InvestingPro’s Fair Value model captures 63% gain in Steelcase ahead of acquisition

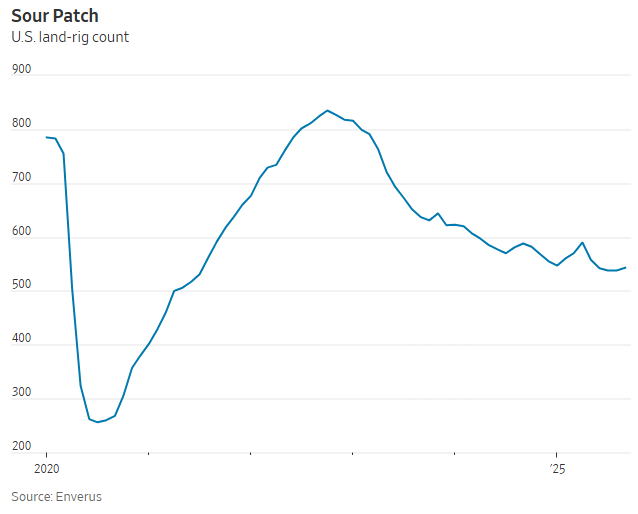

Oilfield service companies are fighting an uphill battle after years of weak demand from traditional energy producers. A relentless multi-year decline in U.S. rig counts has resulted in beaten-down oilfield service companies turning to an unlikely new customer base: technology firms racing to power AI data centers.

According to the WSJ, companies such as Solaris (NYSE:SEI), Liberty Energy (OTC:LBYE), and ProPetro (NYSE:PUMP) are pivoting to supply modular natural-gas turbines directly to data centers. Their experience generating power to fuel fracking operations makes them well-suited for the role. This unique opportunity lies in the speed with which oilfield service companies can bring data centers online. Per the WSJ:

This equipment doesn’t face the years-long wait list that some large-scale natural-gas turbines do, such as ones from GE Vernova. Some utility-scale gas turbines have five- to seven-year wait lists, according to Paul Sotkiewicz, president of E-Cubed Policy Associates. Developers of utility-scale natural-gas power plants are also dealing with a construction-crew shortage. Modular equipment, by contrast, is far less complicated to install and doesn’t face the same constraints.

However, investors should be cautious about assuming this new demand will last. Data centers may only treat oilfield servicers as a stopgap while waiting for utility-scale capacity or cleaner energy sources. If so, the current boom could fade as quickly as it arrived.

But their modular nature means these systems probably aren’t the cheapest option over the long run. They have an upfront cost advantage over, say, utility-scale, combined-cycle gas power plants requiring extensive construction work. But they involve more variable costs: Higher fuel costs, for example, because of lower equipment efficiency. Their equipment also tends to have more frequent replacement schedules, which can lead to escalating costs.

For now, oilfield service companies may have found a lifeline in AI’s insatiable power demand. Whether it becomes a sustainable business model remains to be seen.

