Oracle stock surges on potential $20B Meta AI cloud deal

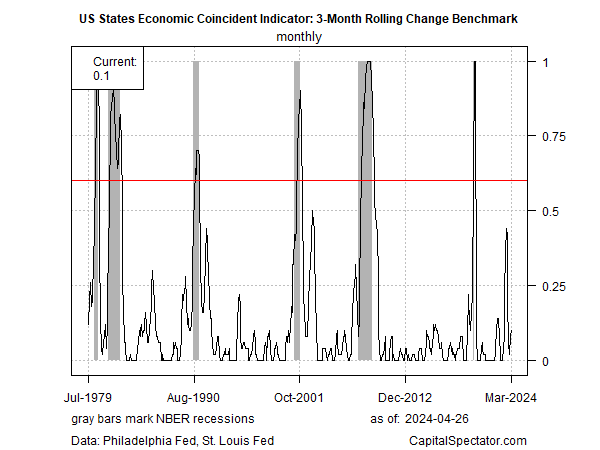

The value of modeling recession risk-based multiple indicators is a hardy perennial. The latest example comes by way of aggregating trends in the 50 US state economies for estimating the odds that an NBER-defined downturn has started or is imminent. As recently as February, this indicator looked ominous. But as the latest updates show, the warning turned out to be noise.

Par for the course in the art/science of estimating recession risk. Although there’s a tendency to look for shortcuts by cherry-picking one or two indicators, history suggests that this temptation is prone to a higher degree of failure vs. building a diversified indicator approach.

The state's economic indicator model offers a timely example, based on the Philadelphia Fed’s 50 state coincident indexes and aggregating the data into a single US indicator. The spike through December suggested the US economy was rolling over and that a recession was a high-risk event in early 2024.

The pushback, as I noted in February, was that there was minimal confirmation in the various business-cycle indexes tracked in the weekly updates of The US Business Cycle Risk Report, a sister publication of CapitalSpectator.com.

That caveat turned out to be correct. Surprising? Not really. Estimating recession risk in real-time – nowcasting — is a slippery affair, and it’s even tougher for guesstimating the future. The reason: there are a lot of moving parts in a $23 trillion economy and countless interactions and feedback loops that animate economic activity are poorly understood, to put it lightly.

The good news is that by carefully reviewing a range of data – i.e., building a diversified set of indicators – it’s possible to develop relatively high-confidence estimates of the broad economic trend in recent history, which lays the foundation for nowcasting current conditions. On that basis, it’s reasonable to make a cautious forecast about the next one-to-two months.

Skeptical? You should be. But if you’re dubious about the methodology I just outlined, which has shown itself to be robust, you should run screaming from the far-more common approach of breathlessly citing the indicator du jour as the last word on estimating recession risk.

Consider the recent failures to inform your thinking. In addition to the states indicator above, recall that the Treasury yield curve has a long history of being labeled as an infallible recession indicator. Unfortunately for those who used this indicator in isolation, false warnings have been the norm in this corner recently.

Several other so-called reliable business-cycle indicators have fallen prey to false signals as well, including the Leading Economic Index.

The solution is to work harder and dig deeper, which is the focus of The US Business Cycle Risk Report. After a decade of real-time analysis, and continually refining the modeling for the newsletter, a crucial empirical fact emerges: there’s no substitute for robust ensemble modeling.

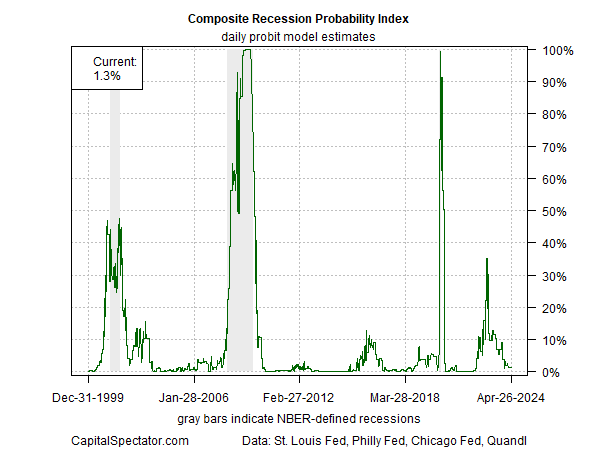

On that note, US recession risk remains low at the moment, based on the newsletter’s primary indicator, which aggregates several business-cycle metrics. The probability that the US is currently in recession, or soon will be, is roughly 1%, according to the Composite Recession Probability Index (CRPI).

It’s instructive to note that CRPI never signaled a recession in the late-2022 slowdown, even though many analysts declared a near-inevitability of a downturn at the time. Why the difference? CRPI reflects a carefully designed set of indicators that focus on maximizing signal and minimizing noise.

To be fair, there’s no guarantee that CRPI will always be accurate. But compared with the usual suspects, it’s miles ahead of the competition in pursuit of the holy grail of recession modeling: timeliness and reliability. Navigating the tradeoff between the two requires attention to drawing on a broad set of indicators and prudently aggregating the mix – attributes that are missing when assuming that one indicator alone can do all the heavy lifting.