Gold prices rebound as risk-off mood grips markets

On analysis of the movements of the Natural Gas futures in different time frames, The current formations in an hourly chart indicate a bumpy move awaits here, as the natural gas inventory announcement tonight could change the sentiments here.

Undoubtedly, the expected injection level tonight is 31 Bcf; which was 22 Bcf last week could find a surprisingly lesser injection this time of approx. 12 Bcf. If this comes according to the expectations the, bulls could run upward to pounce upon the bears.

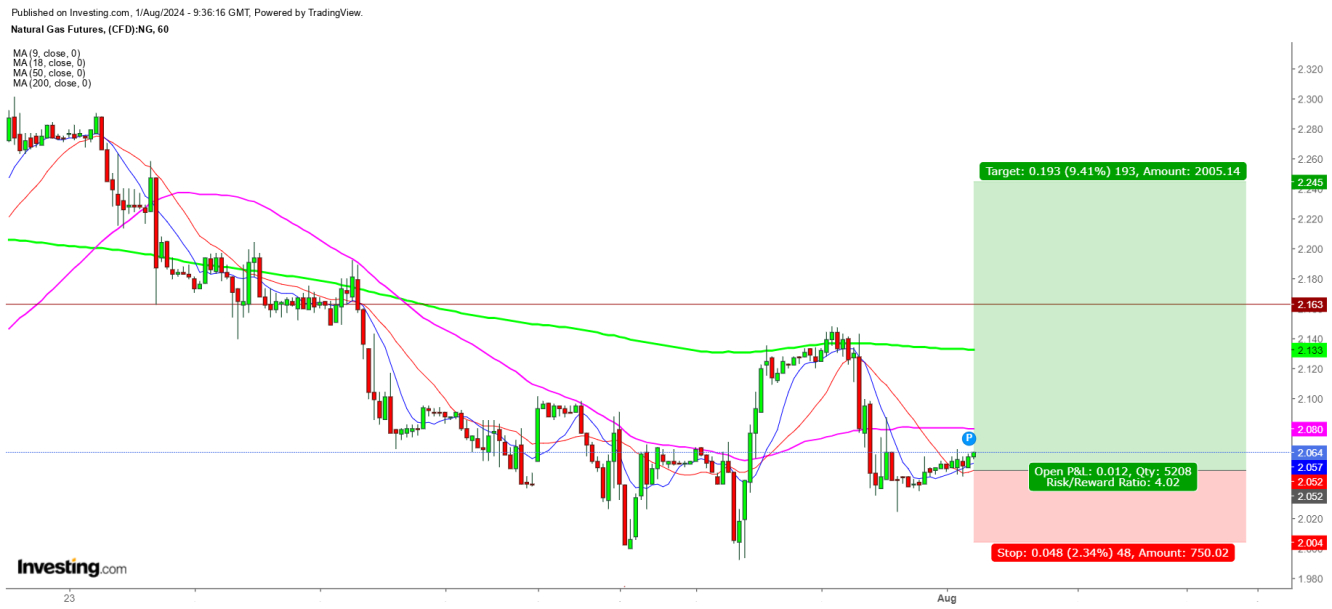

In a 1 Hr. chart, 9 DMA has come above 18 DMA, indicating the advent of price reversal. In such a case, natural gas futures could hit $2.245 before Aug. 5, 2024. A long position at the current level along with a stop-loss at $2, could be the best option for the short term.

In a Daily chart, bulls are struggling to hold the current indicating a limited downside in natural gas prices. Undoubtedly, the announcement of a lesser injection tonight could result in a rally likely to continue during the first half of this month.

I conclude that any downward move by the natural gas futures up to $2 could provide an opportunity to go long.