Bill Gross warns on gold momentum as regional bank stocks tumble

Data steepens the curves from the back end

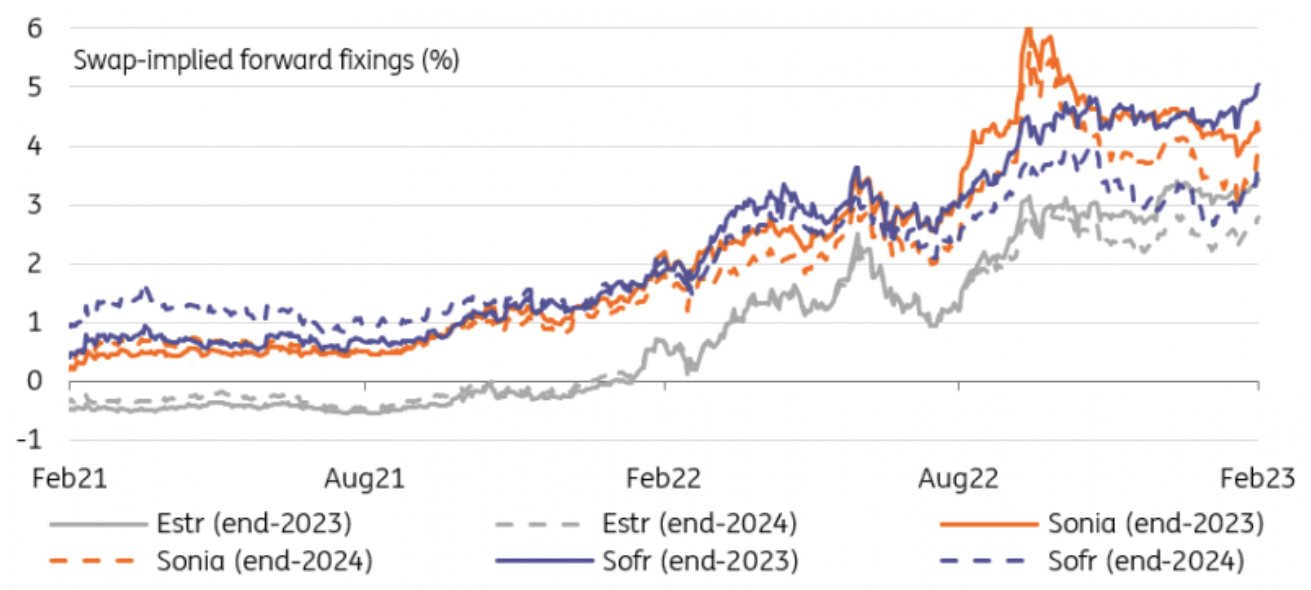

Rates were pressured higher on the back of the much-better-than-expected retail sales data. A potential weather-related bounce in the data for January had been flagged though, and there is a decent risk that we will see some reversal again next month. For now, as noted in the chart below, money markets are seeing the SOFR rate above 5% through the end of this year for the first time. The notion of higher rates being maintained for longer is gaining traction.

