Tyson Foods to close major Nebraska beef plant amid cattle shortage - WSJ

So, I guess NVIDIA's (NASDAQ:NVDA) results were good enough to send the stock higher and clear the resistance at $750, with shares rising to $785.

I’m not sure whether the stock deserved to move that high, but clearly, $277 billion in market cap in just one day seems like an awful lot for a guide that came in $2 billion better than expected, even at 20x times sales.

Again, this is not a total surprise because the options market told us that the odds for an advance to $800 were possible following the results if the stock could break above $750, and that is what happened.

Whether or not anything changed meaningfully for the rest of the market, I don’t know. Well, I do know, and so far, the answer to me is no, not much has changed.

The VIX is still supported at 14, and the US dollar and rates haven’t changed much.

Even the NASDAQ 100 closed below the highs last seen on February 12, around 18,000, and I am curious to see if it can clear resistance there and then gap over it today and is forming a broadening wedge, or if it is a potential double top.

Meanwhile, the technology XLK ETF rose 3% yesterday, and all it did was fill the gap from February 13.

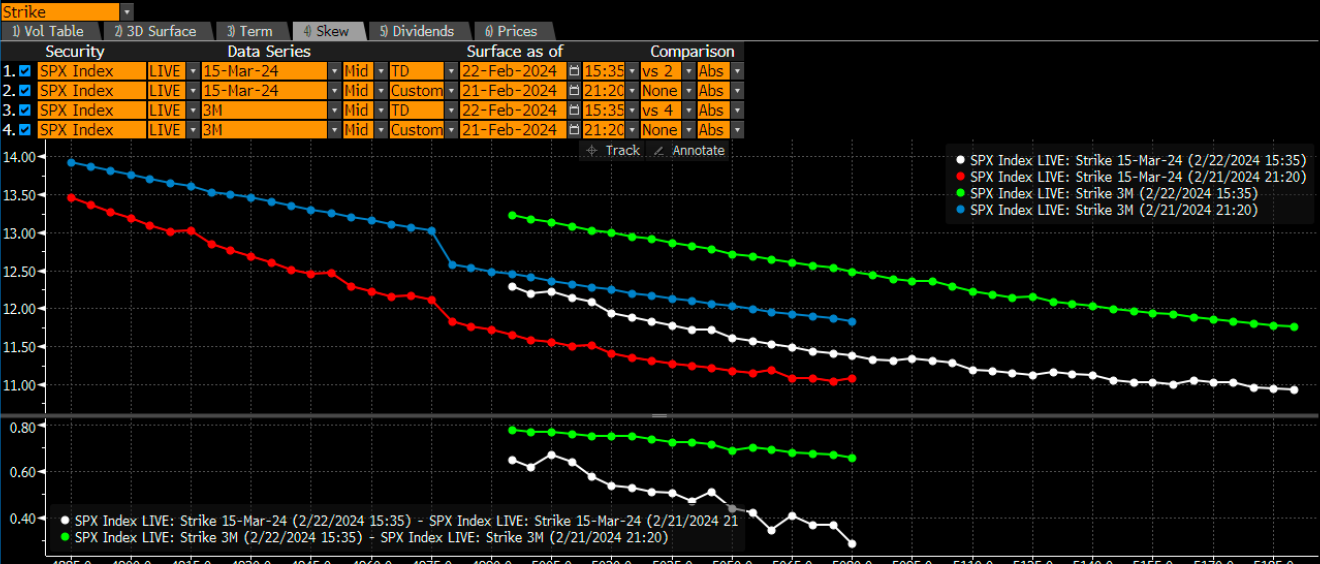

But what was odd yesterday was how we again saw fixed strike implied volatility moving higher from yesterday for both March OPEX and implied volatility three months from now.

We also saw the 1-month implied correlation go higher yesterday, and you don’t often see the S&P 500 and the 1-month implied correlation index go higher on the same day.

We also had 10-year real yields move back to 2% yesterday for the first time since the carnage following the December FOMC meeting.

Meanwhile, 1-year inflation breakevens were up 3.6% yesterday, their highest level since a year ago, with 1-year inflation swaps rising as well.

But what was most bizarre was that despite this screaming of tightening financial conditions in most of the bond and volatility land, credit spreads refused to go higher yesterday and went lower.

So, what we are seeing seems to be out of the land of the bizarre, and while it may be bizarre and out of the ordinary, it is what happened; while Nvidia’s earnings were good enough to send the stock higher yesterday, I don’t know that it was enough to change the bigger picture. But that’s why we play the game every day.

Youtube Video: