FTSE 100 today: Edges higher as pound slips; Mitchells & Butlers jumps on results

The Q1 2025 earnings season heads into its final peak week with mostly positive results from S&P 500 companies thus far. With 90% of companies from the index now reporting, 78% have beaten Wall Street’s expectations, slightly better than what we’ve seen historically.

Furthermore, the average percentage by which companies are beating stands at 8.5%, better than the 10 year average of 6.9%, but slightly below the 5 year average of 8.8%. These better-than-expected results have pushed S&P 500 blended EPS growth to 13.4%, nearly double the expectation at the beginning of the season, and making it the second consecutive quarter of double-digit growth.

Last week saw impressive results from some highly anticipated names. Two of the standouts were Palantir (NASDAQ:PLTR) and Disney (NYSE:DIS). Palantir beat on the top and bottom-line and increased full-year revenue guidance to $3.89B - $3.90B from a prior outlook of $3.74B - $3.76B due to robust adoption of its AI software. Disney also beat on the top and bottom-line when they reported Q1 results on Tuesday, thanks to better-than-expected subscriber growth for its Disney+ streaming platform.

On the flipside, results from Wynn, Clorox (NYSE:CLX) and Restaurant Brands International (NYSE:QSR) came in weaker than anticipated on profits and revenues, which could possibly serve as commentary on how consumers are willing to spend their money in the current environment. Headwinds mentioned on earnings calls ranged from the impact of tariffs to the cautious consumer, providing a good set up for the kick-off of the retail earnings parade this week.

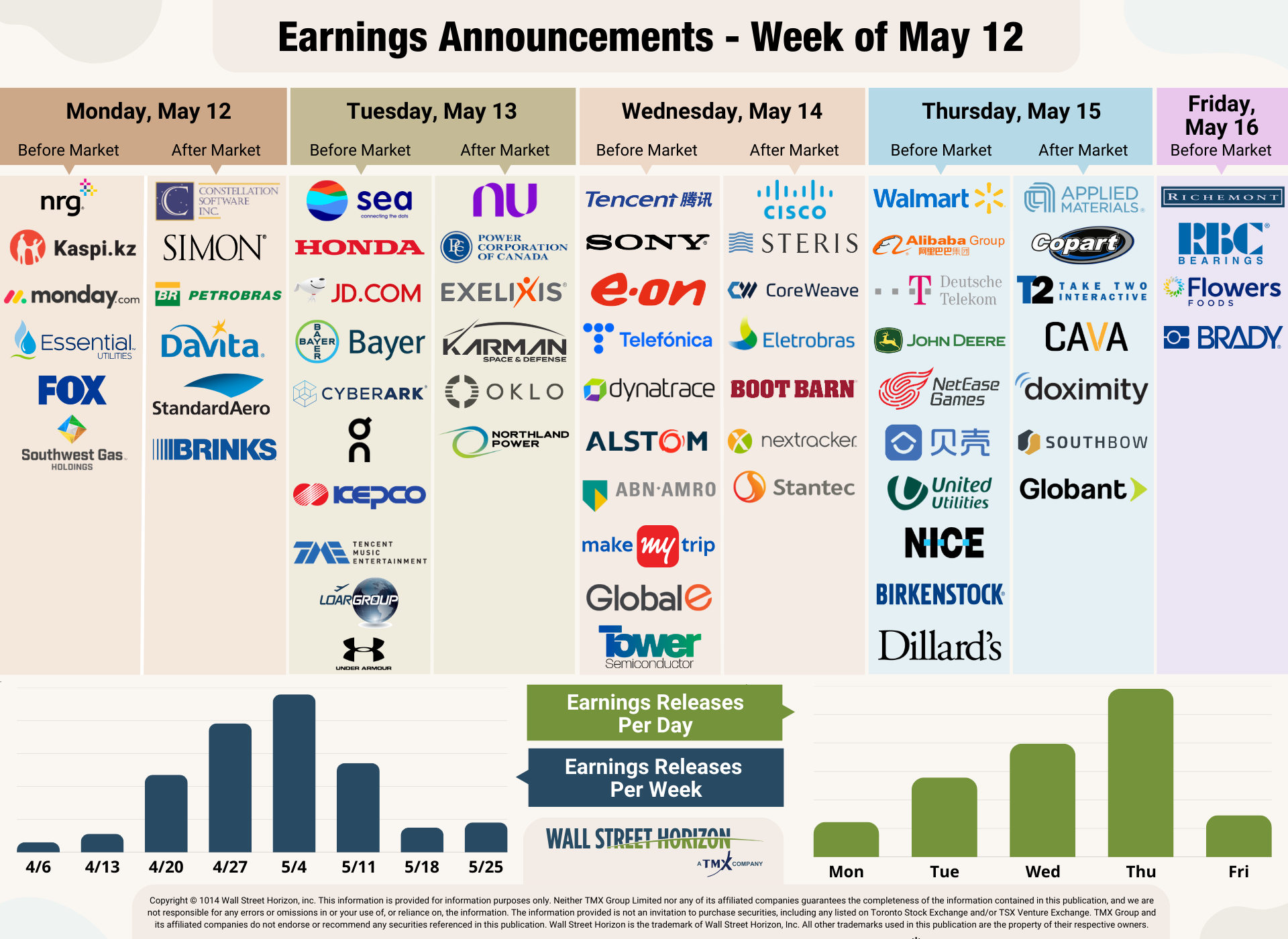

On Deck This Week

In this final peak week of the first quarter earnings season, all eyes will be on the retailers. The world’s biggest retailer, Walmart (NYSE:WMT), is set to release results on Thursday. Walmart has been firing on all cylinders as of late by stealing market share from competitors like Target (NYSE:TGT) and luring higher-income shoppers. In a recent note, Wells Fargo (NYSE:WFC) pegged Walmart as a winner in nearly any macroeconomic backdrop.

Other consumer-facing names to watch this week include department store Dillards (NYSE:DDS), fast casual chain Cava Group, footwear maker Birkenstock (NYSE:BIRK) and Chinese ecommerce giants JD.com Inc Adr (NASDAQ:JD) and Alibaba (NYSE:BABA).

Source: Wall Street Horizon

Outlier Earnings Dates This Week

Academic research shows that when a company confirms a quarterly earnings date that is later than when they have historically reported, it’s typically a sign that the company will share negative news on their upcoming call, while moving a release date earlier suggests the opposite.

This week, we get results from a handful of large companies on major indexes that have pushed their Q1 2025 earnings dates outside of their historical norms. Three companies within the S&P 500 confirmed outlier earnings dates for this week, all of which are later than usual and therefore have negative DateBreaks Factors. Those names are Fox Corp (NASDAQ:FOXA), DaVita Inc. (NYSE:DVA) and NRG Energy (NYSE:NRG).

Q1 Earnings Wave

The third and final week of peak earnings season takes place this week, with 2,300 names expected to report. Thus far, 87% of companies have confirmed their earnings date (out of our universe of 11,000+ global names), and 63% have reported results.

Source: Wall Street Horizon