IonQ CRO Alameddine Rima sells $4.6m in shares

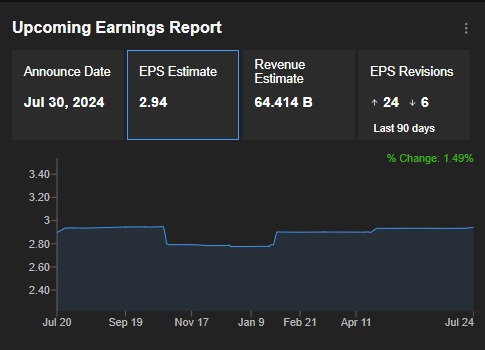

- Microsoft will publish its quarterly results on Tuesday, July 30, after the market closes.

- After several disappointing results from major technology companies, MSFT's release will be closely watched.

- Azure and AI in the spotlight: what do analysts expect?

- Limited-time offer: supercharge your portfolio with AI for under $8/month amid the summer sale!

Microsoft's (NASDAQ:MSFT) earnings report next week takes on added significance after the recent pessimism that stemmed from disappointing reports from other members of the Magnificient 7.

Tesla (NASDAQ:TSLA) and Alphabet (NASDAQ:GOOGL) (NASDAQ:GOOG) stocks faced a selloff following the earnings release, and that means the next titan to report, Microsoft, faces greater scrutiny.

The Redmond, Washington-based company has recently been in the international spotlight, implicated alongside CrowdStrike (NASDAQ:CRWD) in a global IT blackout. Investors will closely scrutinize Microsoft's performance amid these developments and the future outlook.

What are analysts forecasting for Microsoft's results?

As far as the main figures are concerned, the analyst consensus is for EPS of $2.94, identical to the previous quarter and up 9.3% year-on-year.

Source : InvestingPro

Sales are forecast at $64.414 billion, representing an annual growth of 14.6%.

Beyond these figures, Microsoft investors will be particularly interested in the growth of Azure, the Group's cloud division, which has been the main driver of sales and earnings growth in recent quarters.

In this regard, analysts at Goldman Sachs) forecast Azure revenues of $37.2 billion for the quarter to be reported next Tuesday.

Among other things, the analysts said,

"We believe that share gains in Azure and leadership in [generative artificial intelligence] could continue to put Microsoft on a distinct trajectory as long as we are in the infrastructure-building phase of the generative artificial intelligence cycle."

Speaking of AI, the company's comments on its progress and plans in the field of Artificial Intelligence will also be closely watched, given that the IT giant has established itself as a leader in the field thanks to its partnership with OpenAI, the creator of ChatGPT.

The company could indeed provide updates about its Windows PCs designed for AI workloads, and how the new devices are expected to affect Microsoft's IT business.

Finally, we shouldn't forget either that the forecasts that will be shared by the company for the coming quarters could have the last word, as we saw with Alphabet this week, which fell after better-than-expected EPS and sales, due to cautious forecasts.

Are analysts and valuation models pointing to a rise in Microsoft shares?

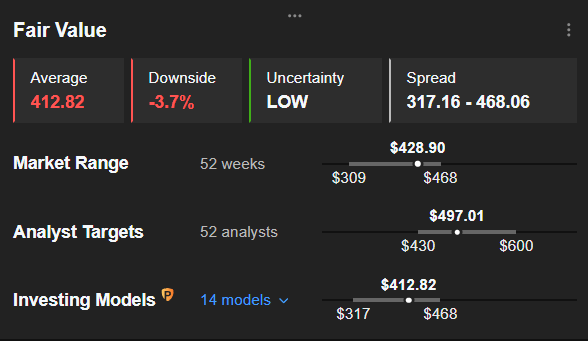

To properly approach the release of Microsoft's quarterly results and their potential impact on the share price, we also need to look at analysts' objectives and valuation models.

The 52 analysts surveyed by InvestingPro who track Microsoft shares have an average target price of $497.01, i.e. 15.8% above yesterday's closing price.

Source : InvestingPro

On the other hand, valuation models call for caution. Indeed, the InvestingPro Fair Value, which calculates an intelligent synthesis of 14 recognized valuation models, stands at just 412.82, or 3.7% below the current price.

Conclusion

As Microsoft shares currently appear to be correctly valued according to the valuation models, we can assume that a positive surprise will be necessary to generate a bullish reaction, and that any disappointment could lead to a sharp plunge in the share price.

Furthermore, it should not be forgotten that Microsoft is the world's second-largest company and that its results, as well as the reaction of its stock, could largely influence the general market, in a context where investors are increasingly worried about a crash in technology stocks.

***

This summer, get exclusive discounts on our subscriptions, including annual plans for less than $8 a month!

Tired of watching the big players rake in profits while you're left on the sidelines?

InvestingPro's revolutionary AI tool, ProPicks, puts the power of Wall Street's secret weapon - AI-powered stock selection - at YOUR fingertips!

Don't miss this limited-time offer.

Subscribe to InvestingPro today and take your investing game to the next level!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.