Trump to impose 100% tariff on China starting November 1

We primarily use the Elliott Wave Principle (EWP) to forecast the financial markets, such as the Nasdaq 100. In our last update from three weeks ago we assessed the state of the market/chart using several objective parameters and found that the Bears had to wait to get their chance,

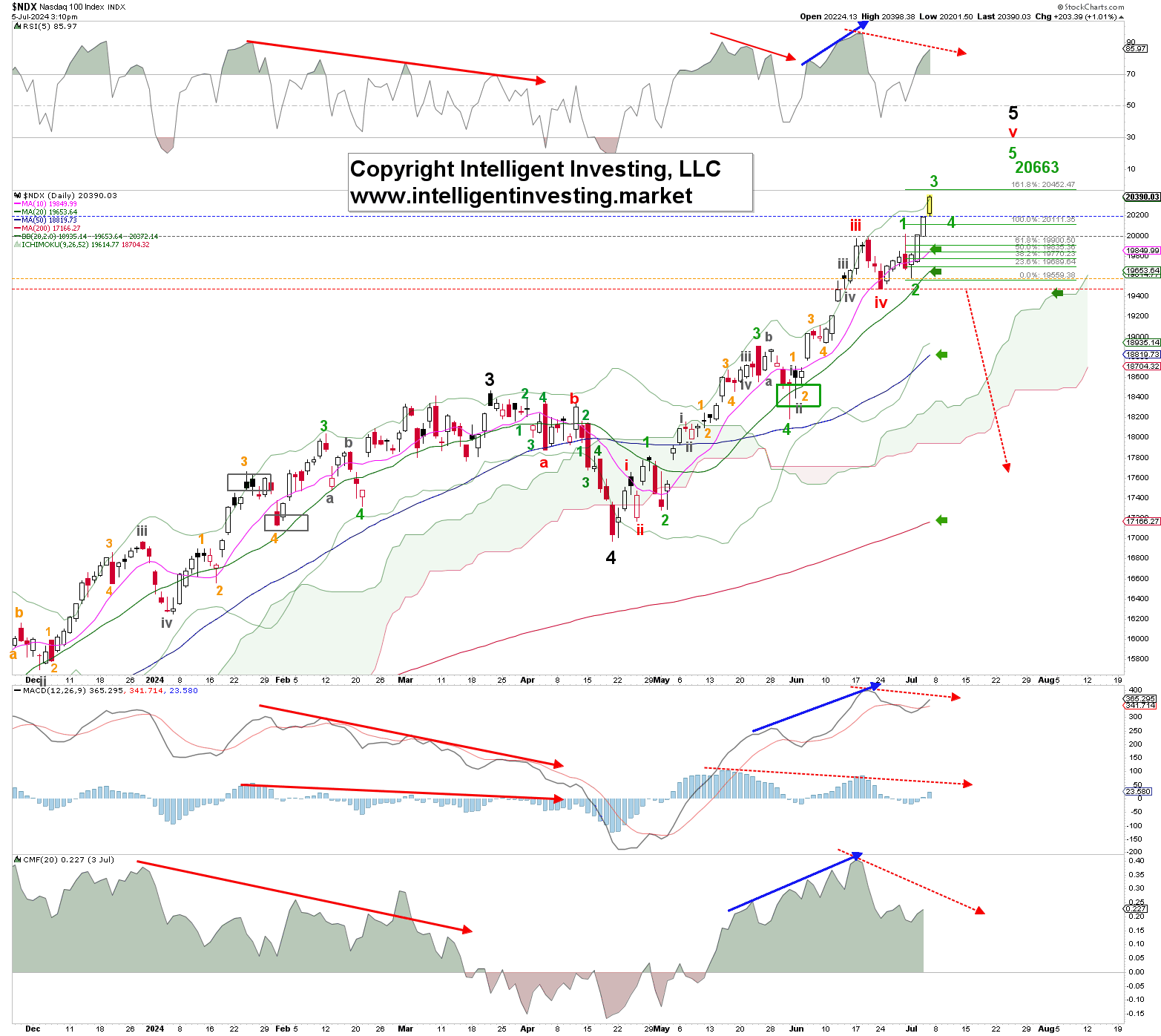

“We must apply a Bullish EWP count until proven otherwise, and as long as the index can stay above $19,100, the third warning level, we can foresee it wrapping up the grey W-iii, followed by a grey W-iv, v; red W-iv and -v. ... The waves’ target zones are at this stage but subject to change: $20,100+/-50, $19,600+/-100, $21,000+/-500, $19,200+/-200, and $25,000, respectively.”

Our bullish stance was correct, as the NDX followed this impulse more closely. It topped on June 20th at $19,979, dropped to $19,472 on June 24, and now trades at $20,378. See Figure 1 below.

Thus, like last, the bears could only close the index below the first warning level we had raised to $19,620 (blue dotted horizontal line in the chart of our previous update). The NDX Bulls then took over and have run the ball almost up to $20,500 (!). Thus, we have updated our EWP count accordingly and expect the index to be in the green W-3, 4, and 5 sequence for the red W-v of the black W-5.

Ideally, the green W-3 tops around the 161.8% Fibonacci extension ($20450+/-50). The green W-4 bottoms around the 100.0% Fib-extension ($20110+/-50), followed by the last green W-5 to ideally the 200.0% extension at $20665+/-50. We should expect this pattern to unfold over the next 2-3 trading weeks.

Like last, the warning levels for the Bulls (blue, grey, orange, and red) continue to rise. The first warning level (blue) is $20,200, and the second (grey) is $20,00, etc.. At this stage, only a break below $19,470, the red 4th warning level, will turn the chart from Bullish to Bearish, but we have the earlier warnings to tell us to become more cautious. For example, negative divergence is starting to build, i.e., the index’s price keeps marching higher, but the technical indicators (TIs) are not: red dotted arrows.

Compare this to the February-March time frame: red solid arrows. Indeed, divergence is a condition, not a trade trigger. Lastly, the mid-May to mid-June rally had no divergences (blue solid arrows), telling us correctly that higher prices after the anticipated red W-iv correction were the most likely scenario. A voila, here we are.