Paul Tudor Jones sees potential market rally after late October

- The steep plunge in Moderna stock comes amid signs that the pandemic is moving towards an endemic stage

- The company still maintains a strong sales pipeline for its COVID vaccines, which should keep it cash-rich in the short run

- Beyond COVID-19, Moderna executives are optimistic their technology will bring cures for other respiratory infectious diseases

2022 has been terrible for virtually every stock that gained attractiveness on the back of the COVID-19 pandemic. That includes Moderna Inc (NASDAQ:MRNA), one of the largest producers of COVID shots and a former market darling. The biotech company's shares are down more than 43% this year, massively underperforming the benchmark indices.

The steep plunge comes amid signs that the pandemic is moving towards the endemic stage, and people are less keen to roll up their sleeves for booster shots, even amid the emergence of more-transmissible virus variants.

According to data compiled by the Centers for Disease Control and Prevention, only about 31% of Americans eligible for a fourth shot have received one. The Cambridge, Massachusetts-based Moderna, which makes almost all of its sales by selling COVID shots, is particularly vulnerable to this declining trend.

In its second-quarter earnings release this month, the company reported to investors that its profit fell 21% to $2.2 billion due to charges tied to expired vaccine doses and changes to purchase commitments. These included a $499 million inventory write-down for unused doses that have exceeded or should exceed their approved shelf lives soon.

Attractive Risk/Reward?

There is no doubt that Moderna has passed its peak as the pandemic shifts into an endemic phase where the virus is less disruptive to society. Still, in my view, its stock offers an attractive risk/reward proposition on both a short- and long-term basis.

In the short run, the company has maintained a strong sales pipeline for its COVID vaccines, which will keep it cash-rich. According to Moderna's latest forecast, the company has advance purchase agreements representing about $21 billion in sales for the year, including COVID-19 booster shots.

Furthermore, the company expects sales to accelerate in the last quarter of the year from the current quarter as more governments approve its updated COVID-19 vaccine.

According to Investment bank Cowen, the endemic phase may not emerge for another two years. If that's the case, Moderna's current COVID vaccine will have longer and stronger demand than many expect.

In the meantime, Moderna's strong order book is keeping its financial situation quite impressive. It's among those quality names with solid balance sheets, high margins, and above-average free cash flow yield.

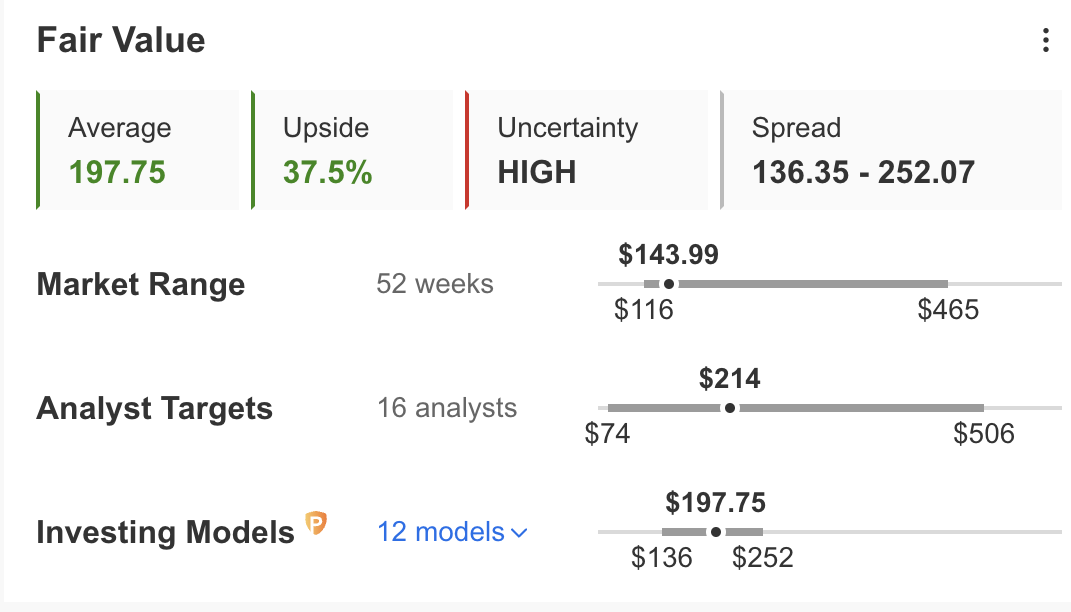

And according to several financial models like those that value companies based on P/E or P/S multiples or terminal values, the average fair value for MRNA stock on InvestingPro stands at $197.75, implying more than 37% upside potential.

Beyond the COVID-19 pandemic, Moderna executives are optimistic that their technology will cure other respiratory infectious diseases, such as the respiratory syncytial virus (RSV); and cytomegalovirus (CMV); as well as other potential therapies for ailments, including cancers and inflammatory diseases.

Bottom Line

With vaccine hype waning and many retail investors pulling back from Moderna, its valuations have become more attractive, reflecting a better risk-to-reward scenario on its pipeline of potential treatments outside COVID-19. That adjustment, in my view, has made Moderna a better bet for long-term investors than it was last year.

Disclosure: The writer doesn't own Moderna stock