3 China AI stocks to consider on Nvidia exports news

This article was written exclusively for Investing.com.

- Energy leads the way for the second consecutive quarter

- All sectors post gains in Q2 and over the first half of 2021

- MGE wheat leads on the upside, with natural gas and ethanol both up over 30%

- Lumber, rhodium, and soybean meal posted double-digit percentage losses

- The commodity bull continues to push prices higher

The commodities asset class gained 10.76% in Q2 2021 and was 20.32% higher over the first six months of this year as of June 30, 2021. Three commodities moved to new all-time highs in Q2 as lumber surged to over $1700 per 1,000 board feet, copper rose to nearly $4.90 per pound, and palladium probed above the $3000 per ounce level. The June FOMC meeting caused many commodities to retreat. The central bank increased its GDP growth forecast for 2021 from 6.5% to 7% and raised inflation expectations to 3.4%. In the wake of the May CPI data, the Fed seemed ready to set the stage for tapering quantitative easing and raising the short-term Fed Funds rate over the coming months. Seven committee members anticipate tightening credit in 2022.

Commodity prices may have declined in June, but they still posted gains in Q2, pushing prices even higher than at the end of Q1 2021.

The bull market in commodities, inflation-sensitive assets, remains firmly intact at the end of June 2021.

Energy leads the way for the second consecutive quarter

The energy commodities sector that includes crude oil, oil products, natural gas, and ethanol, moved 25.08% higher in Q2 and was 52.60% higher over the first half of 2021. The quarterly and six-month results as of June 30 were impressive:

- NYMEX Crude oil: +24.19% in Q2 and +51.42% higher YTD

- Brent Crude oil: +20.15% in Q2 and +44.98% higher YTD

- Gasoline: +14.40% in Q2 and +58.98% higher YTD

- Heating oil (Distillates): +20.26% in Q2 and +43.42% higher YTD

- Natural Gas: +39.95% in Q2 and +43.76% higher YTD

NYMEX crude oil futures rose to the highest price since October 2018, while natural gas reached its highest level since December 2018. Meanwhile, ethanol reached its highest price since April 2014. In 2014, crude oil was over $100 per barrel, gasoline was above $3 per gallon wholesale, and natural gas peaked at above $6.40 per MMBtu.

Thermal coal for delivery in Rotterdam rallied to the highest price in a decade in Q2.

All sectors post gains in Q2 and over the first half of 2021

All six commodity sectors posted gains in Q2 and were higher than the levels at the end of December 2020:

- Energy: +25.08% in Q2 and +52.60% higher YTD

- Base Metals: +13.26% in Q2 and +23.14% higher YTD

- Soft Commodities: +12.0% in Q2 and +6.50% higher YTD

- Grains: +7.71% in Q2 and +14.82% higher YTD

- Animal Proteins: +5.09% in Q2 and +23.64% higher YTD

- Precious Metals: +1.55% in Q2 and +1.25% higher YTD

MGE wheat leads on the upside, with natural gas and ethanol both up over 30%

The Baltic Dry freight index moved 68.06% higher as bulk raw material demand soared during Q2. The index moved 147.66% higher over the first half of 2021. Aside from increasing commodity prices on the back of demand, higher fuel prices sent the freight index to the highest level in years. In Q2, MGE Spring wheat futures led the way on the upside with a 42.24% gain.

Source: Barchart

The chart highlights the ascent of spring wheat futures that reflect the drought conditions in the US Pacific Northwest over the past months that took the price over the $8 per bushel level. MGE wheat rose to its highest price since 2013.

Source: CQG

Natural gas futures rose 39.95% in Q2 and were 43.76% higher in 2021 as of June 30. The monthly chart shows the move from lows of $1.432 per MMBtu in late June 2020, a quarter-of-a-century low, to a high of $3.814 in Q2 2021. Natural gas reached its highest price since December 2018, with the next level of technical resistance at the November 2018 $4.929 per MMBtu peak.

Source: CQG

Ethanol was the third-leading commodity in Q2 with a 31.56% gain and a 73.06% price increase from the level at the end of 2020. Ethanol futures rose to the highest price since 2014. The shift in US energy policy under the Biden Administration to a greener path supported biofuel prices in Q2.

Many commodities posted double-digit percentage gains in Q2. Iron ore, coffee, corn, LME tin, NYMEX crude oil, soybean oil, heating oil, and Brent crude oil were all over 20% higher for the second quarter. Sugar, LME lead, gasoline, LME nickel, LME aluminum, and KCBT wheat were all over 10% higher in Q2. Winners outnumbered losers in the commodities asset class by over a 5.6:1 margin.

