Street Calls of the Week

It was another rough day. Stocks fell again as the market searched tirelessly to find the level at which the Trump administration could no longer endure the pain. From listening to Treasury Secretary Scott Besentt yesterday, that pain point is not 10%, and my guess is that it might not even be 20%.

I think the only thing they are really focused on is bringing down rates, and right now, the more the stock market drops, the better it appears to be for rates.

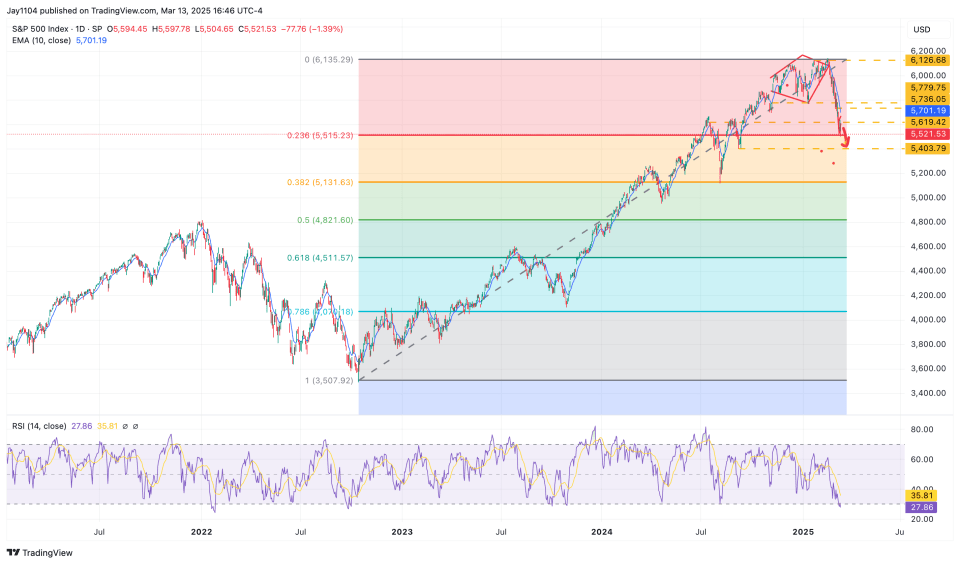

From the intraday low of around 3,500 on October 13, 2022, to the high of 6,147 on February 19, 2025, a 50% retracement in the S&P 500 would take the index to 4,810, which, interestingly, is exactly the same spot where the S&P 500 peaked in January 2021. A 61.8% retracement, which is actually a pretty healthy and normal correction, would take the index to 4,500, around the July 2023 peak.

But more seriously, it speaks to how much the market rose, and quite possibly unjustifiably so. To be fair to Team Trump, if you are trying to set an economic and geopolitical agenda, are you really going to let the stock market bully you around?

Team Trump has already said they are trying to “Detox” the economy, and it could lead to a slowdown, so the bar is set. Plain and simple, I do not think they care if the stock market drops.

In fact, if the plan is to lower rates by reducing inflation, then you have to lower asset prices. Rising asset prices are inflationary.

I just think that none of this is surprising at all. The stock market was significantly overvalued, and all it needed was a reason to go down, and now we have that reason.

Will it continue? I think so because the market wants to know when Team Trump will say, “OK, we will back off.” I don’t think that will happen soon because they are looking at rates and spending cuts.

That could mean that prices still have a long way to go on the downside. As a long-only, plain vanilla guy, that just means trying to limit my losses the best I can and having capital that I am willing to deploy when I start to find some value.