Street Calls of the Week

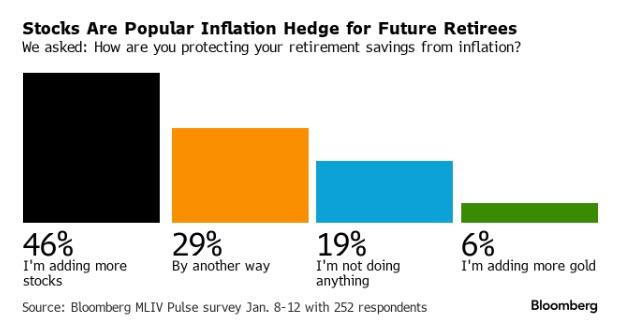

As the financial markets grind higher, retirement savers have consciously decided to add more to equity risk. Such was the result of a recent Bloomberg survey.

“Retirement savers want more stocks in their portfolios as a hedge against inflation, potentially offering a long-term tailwind for equities as societies age, according to the latest Bloomberg Markets Live Pulse survey.

Almost half of the 252 respondents said they were putting more funds into stocks as a response to rising prices – far eclipsing the 6% who said they’d be adding the traditional inflation hedge, gold.” – Simon White

While the respondents said they were buying stocks as a hedge against inflation, which may be part of the answer, the reality is that a surging bull market over the last 14 years is more likely the real reason.

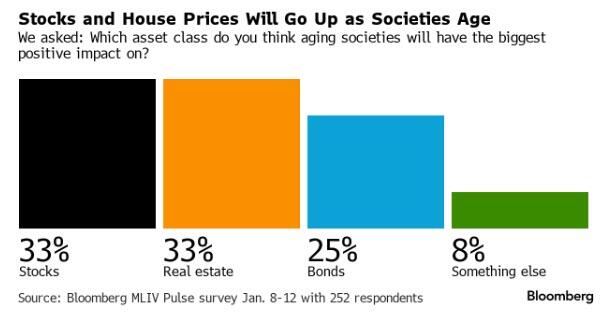

The same psychology permeated into the next question, which asked which asset classes would do the best as society ages.

Given the real-world experience of most individuals of skyrocketing home prices and stocks, it was not surprising to see both ranking as top answers.

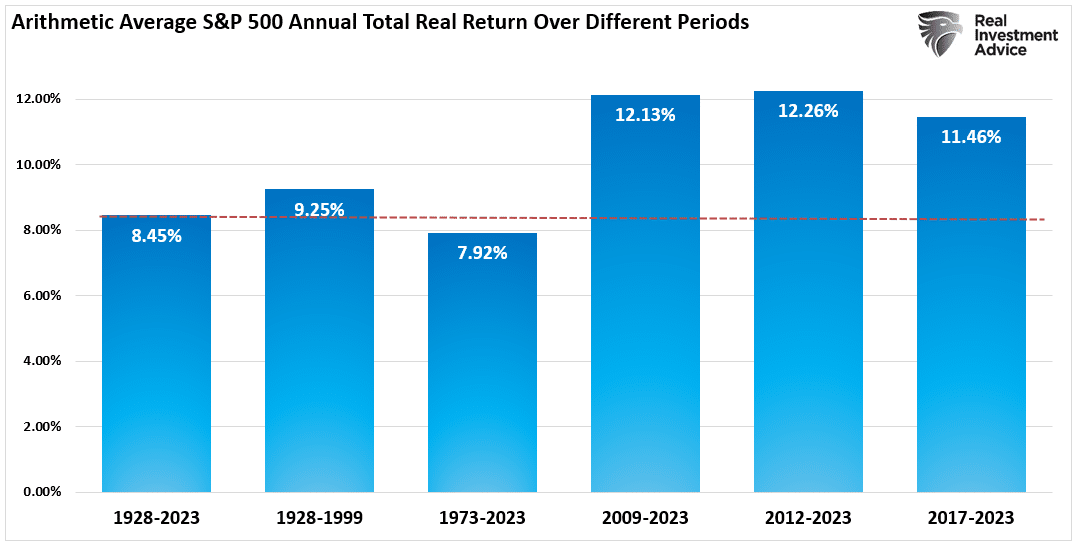

Given the recency bias of most individuals, the responses were unsurprising given the outsized proportion of market gains relative to the long-term averages.

Such was the recent topic of this article To wit:

The chart shows the average annual inflation-adjusted total returns (dividends included) since 1928.

