Trump to impose 100% tariff on China starting November 1

US Treasuries traded heavily on Monday, on a day of complexities and different crosswinds that make interpretation tough. Bunds remain a good, safe asset to hide for any US-driven turmoil, which can help keep yields close to swaps. Whilst we still see Bunds underperform swaps due to supply pressures, the room is more limited since ’Liberation Day’

Flows are positive for Treasuries but a chunk of other impulses remain an issue

Friday’s Treasury International Capital (TIC) net monthly flows showed ongoing demand for US Treasuries and equities from foreigners. The only hiccup was in April, which saw ’Liberation Day’. And even the "Sell America" theme then was a one-week affair. Apart from that week, we’ve seen nothing more than "Buy America Back".

The details show that Canada and the Asian centres that were sellers in April, have been buyers through May and June. In fact, the full data for June point to foreign buying versus some domestic selling. Flows data from other sources confirms this to be the case.

Despite This Backdrop, Monday Saw Upside to US Treasury Yields Dominate.

There are a few things in play here.

First, we’ve just come off a week that confirmed toppy CPI, PPI and import price inflation data. The CPI data confirmed the US as a 3% inflation economy right now, while the PPI data held out the prospect for that to morph to a 4% one.

Second, there have been some rate lock trades going through the market, which is effectively a short market pressure.

Third, it looks like a deal is in the works on the Russia-Ukraine war. And fourth, there is some growing aprehension that Chair Powell may decide to avoid endorsing a rate cut, and rather prefer to warn on near-term inflation risks.

Strong demand for Bunds will keep swap spreads at bay

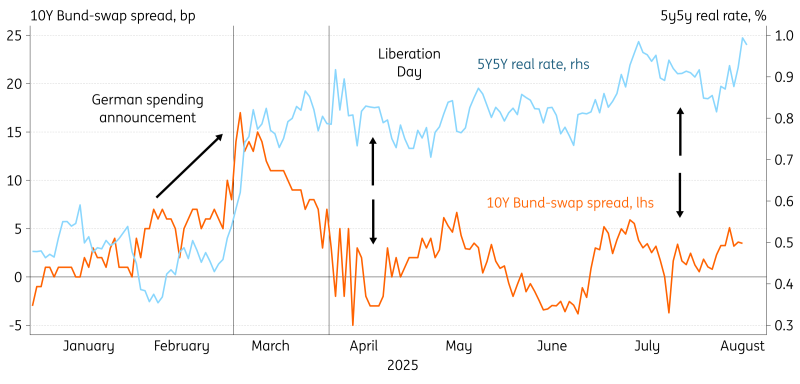

Whilst the TIC data show USTs are in high demand amongst foreign investors, we continue to see value in eurozone government bonds as a robust hedge for future turmoil. The spread between 10Y Bunds and swaps is just 6bp, still not back to the levels from before ’Liberation Day’ or even from before the German spending announcement in March. So either markets have lost faith in the spending plans or demand for Bunds has structurally increased.

Real rates suggest that markets are still positioned for higher future growth, suggesting that the strong performance of Bunds is driven by strong demand. If we look at the 5Y5Y real rates as a proxy of long-term growth expectations, we see that those have remained firm ever since the German spending announcement.

The spending plans may not lead to stellar growth outcomes, it does reduce the tail risk of reducing to a secular stagnation scenario. This is consistent with the higher real rates.

Whilst we target a 10Y Bund spread closer to 10bp in the near term, we also agree with markets that Bunds are an excellent hedge against US-driven market volatility going forward. USTs are still the more established safe asset, but to hedge against all possible scenarios, Bunds may have turned into the better bet, keeping yields lower compared to before ’Liberation Day’.

Therefore, despite German spending and quantitative tightening adding upward pressure to Bund yields, we think the scope to diverge from swaps will be limited.

Markets See Better Growth but Also Opt for Bunds as a Safe Haven

Source: Macrobond, ING

Tuesday’s Events and Market View

Very little data on the agenda. From the eurozone we have the current account data for June, which usually doesn’t grab markets’ attention but is now more of interest given US tariffs. The US will publish housing starts and permits data, with both expected to show a slight deterioration from the month before.

In terms of supply we have the UK with a 10Y gilt linker for £1.6bn and Germany will auction 5Y Bobls for €4.5bn.

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user’s means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more