $143.83 from Nov. 17, 2020.

Source: Investing.com

The recent earnings miss is not an outlier for KMB, owner of such well known staple brands as Scott bathroom tissue, Huggies diapers and Kotex feminine hygiene products. Results have underperformed expectations for 4 of the last 5 quarters.

The outlook for future earnings does not provide positive news, either. The consensus expectation for Q4 EPS is lower than in any quarter for at least 5 years and the expected annualized EPS growth rate for the next 3-5 years is -1.7% per year.

Source: ETrade. Green (red) numbers are the amount by which the EPS exceeded (missed) the consensus expected result.

KMB has a following among income investors thanks to the 3.5% dividend yield and 49 consecutive years of dividend growth. The trailing 3-, 5-, and 10-year dividend growth rates are 4.2%, 4.3%, and 5.4% per year, respectively.

On the basis of the Gordon Growth Model, one might reasonably expect future annualized returns in the range of 7.7% to 8.9%, although I would be inclined to look to the lower end of this range given the earnings outlook.

I last analyzed KMB on Mar. 13, 2021, when I assigned it a neutral rating and said in the article title it was "Not Quite A Buy." The company has missed the expected EPS in each of the three quarters reported between then and now (Q1, Q2, and Q3) and the total return on KMB since my post is -0.9% (as compared to 16.96% in price return for the S&P 500).

In mid March, the Wall Street analyst consensus rating was neutral-to-bullish, with a 12-month consensus price target that was about 10% above the share price at that time (for an expected total return of almost 13.5%).

This was a high expected return for such a low-beta, low-volatility stock. Countering the Wall Street analyst consensus, however, was the consensus outlook from the options market, which was bearish in mid March.

The price of an option on a stock represents the options market’s consensus estimate of the probability that the stock price will rise above (call option) or fall below (put option) a specific level (the option strike price) between now and when the option expires.

By analyzing the prices of call and put options at a range of strike prices, all with the same expiration date, it is possible to calculate a probabilistic outlook for the stock price that reconciles the options prices. This is referred to as the market-implied outlook and represents the consensus outlook of buyers and sellers of options. The market-implied outlook for KMB in mid-March for the period until Jan. 21, 2022 was bearish, with peak probability corresponding to a price return of -8%.

With 7.5 months since my last analysis and KMB’s three quarters of disappointing earnings, I have updated the market-implied outlook and compared it to the current Wall Street analyst consensus outlook for KMB.

