TSX jumps amid Fed rate cut hopes, ongoing U.S. government shutdown

Yesterday, the CEO of MicroStrategy Incorporated (NASDAQ:MSTR), Michael Saylor, announced the acquisition of another 9,245 BTC worth around $623 million at a purchase price of $67,382 per BTC. This brings MicroStrategy’s total Bitcoin (Bitcoin) holdings to 214,246 BTC at an average price of $35,160.

After this week’s price pullback, Bitcoin’s year-to-date return is 42%, while MSTR stock doubled that return for its shareholders at 84%. With MicroStrategy holding 1.02% of Bitcoin’s 21 million BTC supply, the software company now clearly serves as a BTC proxy exposure.

Just as the BTC price dropped by 7.1% on Tuesday, MSTR shares followed suit with a 7.7% pullback. In other words, the positive news announcement failed to excite MSTR traders’ expectations of Bitcoin’s future growth.

Should investors then see MicroStrategy stock as a solid buy?

Michael Saylor’s Bitcoin Game Plan Explained

Since Michael Saylor acquired the first batch of 21,454 BTC in September 2020, he leveraged the company’s debt load to acquire more bitcoins. From that point onward, MicroStrategy’s market cap increased by 1270%, from $1.7 billion to $23.3 billion.

Saylor has achieved this rapid valuation by recognizing the value of hoarding a scarce asset against the perpetually debased currency in which it is priced. For example, former Treasury Secretary Lawrence Summers recently revealed that the Federal Reserve stealthily took at least 18% of wealth last year via inflation.

Such a high uncertainty about the value of money acts as a driver for Bitcoin’s appreciation. Ultimately, because the debt used to collateralize MicroStrategy’s Bitcoin acquisitions is also priced in USD, this leads to a feedback loop:

- Use debased USD to buy limited BTC.

- As the BTC price grows higher, the MSTR stock follows.

- Use the premium on MSTR stock, effectively priced in BTC, to pay back the debt.

- Return to the first step.

But What About MicroStrategy Shareholders?

MicroStrategy shareholders are satisfied because BTC returns outpace debt interest, enabling the company to take a relaxed view on debt-loading. After all, Saylor can always issue more MSTR shares without diluting them if they are already priced in BTC.

This is why Saylor was comfortable in raising more money via convertible senior notes of $525 million, with a maturity date of March 15, 2031, at an annual interest rate of 0.875%. On Monday, the offering was concluded at $592.3 million net proceeds from the notes sale, used to buy more BTC, with an aggregate principal amount of $78.75 million.

With a conversion price of ~$2,327.21 per MSTR share, this represents a 40% stock premium. As of December, MicroStrategy’s debt to equity ratio is 1.008, which is significantly lower from 2.201 in December 2021 or 4.910 in March 2023.

