Goldman lists 2 reasons why gold prices may exceed its $4,000 forecast

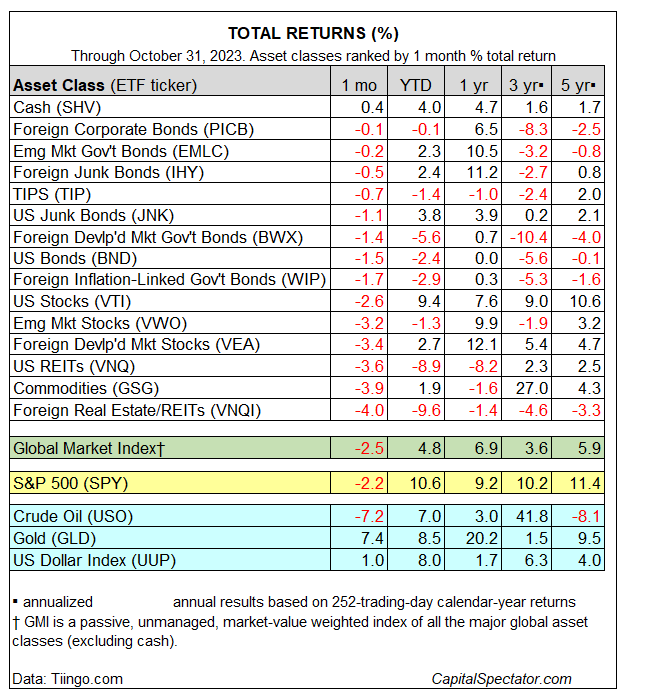

October was another rough for global markets. With the exception of cash, all the major asset classes fell last month – the third straight month of red ink for all but a handful of markets, based on a set of ETF proxies.

Safety has become an indispensable asset, as last month reminded us. The iShares Short Treasury Bond ETF (NASDAQ:SHV), a cash proxy, rose 0.4% in October — the lone gainer among the major asset classes. For the year to date, SHV is up 4.0%, outperforming all the funds that comprise the major asset classes except US stocks (Vanguard Total Stock Market Index Fund ETF Shares (NYSE:VTI)).

Losses in October dominated, with foreign property shares (VNQI) suffering the deepest cut. Vanguard Global ex-U.S. Real Estate Index Fund ETF (NASDAQ:VNQI) fell 4.0% last month, the fund’s third-straight monthly decline. So far in 2023, VNQI has tumbled nearly 10%, the worst performer this year for the major asset classes.

Gold (GLD), a component of the broadly defined commodities category (GSG), is an upside outlier this year. In addition to rallying 7.4% in October, the strongest monthly gain for the markets listed above, the precious metal is also among the year-to-date leaders in the table above via an 8.5% increase.

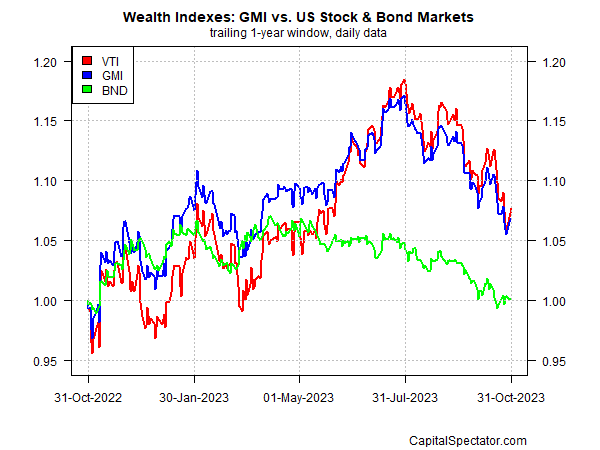

Given the bearish winds blowing anew, it’s no surprise that the Global Market Index (GMI) fell for a third month in October, shedding 2.5% for the month. This unmanaged benchmark (maintained by CapitalSpectator.com) holds all the major asset classes (except cash) in market-value weights and represents a competitive benchmark for multi-asset-class portfolios. Despite the latest declines, GMI is holding on to a moderate 4.8% year-to-date gain – outperforming all its component markets except for the 9.4% year-to-date gain for US shares (VTI).

GMI’s performance over the past year continues to track the ebb and flow of US stocks (VTI). US bonds (BND), on the other hand, are flat over the 12 months.