Wall Street Consensus Outlook

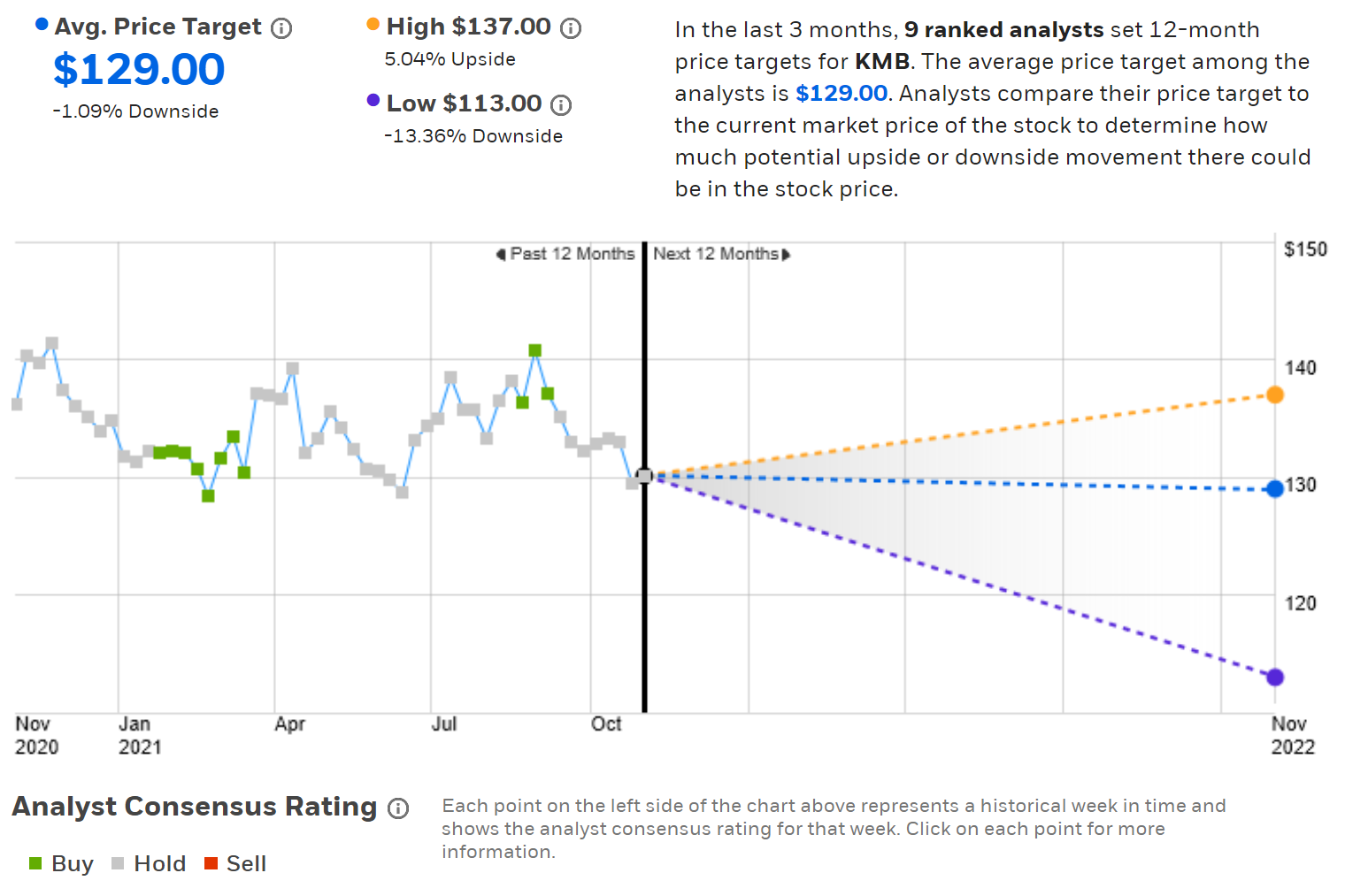

E-Trade calculates the Wall Street consensus outlook using ratings and price targets from 9 ranked analysts who have published their views within the past 90 days. The consensus rating is neutral and the 12-month price target is $129, 1.9% below the current share price and $22 below the 12-month price target in March.