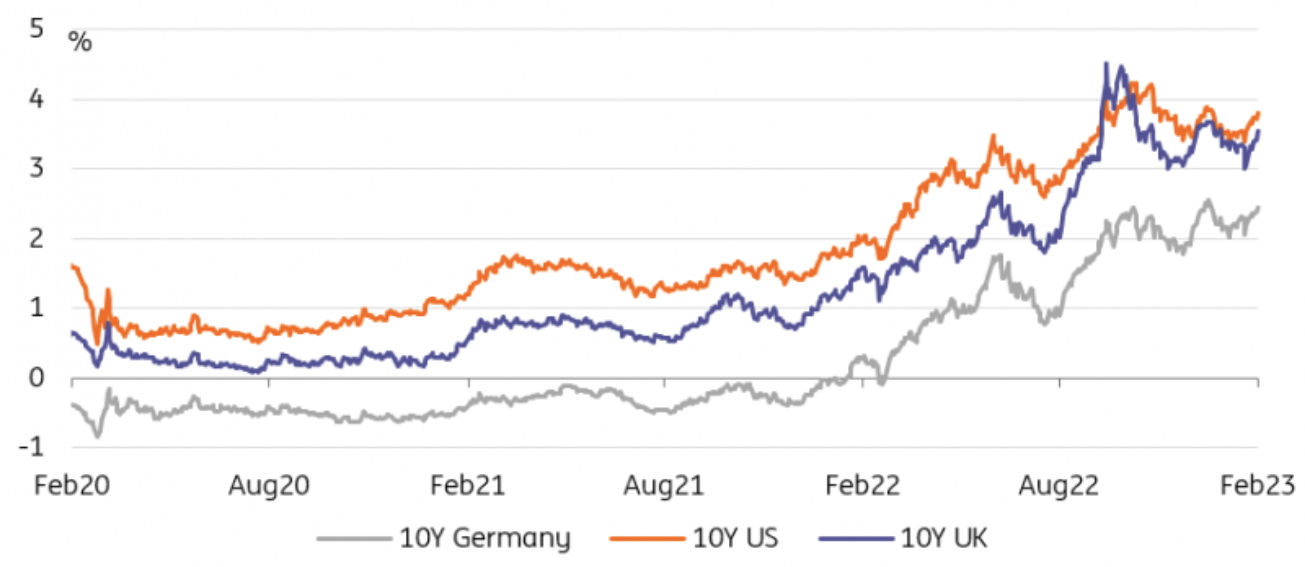

More notably this time round, it's the back end of the curve leading rates higher which also helped the Treasury curve pull back from its record inversion. The 10Y UST yield is now back above 3.8% and thus not far below the local high it had ended 2022 on. That itself is still a decent stretch from the October high at over 4.30%, giving yields some room for further upside.

Of course, the size of the surprise in the data helps to explain the larger market reaction, but we think it speaks more to overall positioning in rates going into the past week(s) and also the stretched valuations in terms of the curve, which we have also highlighted over the past days. Note, for instance, that equity markets ended the day higher, dismissing the hawkish implications that the resilience shown in the data may have for the Fed.

Hawkish repricing pushes Fed and ECB expectations to new highs

Source: Refinitiv, ING

The ECB's hawkish message has finally sunk in

When ECB President Christine Lagarde addressed EU lawmakers yesterday she reiterated the call for another 50bp hike in March with underlying inflation still too high and price pressures remaining strong. But again, she has left it to other ECB officials to flesh out any guidance beyond the next meeting. Following the last press conference, the central bank's hawks have been more vocal, and also quite successful at realigning markets more to their views.

The terminal rate has risen to 3.56% from a pre-meeting level of 3.44%, and the market’s expectations of subsequent policy easing have become less pronounced, down to below 90bp from the interest rate peak through the end of 2024. Financial conditions as measured by real rates are at the upper end of their recent range since December.

Our economists do see a possible scenario where, after March, the ECB continues to hike meeting-by-meeting by 25bp through June - this would bring the deposit facility rate to 3.5%. The market has moved even beyond that, but of course developments in the US have come to help the hawks and we doubt they would have achieved this feat on their own.

Today’s slate of public appearances of ECB officials has a more dovish lean with Fabio Panetta and the ECB’s chief economist Philip Lane scheduled to speak. With the Bundesbank’s Joachim Nagel and Ireland’s Gabriel Makhlouf, there are also hawkish voices again, but we have heard from both already more recently. In any case, we have the feeling that markets are more inclined to listen to data these days.

10Y Bunds are approaching a crucial level

Source: Refinitiv, ING

***

Disclaimer: The information in the publication is not an investment recommendation and it is not an investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. This publication has been prepared by ING solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. For our full disclaimer, please click here.