Eos Energy stock falls after Fuzzy Panda issues short report

- Lockhead Martin shares are up more than 26% since the beginning of the year

- Q1 top line was short of estimates, but management reiterated 2022 outlook

- Despite short-run volatility, long-term investors could consider investing now

Global aerospace and defense behemoth Lockheed Martin (NYSE:LMT) stock has returned 26.3% since the beginning of January. For comparison, Boeing (NYSE:BA) has lost 23.3% so far this year.

Meanwhile, the Dow Jones US Select Aerospace & Defense is up 4.5% so far in 2022. Understandably, the sector has been in the limelight following the Russian invasion of Ukraine, and many A&D stocks have skyrocketed.

Even before the recent military conflict, the outlook for A&D companies had been strong. Recent research highlights:

“The US aerospace and defense sector is one of the largest, globally, in terms of infrastructure and manufacturing activities.”

By the end of the decade, the US market is expected to be worth well over $550 billion.

Lockheed Martin issued Q1 financials on Apr. 19. While the bottom line beat estimates, revenue came in short of expectations. Sales decreased 8% to $15 billion year-over-year.

Net earnings came in at $1.7 billion (or $6.44 per share), down from $1.8 billion (or $6.56 per share) in the prior-year quarter. Cash from operations stood at $1.1 billion compared with $1.5 billion a year ago.

On the results, CEO James Taiclet said:

“Lockheed Martin had a solid start to the year by delivering margin expansion and free cash flow above our expectations despite recent COVID-surge impacts on our operations and supply chain. We remain confident in our guidance for the remainder of the year and our growth outlook beyond.”

Despite these mixed results, the A&D leader reiterated its 2022 financial outlook. Accordingly, net sales and diluted EPS are forecast to come around $66 billion and $26.70, respectively.

On Mar. 7, LMT shares went over $479, reaching a record high. However, investors hit the sell button after the release of the quarterly metrics.

Now, the stock is changing hands at around $444.98. It pays a quarterly dividend of $2.80 for a yield of 2.5%.

LMT's 52-week range has been $324.23–$479.99, while the market capitalization stands at $118.6 billion.