Lumber, rhodium, and soybean meal posted double-digit percentage losses

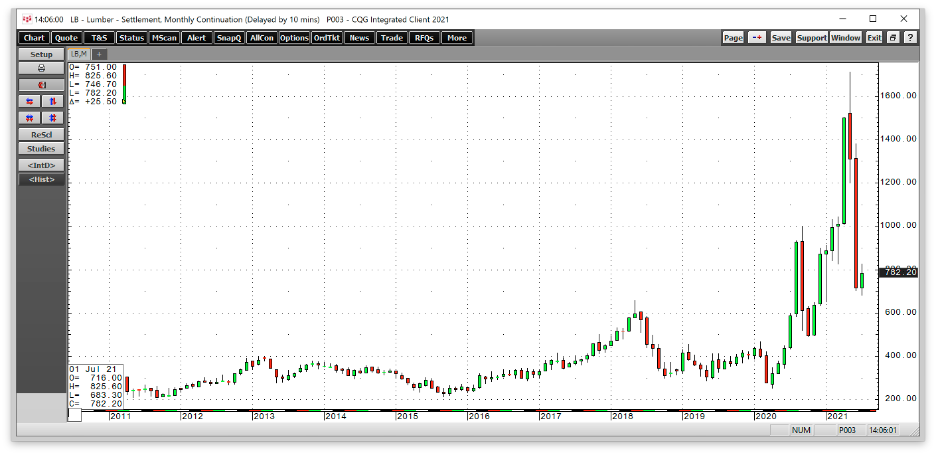

Double-digit percentage losers included lumber, rhodium, and soybean meal in Q2. Lumber also rose to a new record high at over $1700 per 1,000 board feet before the parabolic rally imploded.

Source: CQG

The monthly chart shows the wild price swing that took the price below the $800 level at the end of Q2. Before 2017, lumber futures had never traded above the $493.50 per 1,000 board feet level. Lumber was 29.05% lower in Q2 and 17.99% under the 2020 closing price on June 30.

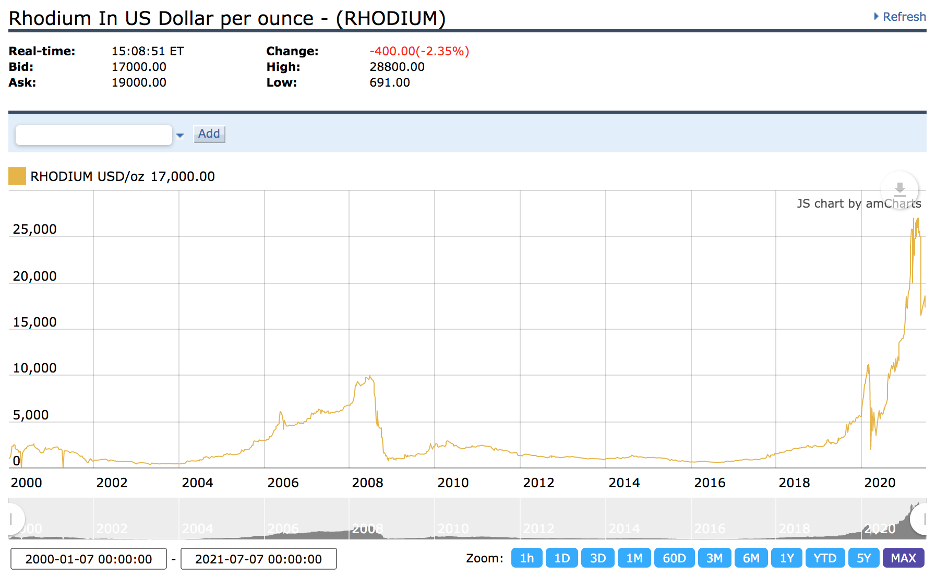

Source: Kitco

After reaching a new all-time high at the $28,800 per ounce level in Q2, rhodium corrected and would up with a 23.20% loss for the quarter. Rhodium, the platinum group metal that only trades in the physical market, was still 23.87% higher over the first six months of 2021 at the end of June.

Source: CQG

Soybean meal, a product of the soybean crush, fell 11.27% in Q2 and was 12.55% lower than its closing level at the end of 2020 on June 30. Platinum and rough rice futures were also lower in Q2.

The commodity bull continues to push prices higher

The tidal wave of central bank liquidity, historically low interest rates, and a tsunami of government stimulus ignited inflationary pressures that lifted commodity prices over the first half of 2021.

The Fed appeared to set the stage for tightening credit at the June FOMC meeting, which weighed on some commodities prices while others continued to appreciate. Metals fell after the June meeting, but energy continued to rise. The shift in US energy policy had a more substantial impact on prices than central bank policy and rhetoric.

As we move into Q3, expect lots of volatility in markets across all asset classes. While commodity prices have soared over the past months, there is no guarantee the rallies will continue. The cure for high prices in the commodities asset class is always high prices as production increases, inventories begin to build, and consumers seek substitutes. However, the trend is always your best friend in all markets, and it remains higher in the early days of the third quarter.