Paul Tudor Jones sees potential market rally after late October

- Natgas' Achilles' heel seems to be output above 100 bcf daily

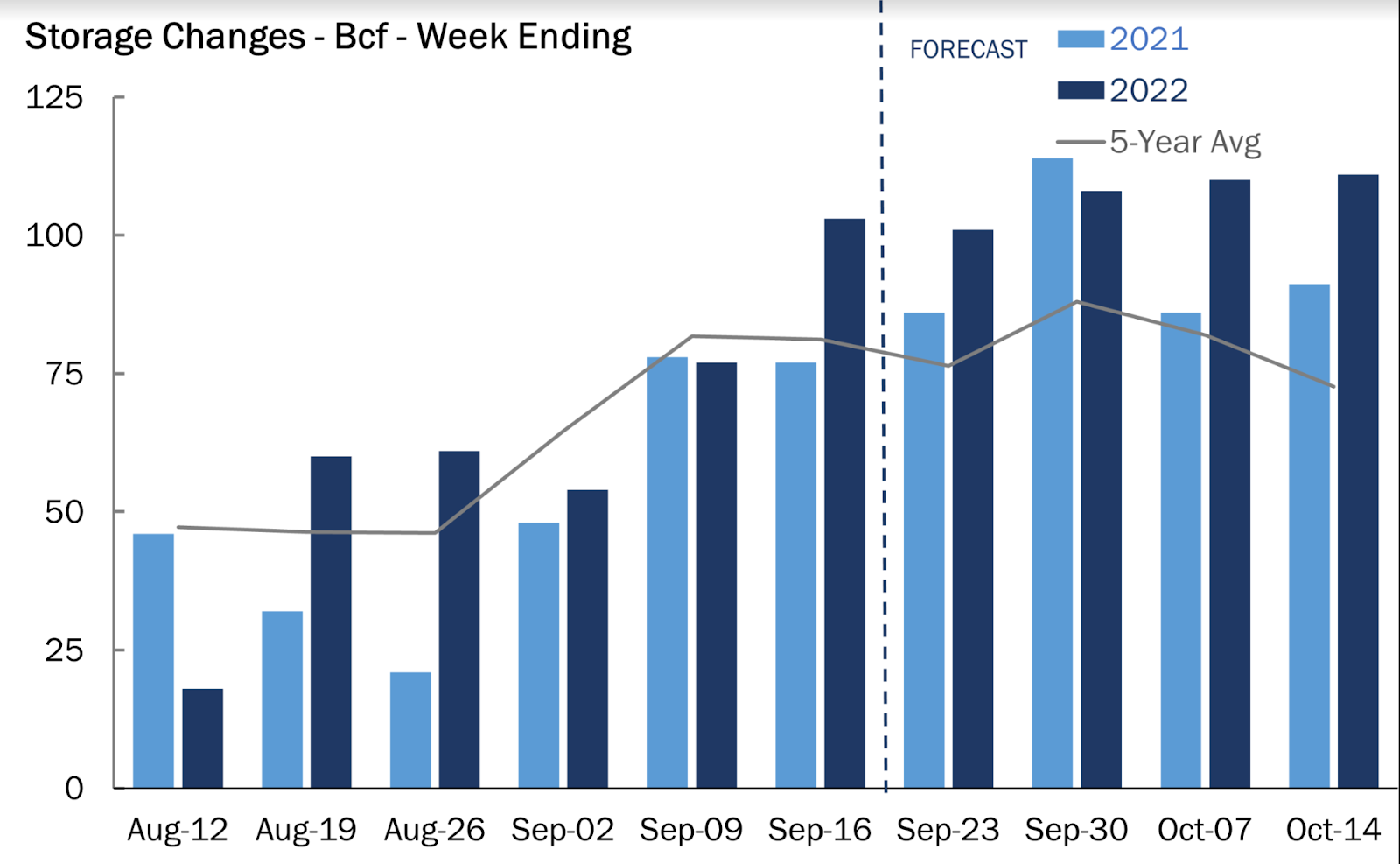

- Analysts forecast a higher-than-seasonal 94 bcf build to gas storage last week

- Last week's weather reading was 60 CDDs, slightly above the 30-year norm

- Some analysts call for $5.50 pricing if storage doesn't fundamentally improve

Amid this week's tumble to the $6 levels seen in July, natural gas' Achilles' heel seems to be not in a lack of demand owing to the onset of fall weather that has reduced the need for air-conditioning—and, consequently, gas burns.