What To Expect From Lockheed Martin Stock

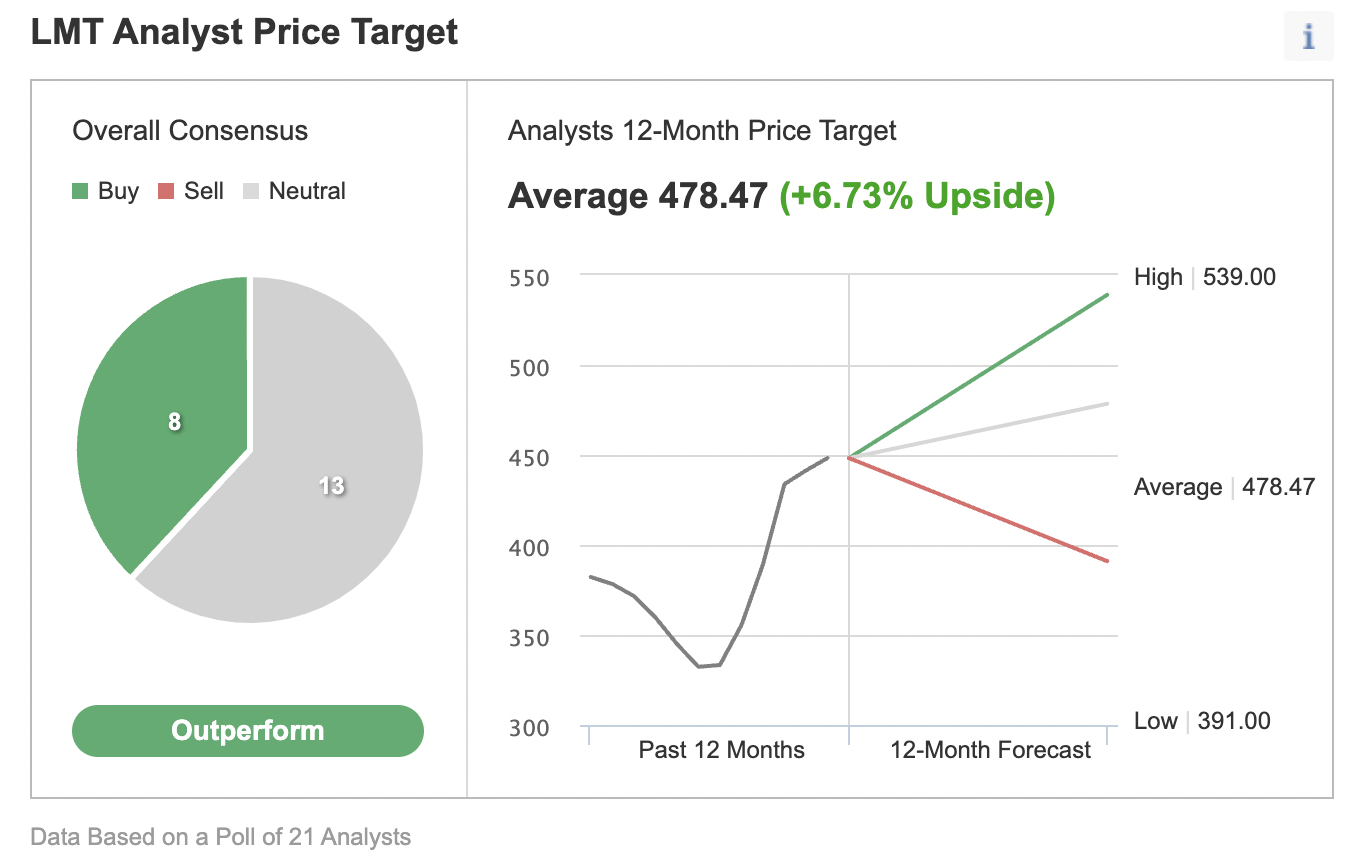

Among 21 analysts polled via Investing.com, LMT stock has an "outperform" rating.

Source: Investing.com

Wall Street also has a 12-month median price target of $478.47 for the stock, implying an increase of around 6.7% from current levels. The 12-month price range is between $391 and $539.

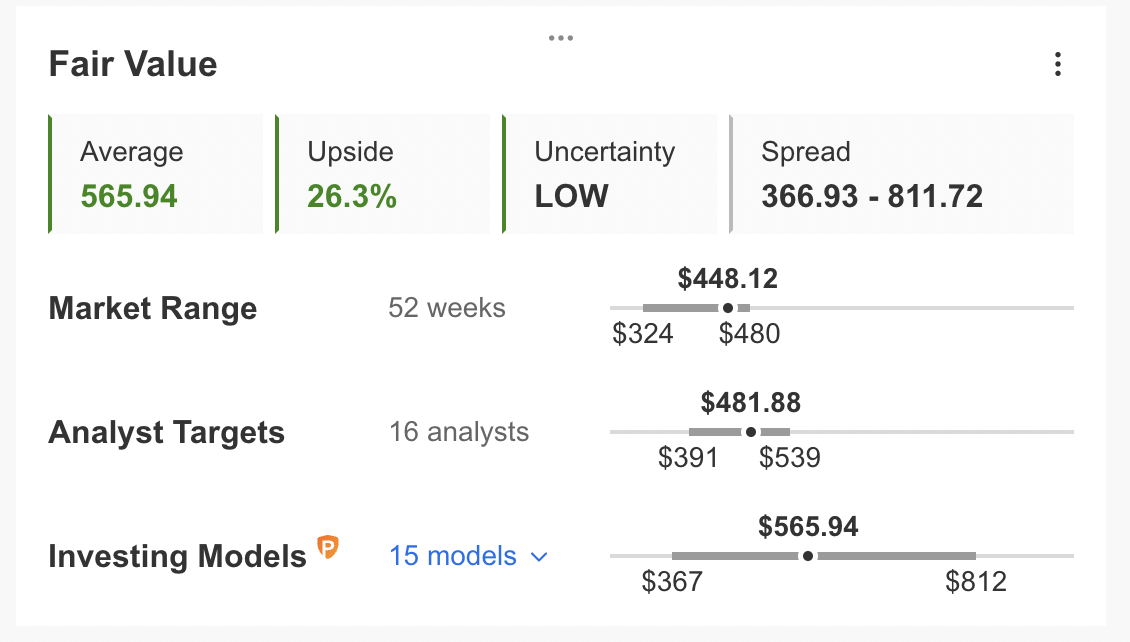

However, according to a number of valuation models, such as P/E or P/S multiples or terminal values, the average fair value for LMT stock stands is $565.94 at InvestingPro.

