IonQ CRO Alameddine Rima sells $4.6m in shares

The US dollar was stronger on Wednesday, breaking through a trend line and now appearing to form a potential double bottom, with a clear bullish divergence emerging alongside the RSI. To confirm the double bottom, the dollar will need to rise above 100, which could turn into the pain trade for the remainder of 2025.

The 10-year rate also rose on Wednesday, forming a bullish engulfing pattern while holding support at the 10-day exponential moving average. It’s quite possible the 10-year rate could be heading back toward the 4.30% region.

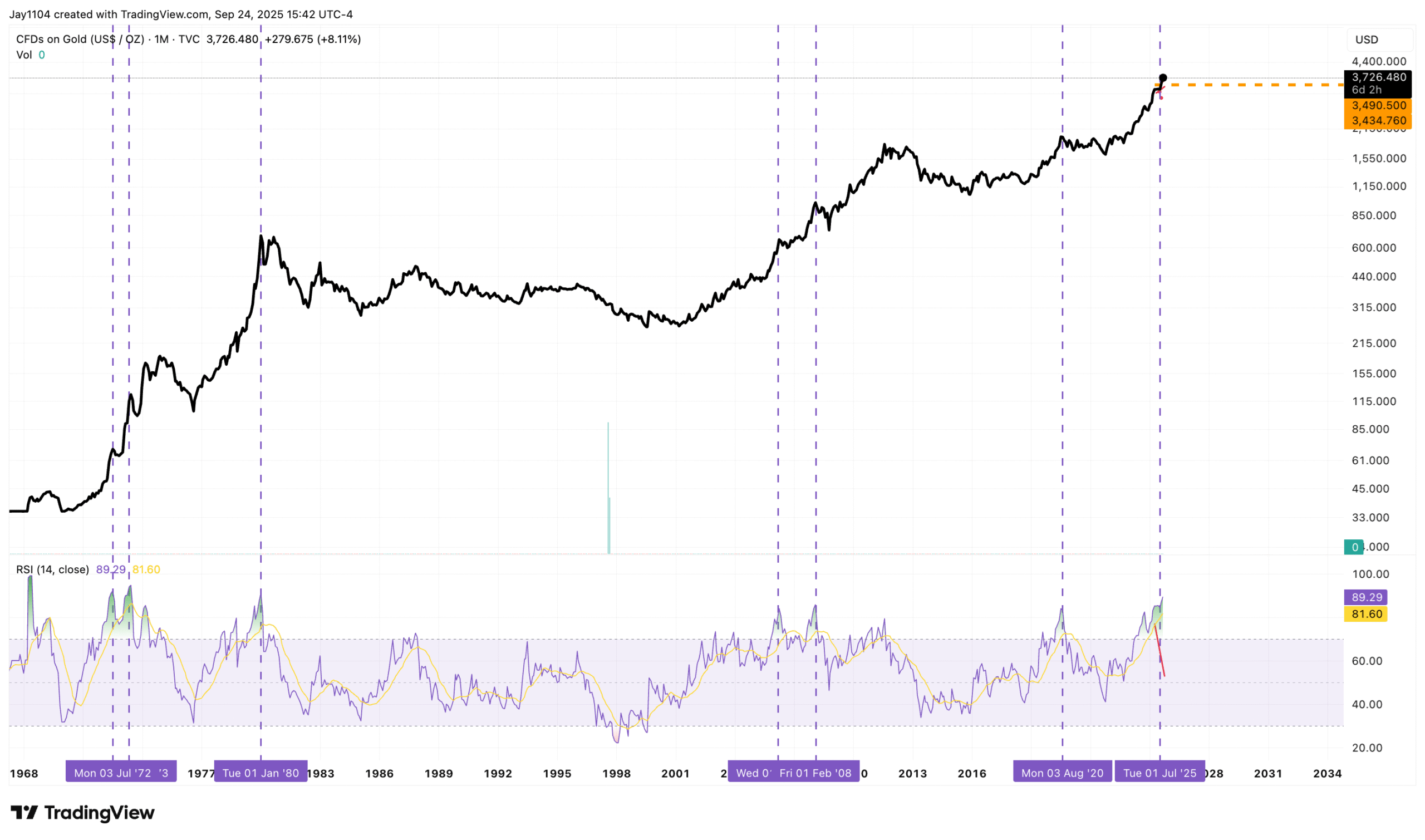

If anything is going to break gold’s recent run-up, it’s a stronger dollar and higher rates. Gold is extremely overbought, with an RSI of 89.3 on the monthly chart—a level not seen since 1980, when I was three years old. At this point, it just looks unsustainable. Historically, when gold has reached these kinds of extremes, it has either paused or pulled back. And if you bought gold in 1980, you had to wait until 2007 just to get your money back. The S&P 500 fell by around 30 bps on the day, with selling spread across the market and no signs of dispersion. Oddly, volatility was also down, which isn’t easy to explain and is not what we typically expect. Perhaps that points to the nature of the selling, suggesting it came more from real sellers than the usual programmatic flows we often see.

The S&P 500 fell by around 30 bps on the day, with selling spread across the market and no signs of dispersion. Oddly, volatility was also down, which isn’t easy to explain and is not what we typically expect. Perhaps that points to the nature of the selling, suggesting it came more from real sellers than the usual programmatic flows we often see.

Still, the S&P 500 touched the 10-day exponential moving average and managed to bounce, so for now, support is holding. Until that moving average breaks, all of this remains just noise.

The IWM closed below its uptrend for the first time since August, a line that has been steady for some time. Maybe it’s nothing, and the IWM bounces today. Or maybe the RSI breakdown is signaling that a change in trend is underway. A move back below the old 2024 high would not be a positive development and would likely signal a return to the 20-day moving average.