Source: E-Trade

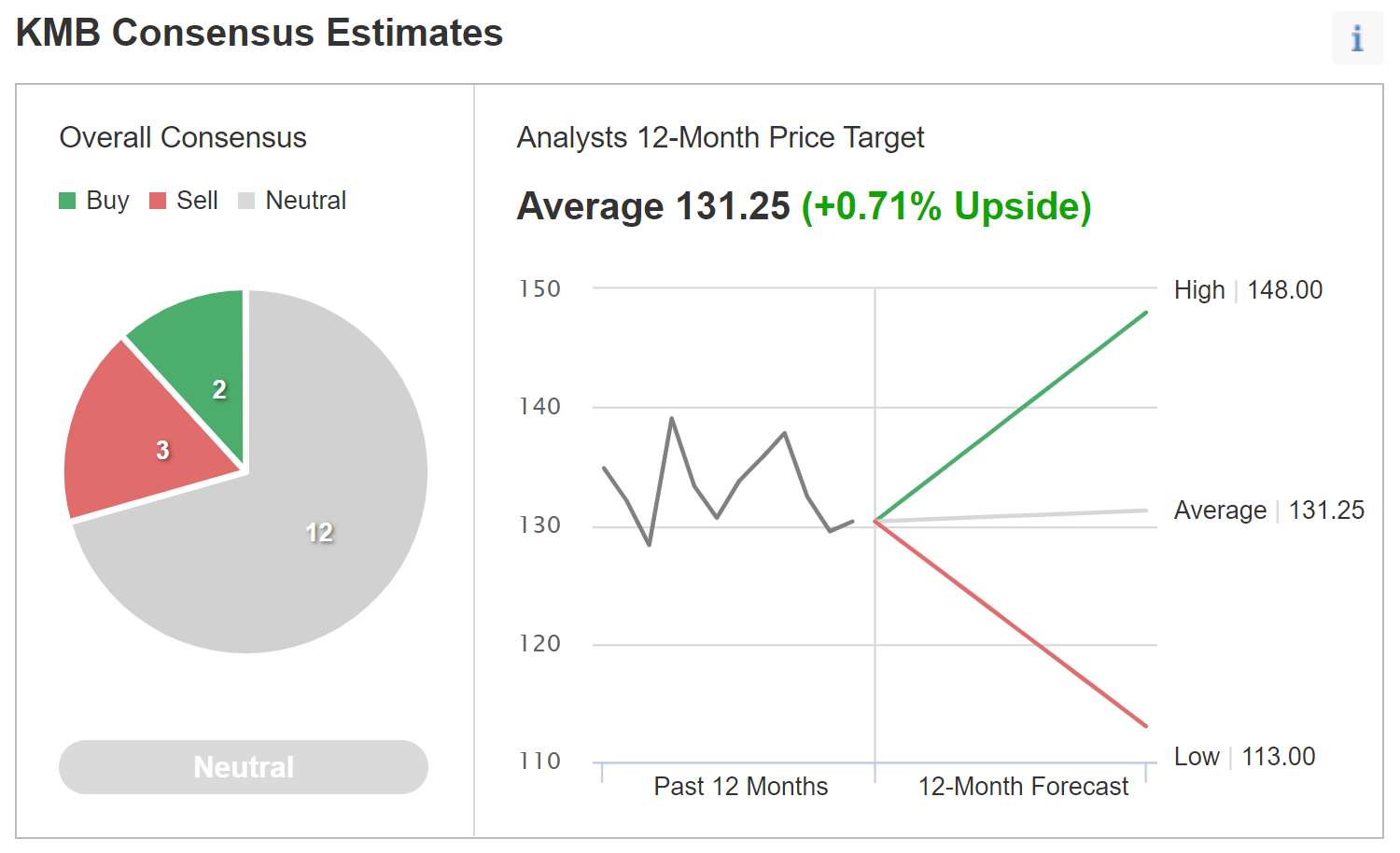

Investing.com uses ratings and price targets from 17 analysts to construct the Wall Street consensus. The consensus rating is neutral and the consensus price target is 0.71% above the current price.

Source: Investing.com

The Wall Street consensus outlooks calculated by E-Trade (using only ranked analysts) and Investing.com (using a larger number of analysts) agree on a neutral rating for KMB and that the expected 12-month appreciation is close to zero.

Market-Implied Outlook for KMB

I have analyzed put and call options on KMB at a range of strike prices, all expiring on Jan. 21, 2022, to calculate the market-implied outlook for the next 2.65 months (from now until that expiration date). I have also calculated the market-implied outlook for the 7.45-month period from now until June 17, 2022 using options that expire on that date.

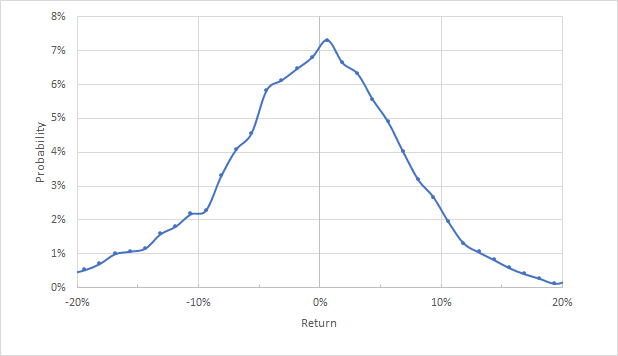

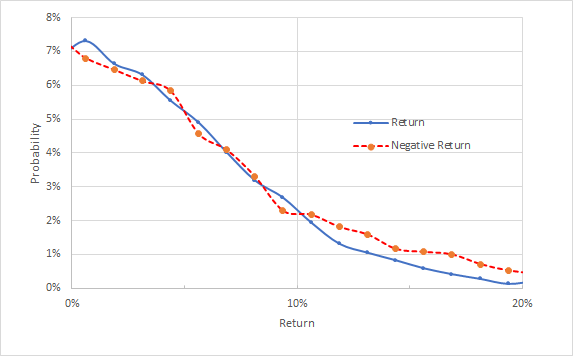

The standard presentation of the market-implied outlook is in the form of a probability distribution of price return, with probability on the vertical axis and return on the horizontal.