CPI and Jobless Claims Keep Fed on Track

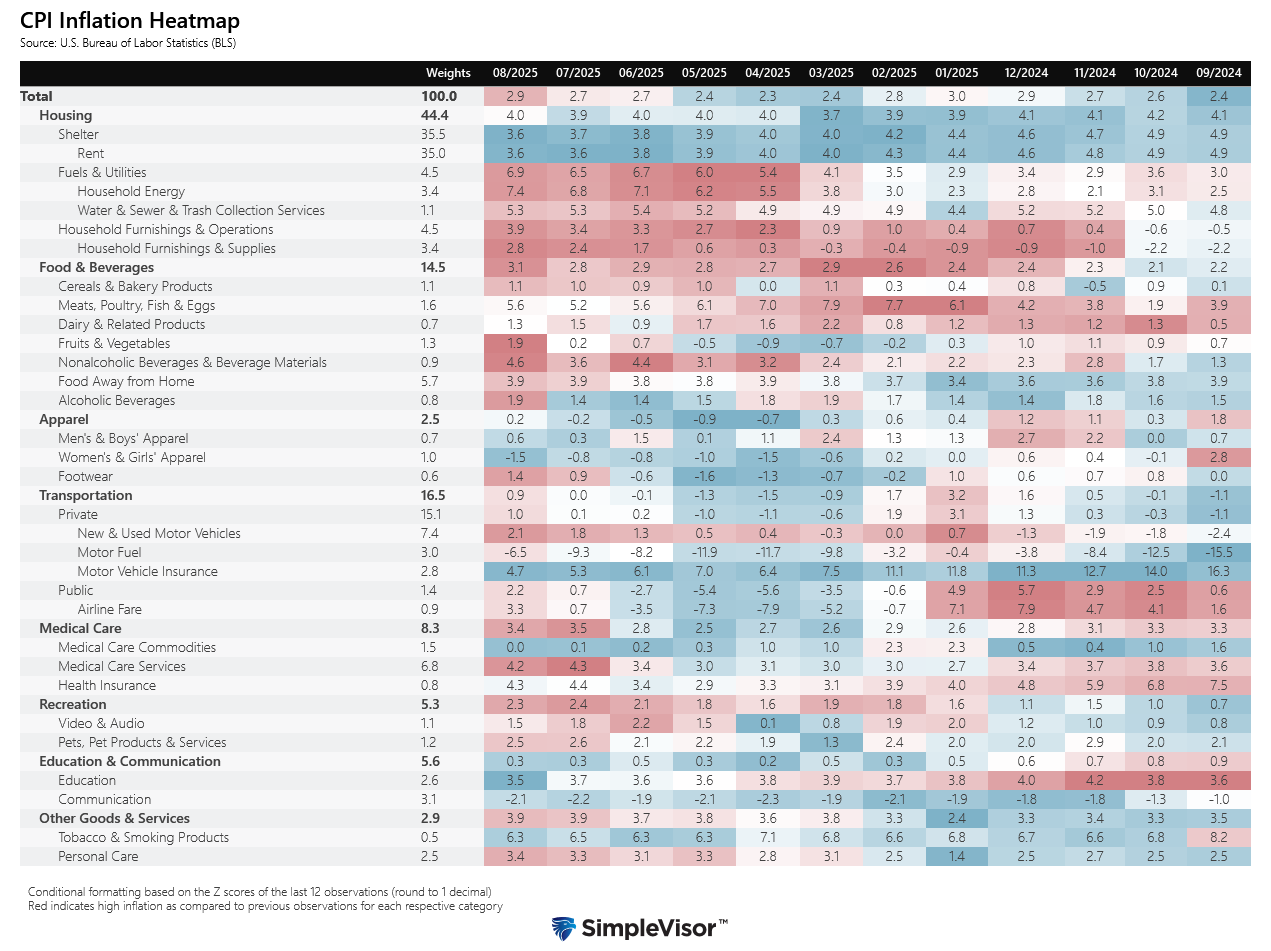

August’s CPI showed inflation still lingering, but not enough to knock the Fed off course. Core CPI rose 0.3%, in line with expectations, while headline CPI rose 0.4%, its largest increase this year. The table below breaks out inflation by its broader categories and weighting.

Looking under the hood, core goods inflation accelerated to its highest level this year. This could signal that tariffs are beginning to impact goods prices; however, they are unlikely to create sustained inflationary pressures. Meanwhile, services inflation remained sticky in August, reaffirming the Fed’s cautious approach to the pace of rate cuts.

Markets, however, chose to look past the CPI release and focused on yesterday’s weekly jobless claims instead. Jobless claims jumped to 263k, the highest since October 2021 and well above expectations of 235k. While weekly data can be noisy, a sustained increase would add to growing evidence that the labor market is softening. Equities closed higher, and bond yields fell as investors look forward to a rate cut next week.

Tweet of the Day