I used the total return data from Aswath Damodaran, a Stern School of Business professor at New York University. The chart shows that from 1928 to 2023, the market returned 8.45% after inflation.

However, after the financial crisis in 2008, returns jumped by nearly four percentage points for the various periods.

After over a decade, many investors have become complacent in expecting elevated portfolio returns from the financial markets. However, can those expectations continue to be met in the future?”

That last sentence is critical.

A Staggering Shortfall

There are a couple of apparent reasons individuals are willing to take on increased risk in portfolios, the most obvious being the rather significant savings shortfall.

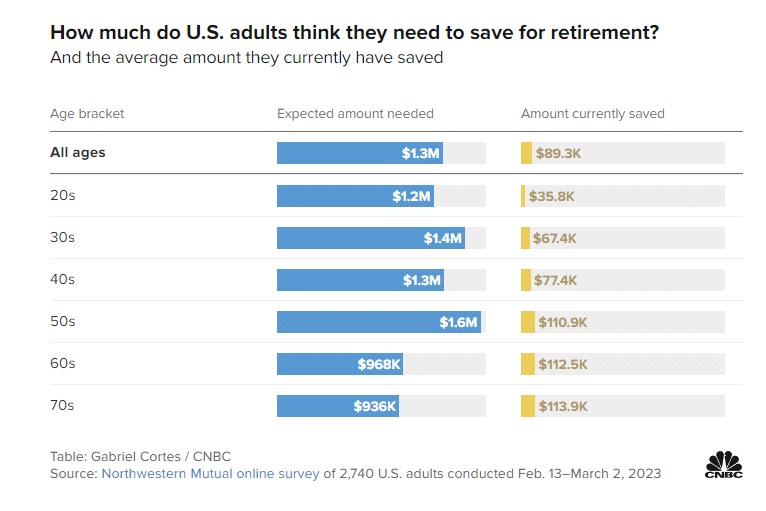

For example, a previous survey by CNBC found that most Americans will need $1.3 million to retire comfortably.

“When it comes to how much they will need to retire comfortably, Americans have a “magic number” in mind — $1.27 million, according to new research from Northwestern) Mutual.

The survey found that respondents in their 50s expected to need the most when they retire — more than $1.5 million. For those in their 60s and 70s, who are close to or in retirement, those expectations dropped to less than $1 million.”

The problem with that data is that most individuals are nowhere close to those levels of savings.

