Europe’s Stoxx 600 inches lower amid French political crisis

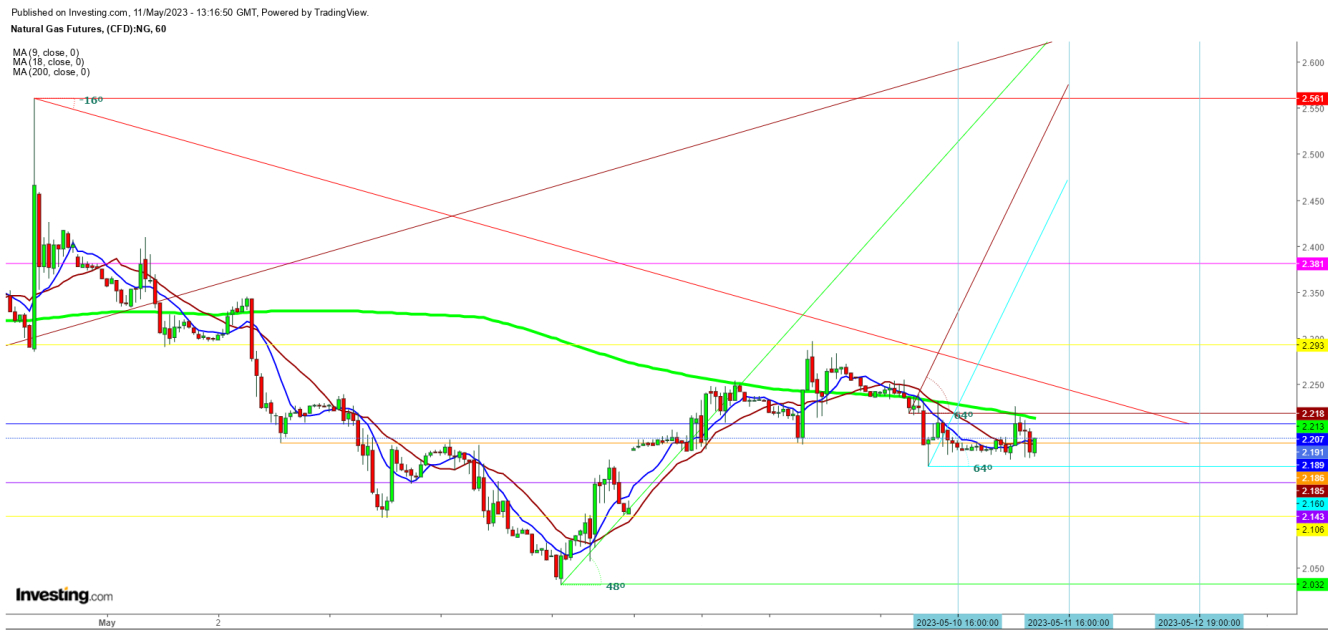

This week, movements in natural gas futures indicate a sudden increase in uncertainty among traders as they struggle to break above the 200 DMA on the upper end of the one-hour chart, while also attempting to maintain their position above the gap that was created at the beginning of the week.

Observing movements across various time frames, I noticed the same behavior in the daily chart from Nov. 5, 2019 to Aug. 28, 2020, while prices hit a low at $1.432 on June 26, 2020, before hitting a high at $2.740 on Aug. 28, 2020; meanwhile, they traded at $1.827 on May 11, 2020.

Now, the point is to note the post-inventory announcement directional move on May 11, 2023. This movement is likely to add further uncertainty regarding the future direction of prices, particularly as the hottest days are expected to be from Mother's Day weekend through Tuesday in western Washington and western Oregon, which includes Seattle and Portland, as reported by weather.com.

It's true that the presence of high pressure could potentially create concerns about a hurricane in the near future, especially given that the U.S. hurricane season is set to begin on June 1, 2023. However, the ongoing uncertainty surrounding the weather patterns may lead to significant price fluctuations until the end of this trading week.

In the 1-hour chart above, natural gas futures are struggling to find a breakout above the 200 DMA, which is at $2.213 on the upper side, while on the lower side trying to hold above the weekly gap that was created at the opening of this week.

This price behavior has increased uncertainty as traders fear a repetition of the same movement witnessed from Nov. 5, 2019, to Aug. 28, 2020.

I conclude that if natural gas futures hold above $2.111 until this weekly close and at the opening of the upcoming week, we will not witness the same low levels as the last time, as bullish sentiment has ensured that any dip below $2 since the beginning of this year has found significant buying support.

Furthermore, if prices hold above the significant resistance at $2.561 before this weekly close, the trend is likely to tilt in favor of bulls.

Disclaimer: The author of this analysis does not have any position in natural gas futures. Readers should take a trading position at their own risk, as natural gas is one of the most liquid commodities in the world.