U.S. stocks retreat sharply on waning rate cut bets; tech sector under pressure

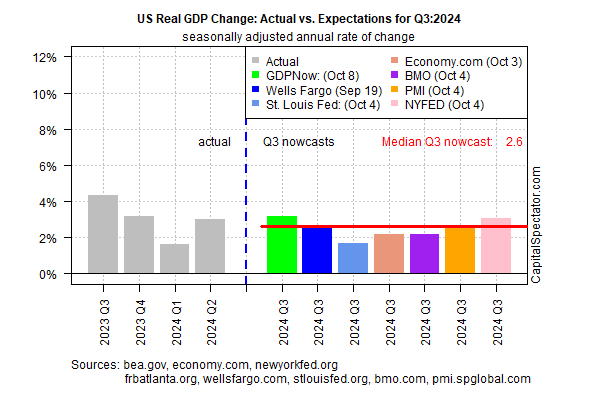

Economic output for the US remains on track to increase at a robust pace in the government’s upcoming third quarter GDP report scheduled for Oct. 30, based on the median nowcast via several sources compiled by CapitalSpectator.com.

Today’s update indicates a 2.6% rise for the real annualized rate in Q3. If correct, growth will downshift modestly from Q3’s strong 3.0% advance.

The upbeat Q3 nowcast reaffirms signals from other economic indicators that downplay recent worries that the US is slipping into recession. CapitalSpecgtator.com has been minimizing that risk for weeks by pointing out that a wide range of economic figures continue to skew positive. In mid-September, for example, we advised that the expansion remained intact, based on a wide range of numbers.

Today’s revised median Q3 GDP nowcast is unchanged at +2.6% vs. the previous update (published on Sep. 30).

Wharton’s Professor Jeremy Siegel also sees “no signs of recession.” He tells CNBC on Tuesday:

“The expectation [for Q3] looks like it’s 2.5%, 2.75% [growth for GDP], which is a pretty good.”

Meanwhile, Goldman Sachs cut its recession risk estimate to 15% after a better-than-expected payrolls report for September. The strong employment report has “reset the labor market narrative” and reduced fears about the labor demand “weakening too quickly to prevent the unemployment rate from trending higher,” Goldman Sachs chief US economist Jan Hatzius wrote in a note to clients on Sunday.