Source: Author’s calculations using options quotes from E-Trade

The market-implied outlook for the next 2.65 months is generally symmetric, with the peak probability corresponding to a price return of +0.63% for this period. The annualized volatility derived from this distribution is 18.9%, which is very low for an individual stock.

To make it easier to directly compare the probabilities of positive and negative returns, I rotate the negative return side of the distribution about the vertical axis (see chart below).

Source: Author’s calculations using options quotes from E-Trade. The negative return side of the distribution has been rotated about the vertical axis.

This view shows that the probabilities of positive and negative returns are very close to one another for returns in the range from -10% to + 10% (from 0% to 10% on the chart above). The probabilities of larger-magnitude negative returns are elevated relative to positive returns (the red dashed line is consistently above the solid blue line) for returns with magnitudes larger than +/-10%. In other words, the market sees more likelihood of large negative moves than for large positive moves.

Dividend-paying stocks tend to exhibit elevated probabilities of negative returns because the dividend payments reduce the upside potential of the stock. In addition, theory suggests that investor risk aversion will tend to add a negative bias to the market-implied outlook because people pay more than fair value for put options.

In light of these factors, equal probabilities of positive and negative returns indicate a slightly bullish outlook. Overall, I interpret the outlook for KMB for the next 2.65 months to be neutral, with a slight bullish tilt because the most-probable outcomes are symmetric between positive and negative returns.

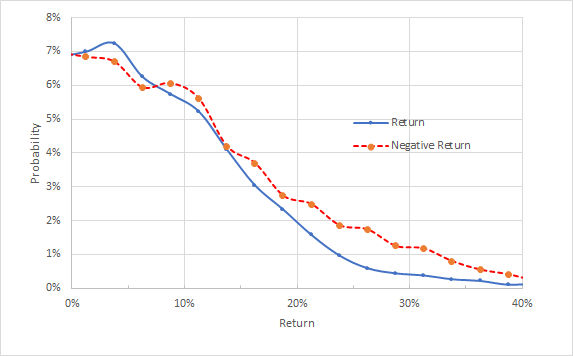

The market-implied outlook for the 7.45-month period from now until June 17, 2022 exhibits comparable probabilities for positive and negative returns in the +/-10% range, but elevated probabilities of larger-magnitude negative returns relative to positive returns. The annualized volatility calculated from this distribution is 21.1%.

Source: Author’s calculations using options quotes from E-Trade. The negative return side of the distribution has been rotated about the vertical axis.

The outlook to early 2022 is neutral, with slightly elevated probabilities of small positive returns (relative to negative returns of the same size) and lower probabilities of larger-magnitude positive returns (relative to large declines). The view to mid 2022 amplifies the elevated probabilities of large negative returns, but is otherwise consistent with the shorter-term view.

Back in March, the market-implied outlook to January 2022 was clearly bearish. Today, the outlook to early 2022 is neutral with a bullish tilt, shifting more bearish, but still predominantly neutral, by the middle of 2022.

Summary

Kimberly-Clark has a long and distinguished history of consistently growing its dividend, a track record that endears the company to income-oriented investors. However, the company has faltered and management sees ongoing challenges from inflation and supply chain slowdowns.

The 3-5 year consensus outlook for EPS growth is slightly negative. Looking just at the dividend yield and growth rate (ignoring current issues), the expected total return is on the order of 8% per year, which is between the trailing 10-year and 15-year annualized returns. The Wall Street analyst consensus outlook is neutral, with expected total return of 3.5% (0% price appreciation) for the next 12 months.

As a rule of thumb for a buy rating, I want to see an expected 12-month total return that is at least half the expected volatility. With the 19%-21% expected volatility calculated from the market-implied outlook, KMB provides too little expected return for the risk level. The market-implied outlook is neutral (albeit with a slight bullish tilt) to the middle of January, shifting to neutral for the view out to mid 2022. I am maintaining my neutral rating on the stock.