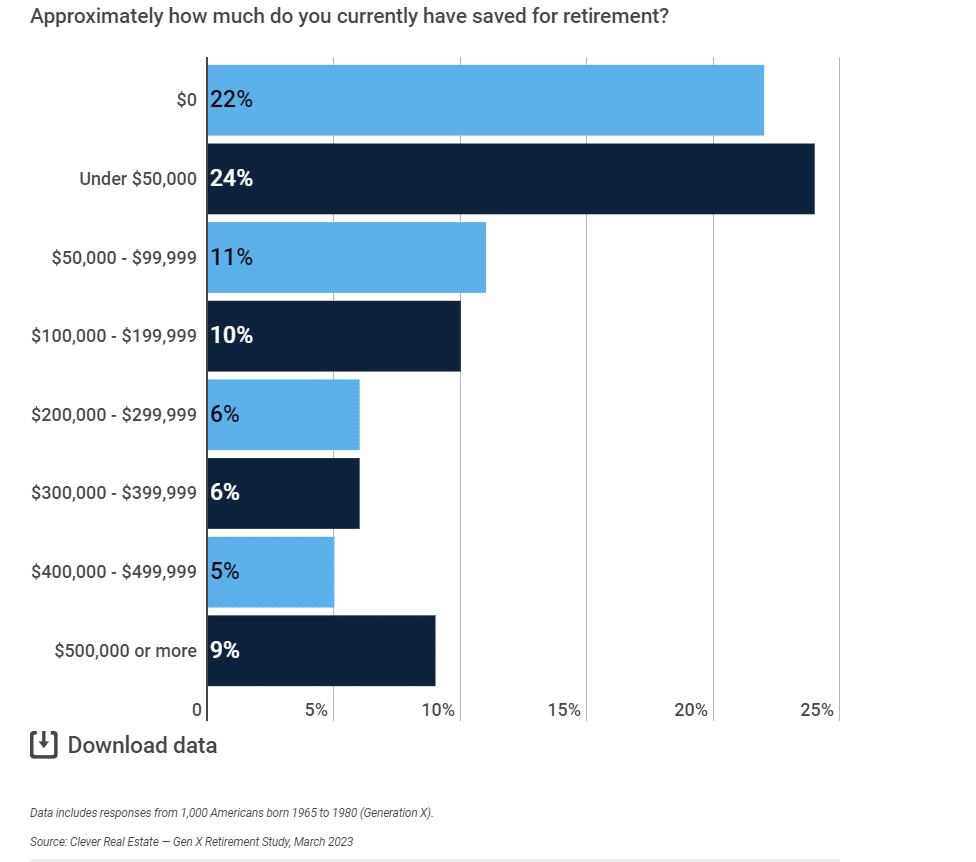

“A recent survey conducted by Clever Real Estate polled 1,000 Gen Xers born between 1965 and 1980 to find out how they fare regarding personal finances and the road to retirement.

A staggering 56% of Gen Xers said they have less than $100,000 saved for retirement, and 22% said they have yet to save a single cent.

While the desire to retire may be there, the money just isn’t. A whopping 64% of respondents said they stopped saving for retirement not because they don’t want to but because they simply can’t afford to.“

Furthermore, a LendingClub survey shows that 61% of U.S. consumers live paycheck to paycheck.

It’s a dire situation for most Americans, particularly those retirement savers. As such, it is unsurprising that more individuals are looking to the stock market as a solution to make up the shortfall.

However, therein lies the risk.

The Risk Of Risk

One of the incredible genetic traits of humans is the ability to forget pain. The trait is essential to the survival of the species.

If cavemen clearly remembered the agonizing pain of being attacked by a predator, they would have likely never left their caves to hunt.

If women vividly remembered the excruciating pain of childbirth, they would probably never have more than one.

In the financial markets, investors all too soon forget the painful memories of bear markets, particularly when the bull is stampeding.

Currently, the bull market that began in 2009 remains firmly intact. Despite a mild stumble in 2022, the long-term trend remains higher, and investors feel confident that the trend will remain indefinitely.

However, a risk has been overlooked amid above-average returns over the last decade. That risk is liquidity, which we discussed in more depth in this article

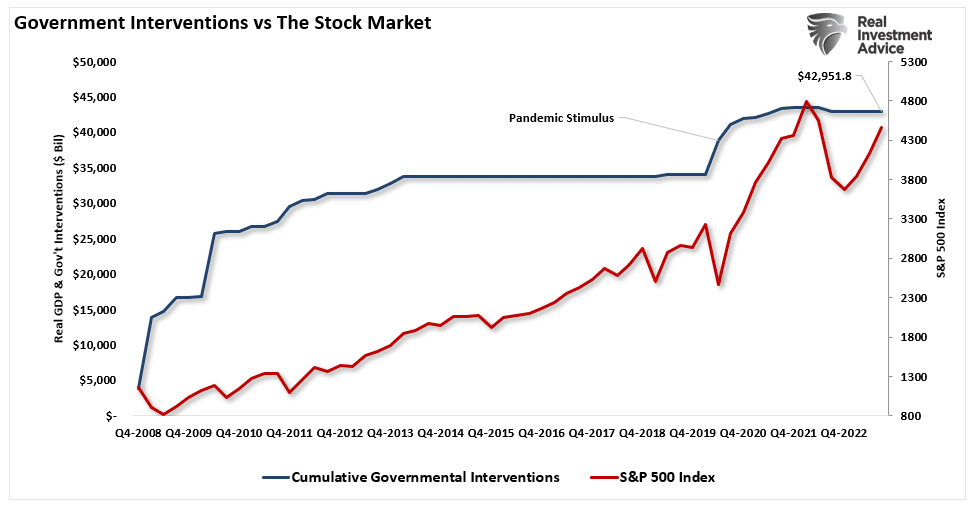

“The psychological change is a function of more than a decade of fiscal and monetary interventions that have separated the financial markets from economic fundamentals.

Since 2007, the Federal Reserve and the Government have continuously injected roughly $43 Trillion in liquidity into the financial system and the economy to support growth. That support entered the financial system, lifting asset prices and boosting consumer confidence to support economic growth.”

