60%+ returns in 2025: Here’s how AI-powered stock investing has changed the game

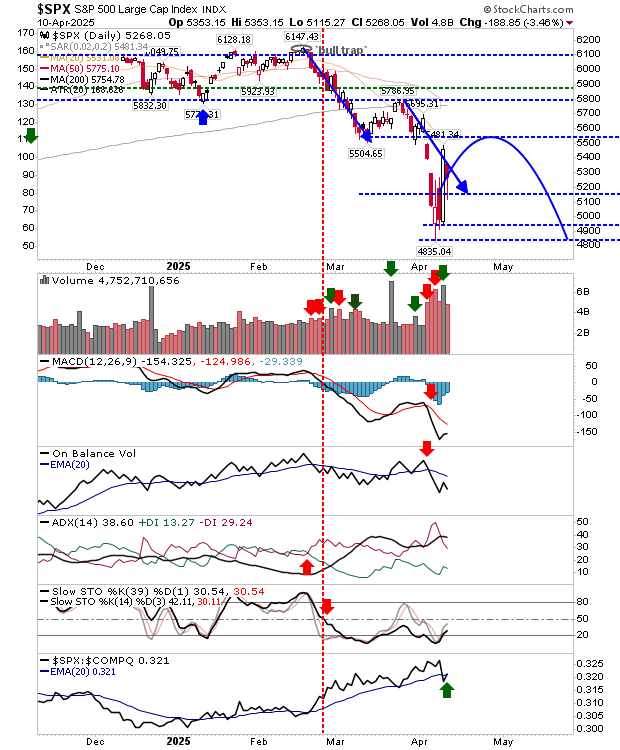

After Wednesday's big recovery, it was going to be hard for markets to follow through Thursday, but I would be looking for a recovery bounce to challenge March swing lows before a retest of the April lows.

I have illustrated this on the S&P 500; now we just need the index to conform.

We likely have had the capitulation volume, although technicals are a long way from turning bullish. Should markets take out 5,500 on this current bounce, then a V-recovery becomes favored.

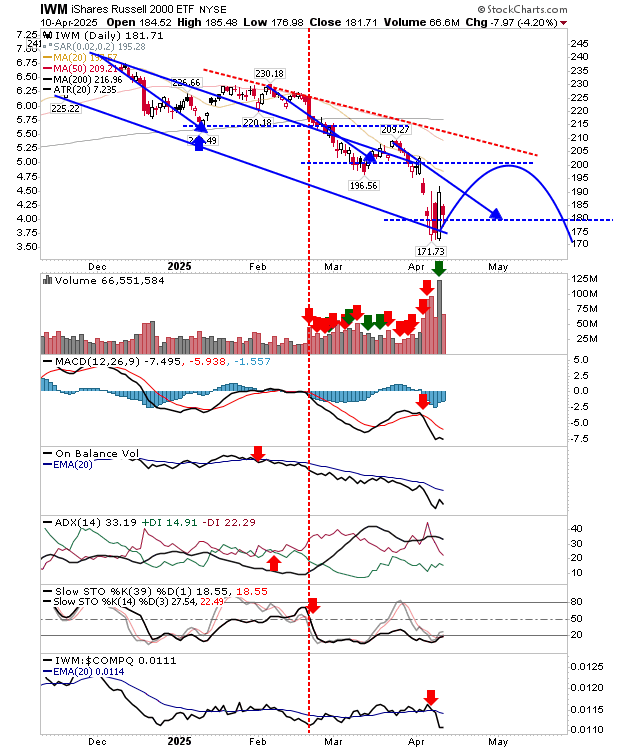

The Russell 2000 (IWM) has a bounce target of $200 (psychological resistance) before a revisit target of $171.

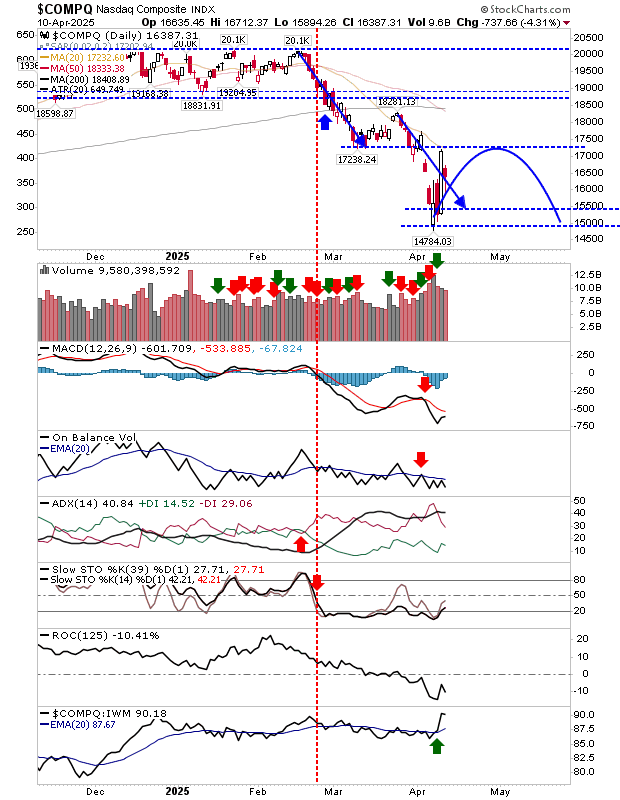

The Nasdaq is more likely to engage in a V-recovery as it has enjoyed stronger trading volumes than peer indices; a close above the 20-day MA would likely confirm.

Trump's stay of execution simply pauses the sell-off, but it will give the market time to consolidate. While a V-recovery is possible, it's hard to see this happening with the 90-day pause and the increased tension with China over tariffs. What might be more interesting is if markets continue to drift, will Trump be forced to abandon tariffs altogether, particularly if American debt holders increase bond selling?