Eos Energy stock falls after Fuzzy Panda issues short report

- The virtual reality market is poised for growth in the next few years

- Meta, Sony, Apple, and Alphabet are all vying for dominance

- Among these giants, Meta emerges as the best option to gain exposure to potential growth in the VR space

The world of virtual reality (VR) is currently witnessing a surge in investor enthusiasm, sparked by recent developments. Apple's (NASDAQ:AAPL) highly anticipated Visio Pro VR headset, set to launch in early 2024, has created significant anticipation.

In addition to this, Meta's (NASDAQ:META) recent introduction of the Quest 3, which Mark Zuckerberg has touted as "the most powerful on the market," has further ignited interest in the VR sector.

Although the concept of VR has been in existence since the 1990s, recent technological advancements have finally made it possible to create VR devices that offer rich features and are accessible to a broader audience.

Consequently, stocks associated with VR technology are now attracting more investor attention than ever before.

Virtual Reality: A Market With a Bright Medium-Term Future

According to analysts, the market for virtual reality is set to explode over the next few years. Indeed, the global AR/VR headset market is expected to post an average annual growth of 5.3% between now and 2023, according to market intelligence firm Vantage Market Research.

Grand View Research's forecasts are even more optimistic, estimating that the global virtual reality market should develop at an annual growth rate of 15% between 2022 and 2030.

In addition to games and entertainment, VR technology has applications in fields as diverse as training, engineering and design, healthcare, and defense.

In short, it's a market with a bright future over the next few years.

Companies with a wide range of profiles stand to benefit, from specialist computer chipmakers such as NVIDIA (NASDAQ:NVDA) or Qualcomm (NASDAQ:QCOM) to those who know best how to use virtual reality to boost their business.

Which Companies Are Set to Benefit?

When it comes to virtual reality hardware - i.e. headsets, joysticks, and other accessories - only a handful of companies share the market. The leader is undoubtedly Meta, which has cornered over 50% of the virtual reality headset market with its Oculus, according to data from International Data Corporation.

This is hardly surprising, given that Meta has positioned itself as the leader in the metaverse concept, investing heavily in this field for several years now, and given that the metaverse cannot exist without high-performance virtual reality equipment.

Following the presentation of the company's new Oculus 3 VR headset, Thomas Monteiro, senior analyst at Investing.com, said:

Meta remains the top contender to dominate the VR market primarily due to Zuckerberg's massive investment in the segment ahead of the competition in 2021 and 2022.

Although the company has shifted focus since then, cutting costs and delivering what Zuckerberg dubbed efficient capital management, it will still be a while before others can catch up with those years.

However, there's also a downside to being the perceived market leader, which is the very high expectations from its shareholders. In that sense, I view Meta's leadership as a double-edged sword, and any mishaps along the way will be scrutinized, likely leading to stock volatility.

Sony (NYSE:SONY) comes in second with 27% market share, but it's important to note that its headset is specifically aimed at video games and requires a PlayStation 5 to operate, making it a much more expensive option than Meta's.

However, we'll soon have to reckon with the arrival of new players in this market, including Apple as we pointed out at the beginning of the article, although the announced price of its headset ($3500) reserves it for a very specific category of users.

Alphabet (NASDAQ:GOOGL), which is due to release its virtual reality headset in the course of next year, also intends to make its mark in virtual reality, and could ultimately prove to be Meta's toughest competitor, given its massive user base.

In this analysis, we'll be asking which is the best stock to buy for investors wishing to gain exposure to manufacturers (or future manufacturers) of virtual reality headsets, by comparing Meta Platforms, Sony, Apple, and Alphabet.

The Best Stock for Exposure to Virtual Reality

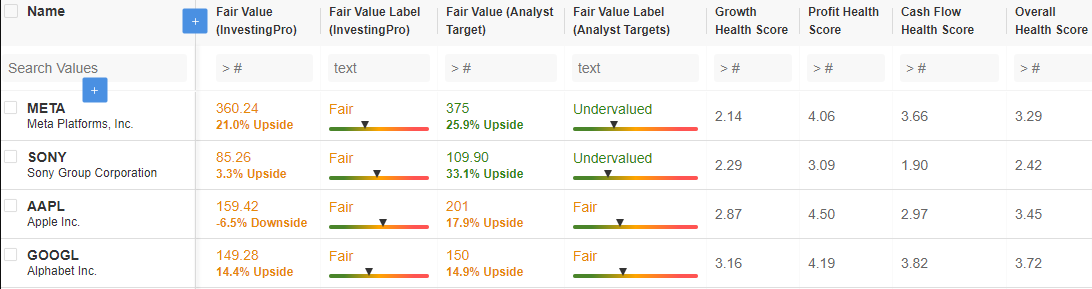

To do this, we began by assembling these stocks into an InvestingPro Advanced Watchlist, looking at their upside potential according to analysts and valuation models, as well as InvestingPro health scores in terms of revenues, earnings, and cash flow:

Source: InvestingPro

What emerges is that Apple and Alphabet shares are considered fairly valued by analysts and valuation models alike, with limited or even negative upside potential.

Sony has a nice 33.1% upside potential according to analysts, who consider the stock undervalued, but the InvestingPro Fair Value, which uses several recognized financial models, suggests almost zero upside potential.

In addition, the company's growth and cash flow scores are well below average.

Meta, on the other hand, has a potential upside of over 21% according to Fair Value. Analysts, who consider the stock undervalued, see a potential upside of nearly 26%.

On the basis of the evidence reviewed here, Meta appears to have the best potential of any stock involved in the manufacture of virtual reality headsets.

Conclusion

In conclusion, Meta stands out as a compelling choice for investors looking to tap into the burgeoning virtual reality (VR) market.

With a substantial lead in technology development and market share, coupled with its significant commitment to VR, the company offers a clear advantage.

Notably, InvestingPro data reveals that Meta boasts the strongest financial health and the most promising upside potential in this exciting investment landscape.

***

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. As a reminder, any type of assets, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor. The author does not own the stocks mentioned in the analysis.