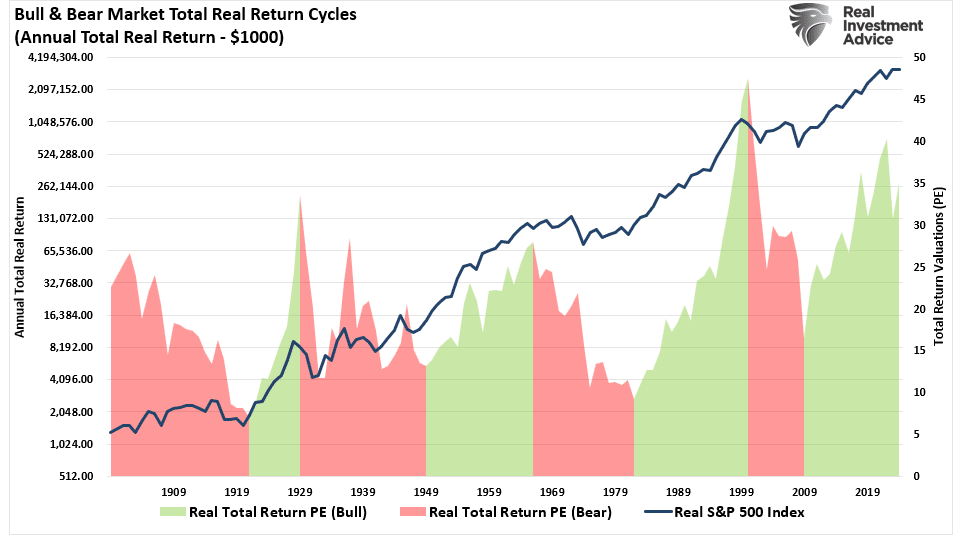

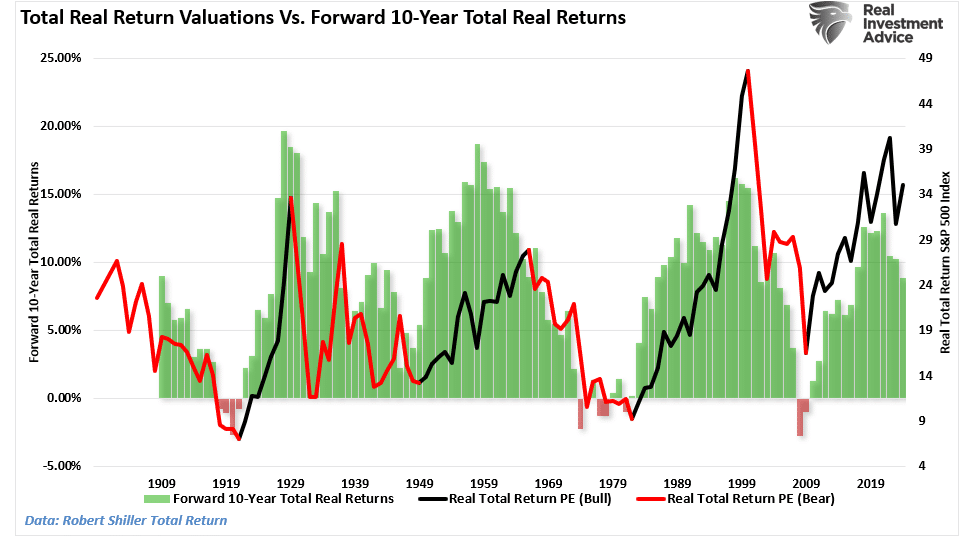

The risk of reduced monetary liquidity may become problematic for stocks to sustain current returns. As shown below, nearly 100% of the index returns from 1900 to the present came during the 4-periods of multiple expansion.

With valuations currently very elevated, the reduction of monetary liquidity may lead to the next secular period of “multiple contraction,” which would yield much lower rates of returns.

In other words, retirement savers currently allocating more savings to equity risk could well be setting themselves up for an extended period of higher volatility and lower expected rates of return.

Conclusion

As Jeremy Grantham previously noted:

“All 2-sigma equity bubbles in developed countries have broken back to trend. But before they did, a handful went on to become superbubbles of 3-sigma or greater: in the U.S. in 1929 and 2000 and in Japan in 1989.

There were also superbubbles in housing in the U.S. in 2006 and Japan in 1989. All five of these superbubbles corrected all the way back to trend with much greater and longer pain than average.

Today in the U.S. we are in the fourth superbubble of the last hundred years.”

Therefore, unless the Federal Reverse is committed to a never-ending program of zero interest rates and quantitative easing, the eventual reversion of returns to their long-term means is inevitable.

It is hard to fathom how forward return rates will not be disappointing compared to the last decade. However, those excess returns were the result of a monetary illusion. The consequence of dispelling that illusion will be challenging for retirement savers.

However, throughout history, investors have repeatedly invested the most into equity risk and the worst possible times. For retirement savers, this time will likely be no different.