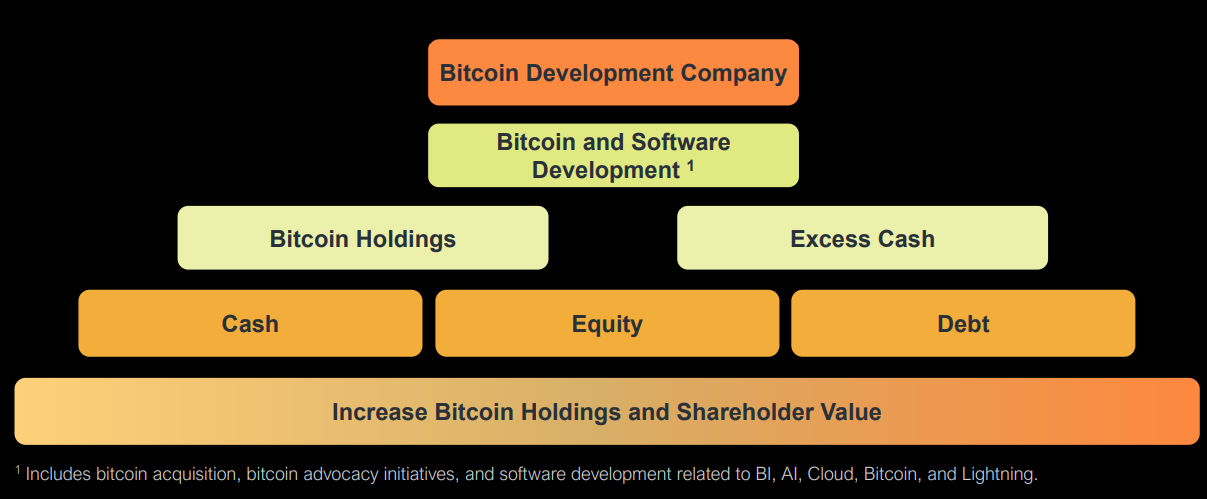

Bitcoin as MicroStrategy’s Core Business

Owing to Saylor’s strategy explained above, over one year, MSTR stock has significantly outpaced BTC, at 426% vs 129% returns respectively. Moreover, Saylor announced the transition of MicroStrategy into a Bitcoin development company on February 9th, 2024.

Based on this model with Bitcoin as an umbrella, the company will focus on integrating MicroStrategy AI solutions to MicroStrategy Cloud in partnership with Microsoft’s Azure OpenAI.

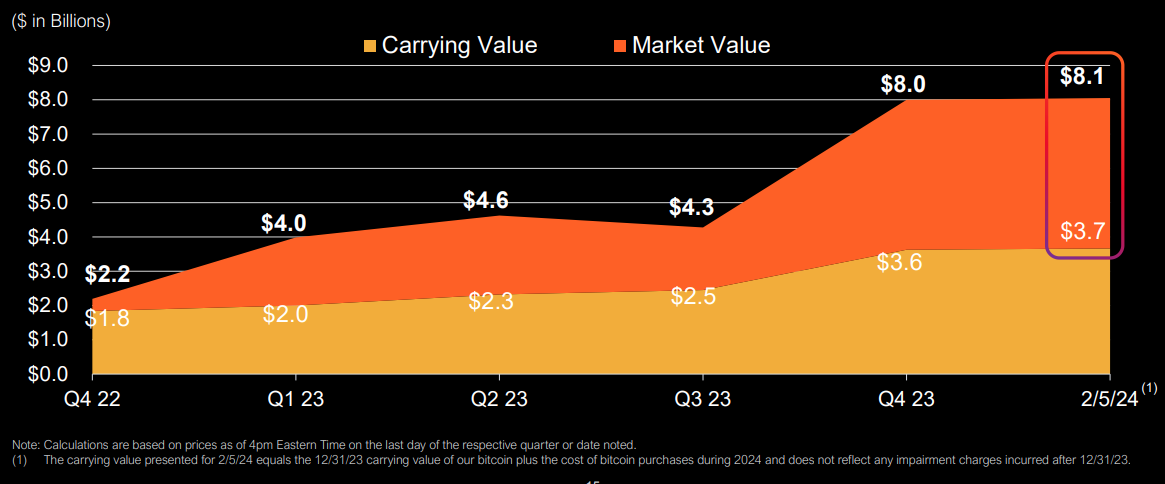

As of the February earnings report before the March convertible notes issuance, the company reported $2.3 billion in cumulative impairment charges. The market value of $8.1 billion outpaced Bitcoin holdings’ carrying value (purchase cost) of $3.7 billion.

Overall, this leaves the company with 91% of total Bitcoin holdings unencumbered, leaving plenty of room for Bitcoin price volatility.

Given the unprecedented success of Bitcoin ETF rollouts, MSTR shareholders are less worried about Michael Saylor becoming the next Nelson Bunker Hunt. The notable oil company executive attempted to corner the silver market, only to be foiled by USG intervention.

What is the Analyst Pricing of MSTR?

With the caveat that MSTR shares rely on the volatility of BTC pricing, the average MSTR price target twelve months ahead is $1,383.33 vs the current $1,415, based on four analyst inputs pulled by Nasdaq.

Following Bitcoin’s 4th halving, the high estimate is $1,810, while the low forecast is $780 per share. The Bitcoin ETF market created a new landscape, putting into question historical cycles. However, Bitcoin’s bull market typically begins within one year after the event.

Do you think Michael Saylor will be an example of more CEOs leveraging debt in this manner? Let us know in the comments below.

Disclaimer: The author does not hold or have a position in any securities discussed in the article.