Nvidia shares pop as analysts dismiss AI bubble concerns

After a volatile few days, indexes have managed to stage a recovery, with some indexes doing better than others.

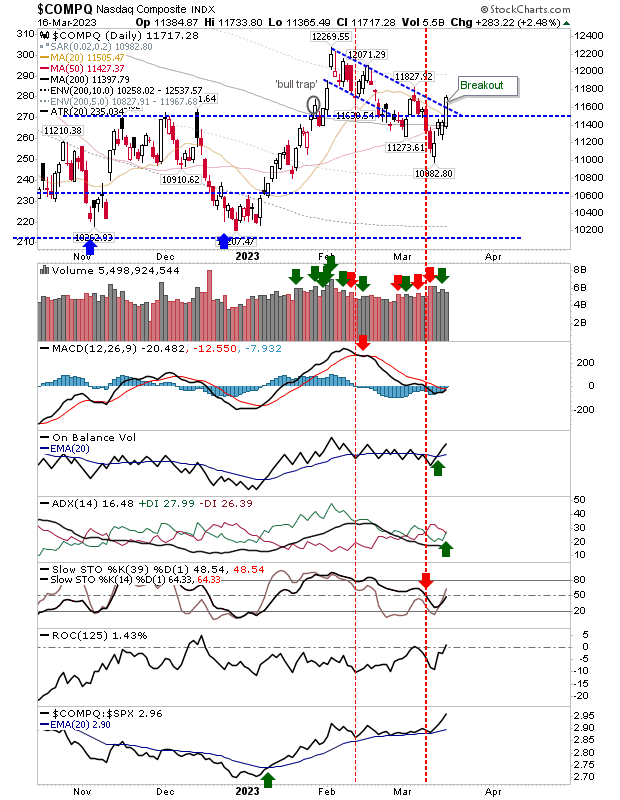

The Nasdaq returned above support while breaking resistance from a bull flag. Volume eased back despite the gain; not a great association gave the extent of today's move higher. One could play the resistance breakout, but we don't want to see an undercut of 11,500 support.

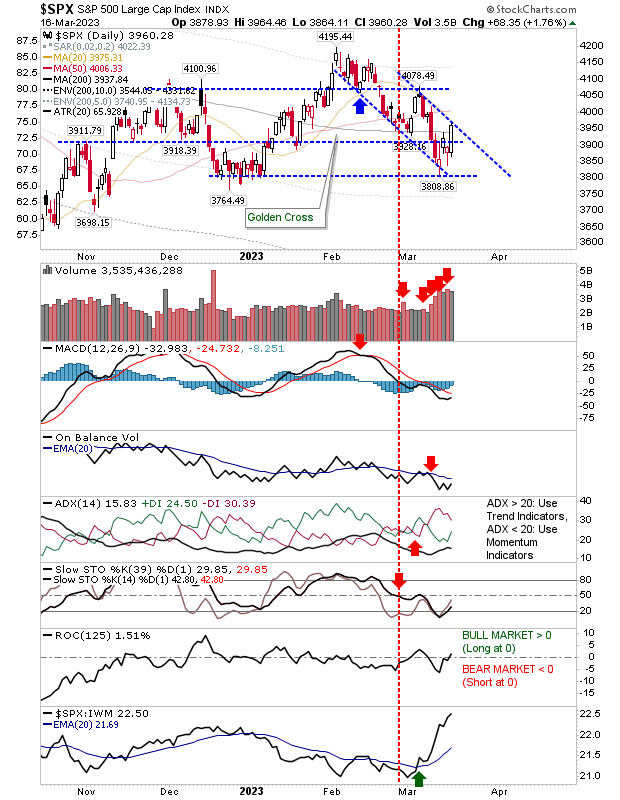

The S&P 500 is trapped inside its prior trading range, having dropped below breakout support. Today's gain brought the index above its 200-day MA, but with the index back inside its prior consolidation, it's unclear what can be expected next.

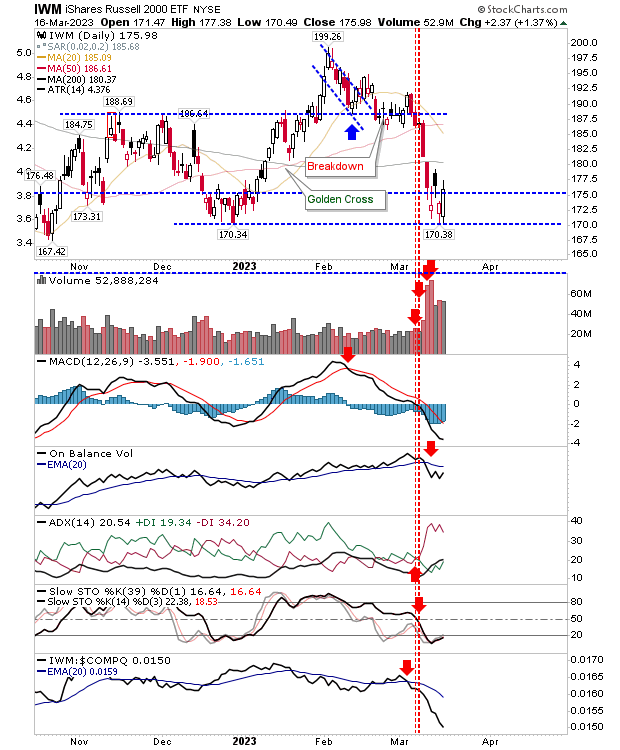

The Russell 2000 had given up the most ground from the indexes; from holding breakout support to a quick return to Christmas lows, it has had the most traumatic week. Today's action ranked as a sizable bullish engulfing pattern on oversold momentum - a bullish sign.

Look for some upside follow-through tomorrow, although I suspect the 200-day MA could prove problematic for bulls.

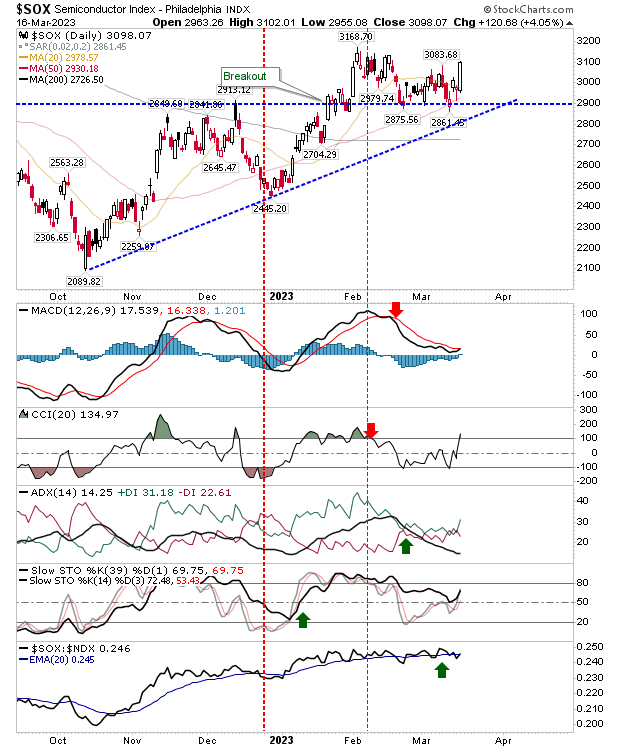

For tomorrow, the Russell 2000 is the easy watch, but I suspect it will fall to the tech sector (or semiconductors) to make the running.