Source: InvestingPro

In other words, fundamental valuation suggests shares could increase around 26%.

At present, LMT’s P/E and P/S ratios are 19.3x and 1.8x. Comparable metrics for peers stand at 21.2x and 1.8x.

Our expectation is for Lockheed Martin stock to trade in a wide range and build a base between $430 and $460 in the coming weeks. Afterwards, LMT shares could potentially start a new leg up.

Adding LMT Stock To Portfolios

Lockheed Martin bulls, who believe the decline in the stock is likely to come to an end, could consider investing now. The target price would be $565.94, or the price forecast by valuation models.

Alternatively, investors could consider buying an exchange-traded fund (ETF) that has LMT stock as a holding. Examples include:

- iShares US Aerospace & Defense ETF (NYSE:ITA)

- Emles Federal Contractors ETF (NYSE:FEDX)

- Invesco Aerospace & Defense ETF (NYSE:PPA)

- SPDR S&P Kensho Final Frontiers (NYSE:ROKT)

- Industrial Select Sector SPDR® Fund (NYSE:XLI)

Finally, some LMT bulls could also be nervous about further declines in the coming weeks. Therefore, they might prefer to put together a "poor man’s covered call" on the stock instead.

So, today, we introduce a diagonal debit spread on Lockheed Martin by using LEAPS options, where both the profit potential and the risk are limited.

Investors who are new to the strategy might want to revisit our previous posts on LEAPS before reading further.

Most option strategies are not suitable for all retail investors. Therefore, the following discussion on LMT stock is offered for educational purposes and not as an actual strategy to be followed by the average retail investor.

Diagonal Debit Spread On LMT Stock

Price at time of writing: $449.20

A trader first buys a longer term call with a lower strike price. At the same time, the trader sells a shorter term call with a higher strike price, creating a long diagonal spread.

Thus, the call options for the underlying stock have different strikes and different expiration dates. The trader goes long one option and shorts the other to make a diagonal spread.

Most traders entering such a strategy would be mildly bullish on the underlying security. Instead of buying 100 shares of LMT, the trader would purchase a deep in the money LEAPS call option, where that LEAPS call acts as a “surrogate” for owning the stock.

For the first leg of this strategy, the trader might buy a deep in the money (ITM) LEAPS call, like the LMT 19 Jan. 2024 350-strike call option. This option is currently offered at $120.90. It would cost the trader $12,090 to own this call option, which expires in less than two years, instead of $44,920 to buy the 100 shares outright.

The delta of this option is close to 80. Delta shows the amount an option’s price is expected to move based on a $1 change in the underlying security.

If LMT stock goes up $1 to $450.20, the current option price of $120.90 would be expected to increase by approximately 80 cents, based on a delta of 80. However, the actual change might be slightly more or less depending on several other factors that are beyond the scope of this article.

For the second leg of this strategy, the trader sells a slightly out of the money (OTM) short-term call, like the LMT June 17 450-strike call option. This option’s current premium is $18.80. The option seller would receive $1,880, excluding trading commissions.

There are two expiration dates in the strategy, making it quite difficult to give an exact formula for a break-even point. Different brokers might offer “profit-and-loss calculators” for such a trade setup.

The maximum potential is realized if the stock price is equal to the strike price of the short call on its expiration date. So, the trader wants the LMT stock price to remain as close to the strike price of the short option (i.e., $450) as possible at expiration (on June 17), without going above it.

Here, the maximum return, in theory, would be about $1,730 at a price of $450 at expiry, excluding trading commissions and costs.

However, in practice, it might be more or less than this value. There is, for example, the element of time decay that would decrease the price of the long option. Meanwhile, changes in volatility could increase or decrease the option price as well.

Here, by not investing $44,920 initially in 100 shares of Lockheed Martin, the trader’s potential return is leveraged.

Ideally, the trader hopes the short LMT call will expire out of the money, or worthless. Then, the trader can sell one call after the other, until the long LMT LEAPS call expires in January 2024.