Bets on October rate-cut overblown as Fed a ’reluctant dove,’ Macquarie warns

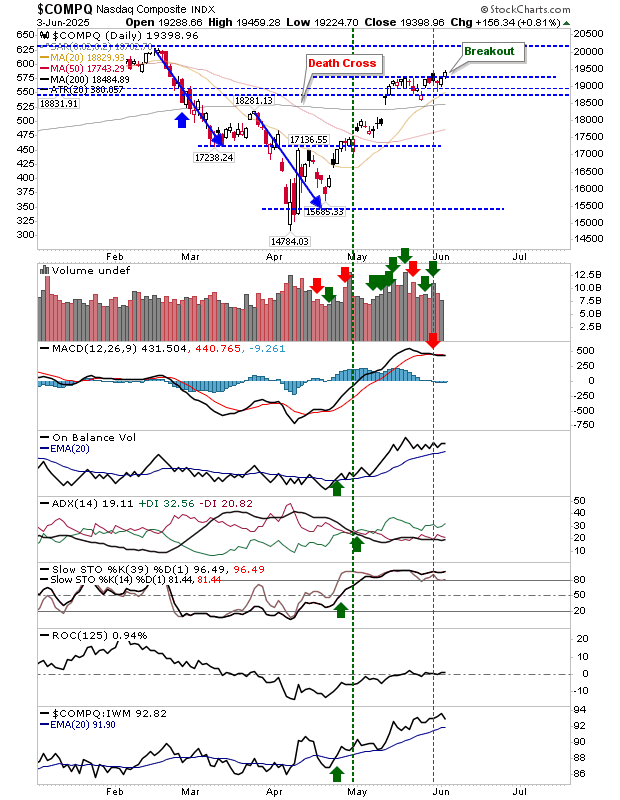

After weeks of back-and-forth, it looks like bulls are about to kick off a solid day of buying. The Nasdaq had the best of the action as it edged above its handle, leaving it in a zone to go challenge 20,000. The MACD is holding to a ’sell’ signal, but is close to a new ’buy’ signal and a return to net bullish technicals. This is looking very positive for the index, and only the lack of accumulation volume is a (mild) negative.

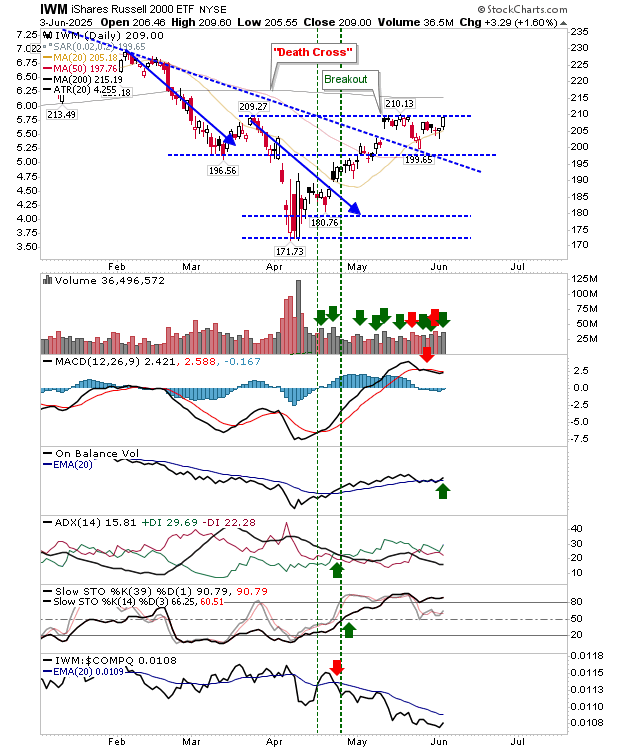

The Russell 2000 (IWM) is lagging the Nasdaq (see relative performance), but it has managed to return to a new ’buy’ signal in On-Balance-Volume that came off the back of an accumulation day. It looks like value traders are ready to take advantage of a break of March swing highs, with a sizable upside zone if it can clear its 200-day MA.

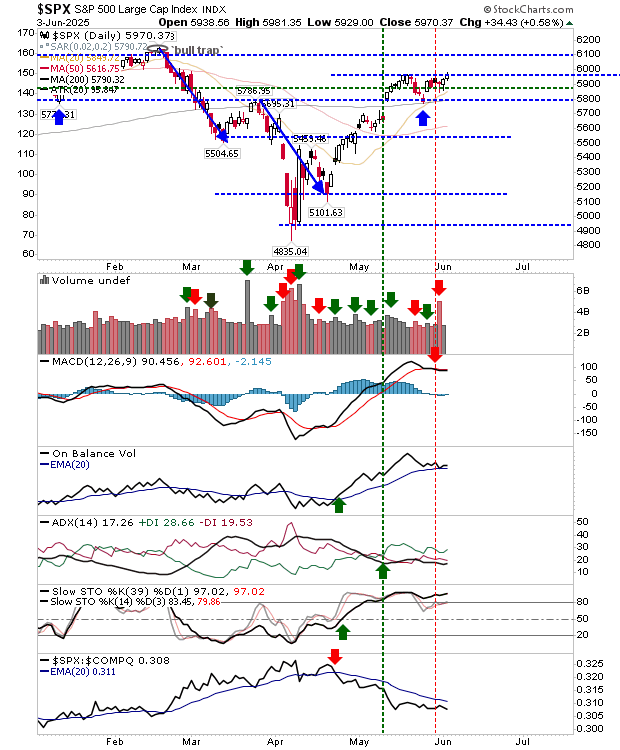

Like the Nasdaq, the S&P 500 is nicely poised to clear handle resistance and move to challenge the February ’bull trap’. Whatever happens over the coming days, support at 5,800 should be strong given proximity of 200-day MA and the March swing high.

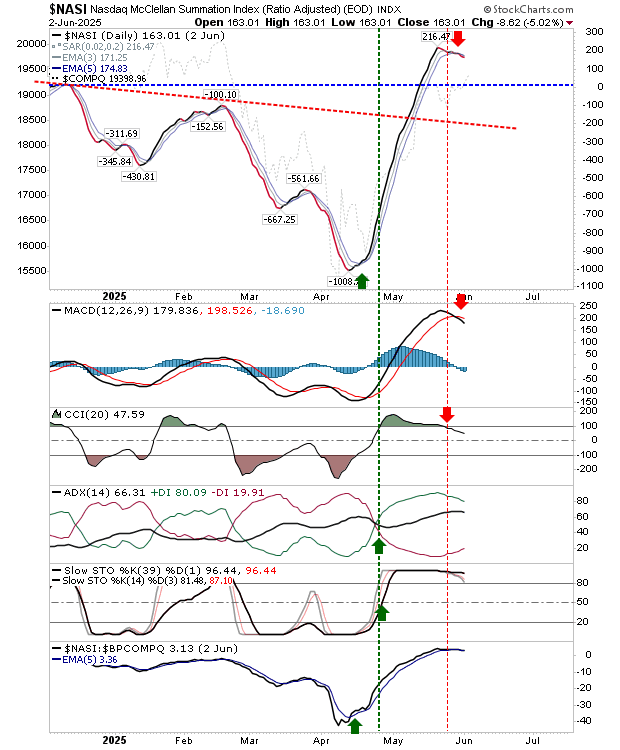

While I remain positive on the Nasdaq, we need to keep an eye on breadth metrics. For example, the Nasdaq Summation Index ($NASI) is on a ’sell’ signal and is a point where taking profits or going short is favored. Given the tight action, a swing trade off a break of consolidation highs or lows (or an option spread) might offer a better risk: reward.