ION expands ETF trading capabilities with Tradeweb integration

- Despite the expected selloff in September, we remain on track to a very positive year for stocks

- Bonds, on the other hand, can't seem to catch a break

- Historical data points to positive Q4 performance and potential year-end gains despite recent corrections

Yesterday marked the start of the final quarter of 2023—a year distinguished by a remarkable stock market recovery amid a continued selloff in the bond market.

Notably, major stock indices, bolstered by the surge of tech giants, have delivered substantial performances, with the NASDAQ Composite surging by approximately 27% and the S&P 500 posting an impressive 11.7% gain since the year's outset.

Europe has also demonstrated resilience, despite a recent correction, with the Euro Stoxx 50 currently standing at +9% YTD.

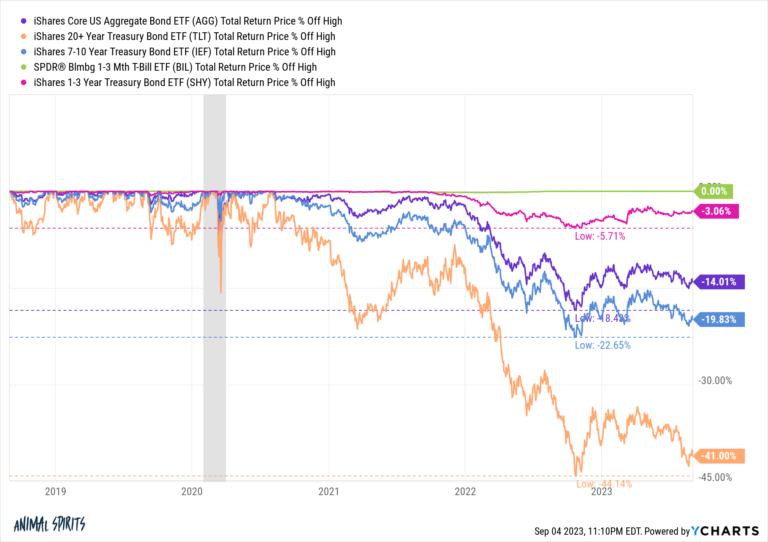

However, as previously mentioned, the persistent influence of inflation and the dramatic shift in monetary policies have cast a shadow on the bond segment for the third consecutive year. This trend is evident when examining US Treasuries as a benchmark, revealing an unprecedented bear market.

The pertinent question arises: should this development truly have come as a surprise, considering the era of near-zero rates and yields that preceded it?

History teaches us that sooner or later, excesses undergo correction; the challenge lies in predicting when precisely that correction will occur.

Source: Animal Spirits/ YCharts

What to Expect for the Current Quarter?

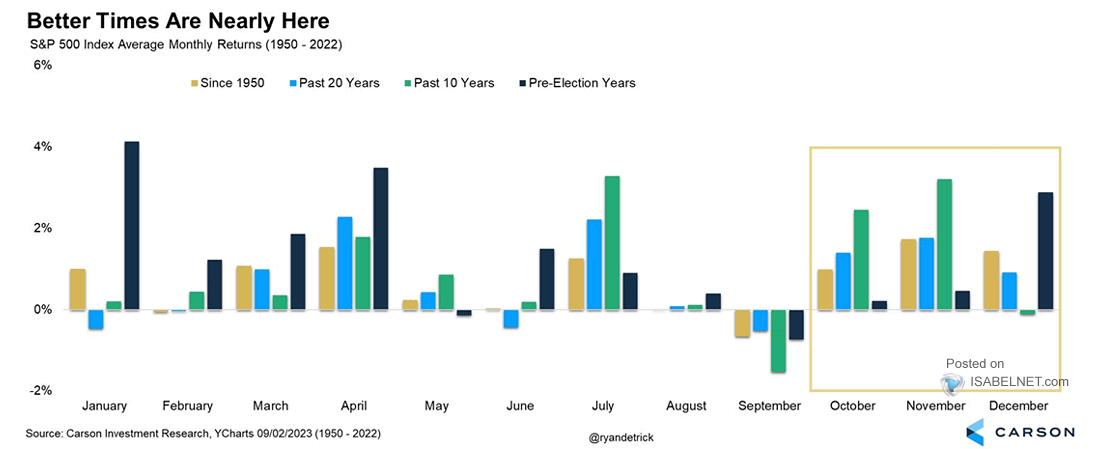

The statistics, which correctly forecasted the first half of the year, as well as the 'usual' September correction period, now seem in favor of a positive year-end, as evidenced by the image below.

Source: Carson Investment Research/Ycharts

Examining the dark blue columns, we can observe the monthly performance of the U.S. stock market in the last quarter of the year leading up to the election. Historically, it becomes evident that this performance tends to be positive, significantly outperforming the months of August and September, which consistently exhibit corrections.

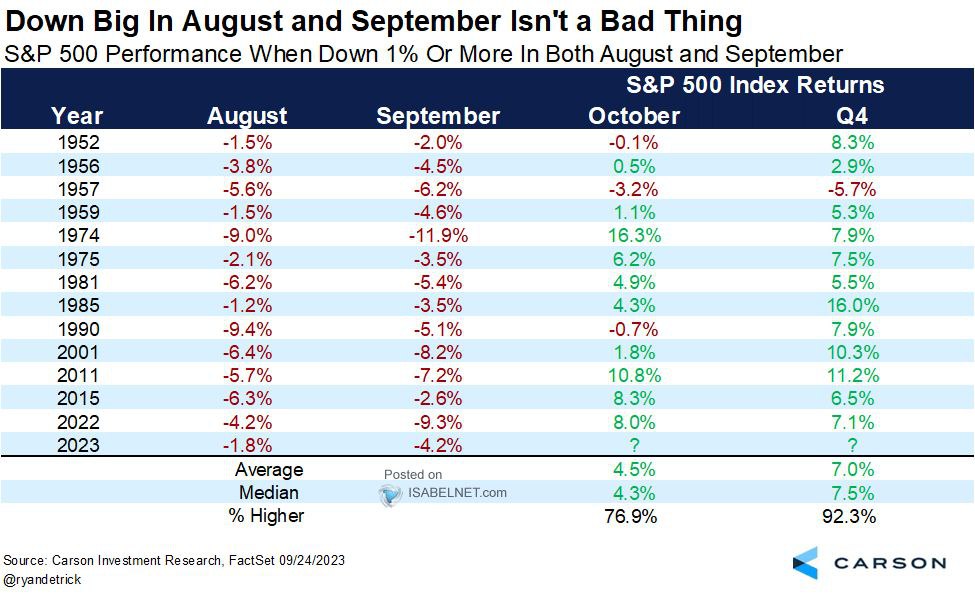

Furthermore, in years characterized by negative performance in August and September, historical data indicates that the fourth quarter has reported positive performance a remarkable 92.3% of the time (see image below).

Source: Carson Investment Research/Ycharts

In a broader context, I recall that for an investor who has diligently executed their strategic planning and portfolio construction, it all ultimately boils down to a single critical market assessment. Yet, it's essential to emphasize that robust fundamentals and a well-defined time horizon consistently take precedence.

See you next time!

***

Disclosure: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. As a reminder, any type of assets, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor. The author does not own the stocks mentioned in the analysis."