Rather, it's the record-high production of above 100 billion cubic feet (bcf) per day that's weighing on the market—and sentiment.

As Alan Lammey, analyst at Houston-based gas markets consultancy, Gelber & Associates, puts it:

"Demand isn't an issue with cooler temperatures dominating most of the US. Dry gas production volumes continue to remain in a range of 99.5 bcf/d to 101 bcf/d, and there's the very real potential for gas storage to see aggressively large, back-to-back, triple-digit weekly injections in the weeks ahead."

The worry over storage being higher than what gas bulls have forecast is weighing on gas futures that, just two weeks ago, hovered at above $9 on the New York Mercantile Exchange's Henry Hub.

Charts suggest that both bulls and bears might be pacing cautiously in the days ahead, said Sunil Kumar Dixit, chief technical strategist at SKCharting.com.

"Yesterday's drop to $6.56 on the Henry Hub got support from the bulls as the low coincided with the 200-Day Simple Moving Average of $6.55 and that helped bring the close of $7.04."

"If there's a sustained move above the 5-Day Exponential Average of $7.06, will help natgas clear the minor resistance zone of $7.30 - $7.77, before it embarks on a retest of the 100 Day-SMA of $7.92."

But Dixit also cautions that weakness below the 200-Day SMA of $6.55 and the 50-Week EMA of $6.50 will work on bearish continuation towards the July low of $5.32.

As the market awaits another weekly update from the Energy Information Administration of gas in storage, analysts tracked by Investing.com and Reuters predicted that US utilities likely added a higher-than-usual 94 bcf to inventories last week.

That injection for the week ending Sept. 23 compares with a build of 86 bcf during the same week a year ago and a five-year (2017-2021) average increase of 77 bcf.

In the week ended Sept. 16, utilities added 103 bcf of gas to storage.

The forecast for the week ended Sept. 23 would lift stockpiles to 2.968 trillion cubic feet (tcf), about 6% below the same week a year ago and 9.6% below the five-year average.

There were around 60 cooling degree days (CDDs) last week, which was slightly higher than the 30-year normal of 47 CDDs for the period, Reuters-associated data provider Refinitiv said.

CDDs, which are used to estimate demand to cool homes and businesses, measure the number of degrees a day's average temperature is above 65 Fahrenheit (18 Celsius).

Storage builds aside, from Northern to the Southern United States, a lack of demand has weighed on gas prices, prompting Goldman Sachs to call for $5 pricing for the 2023 NYMEX gas futures strip.

Data examined by Investing.com shows gas storage levels slated to top out close to 3.5 tcf by early November, though the start of the winter season could open up with a storage deficit of around 150 bcf versus the five-year average.

However, this deficit may be further eroded if October comes in warmer than average as presently depicted by the longer-range weather forecast models.

Should the first half of November come in warmer than normal, it is likely that we will get gas at $5.50 or so over the course of the next eight weeks.

Adds Gelber & Associates' analyst Lammey:

"When factoring in what appears to be the marking of a sizable amount of weather-related demand destruction on Florida and possibly other areas of the Southeast US, there’s not much for gas market bulls to crow about."

"Looking ahead, NYMEX gas futures prices are now being more dominantly controlled by the gas market bears that are pointing to record high dry gas production over 100 Bcf/d, a shoulder season demand outlook that will likely produce triple-digit gas storage injections, and Hurricane Ian which is setting-up to negatively impact powerburn demand in Florida and in portions of the Southeast US."

Disclaimer: Barani Krishnan uses a range of views outside his own to bring diversity to his analysis of any market. For neutrality, he sometimes presents contrarian views and market variables. He does not hold positions in the commodities and securities he writes about.