Bitcoin set for a rebound that could stretch toward $100000, BTIG says

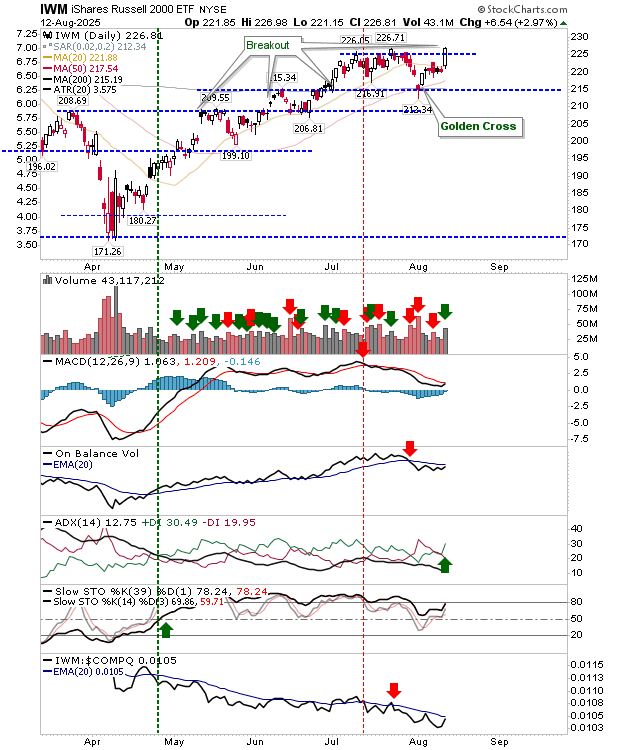

When I left for holidays, the Russell 2000 (IWM) made a breakout, only to dip below breakout support. But upon return, the Russell 2000 ($IWM) has gone on to make a new breakout on higher volume accumulation.

However, technicals are still mixed, although the MACD trigger and On-Balance-Volume are close to fresh buy triggers.

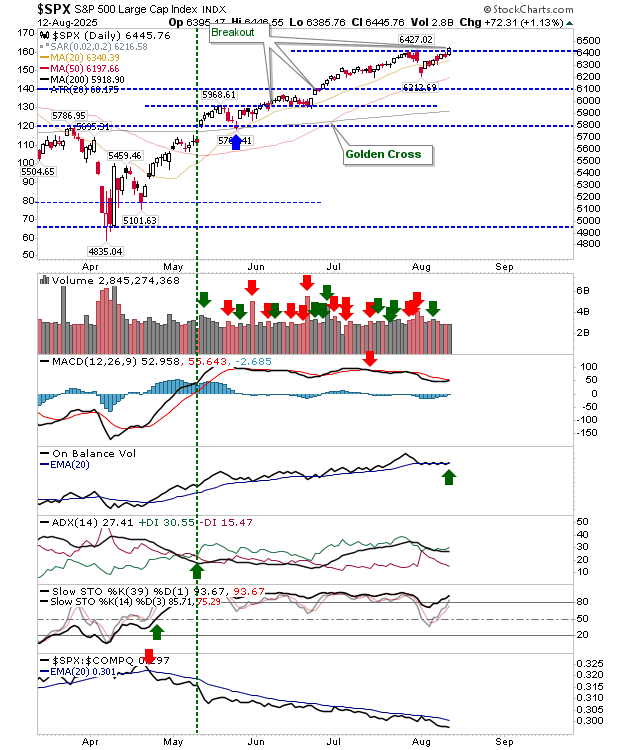

The S&P 500 posted a new breakout after an earlier trend break. In doing so, the process of posting small gains returns. The 20-day MA has played as support and this should continue for now. Technically, only the MACD trigger is holding to a ’sell’ trigger.

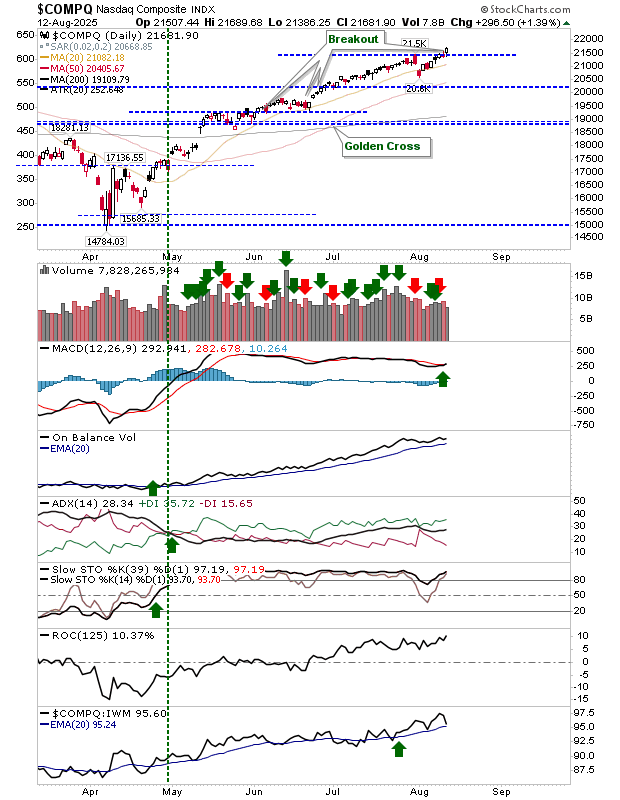

It was a similiar story for the Nasdaq ($COMPQ) as it posts a new breakout, except it did so on net bullish technicals - the only index to do so.

While indices have recovered well from Trump’s Tariff Tantrum, none have reached a point where they could be considered extended (relative to their 200-day MAs). And given that, at least until Labor day, the outlook for all markets remains positive.

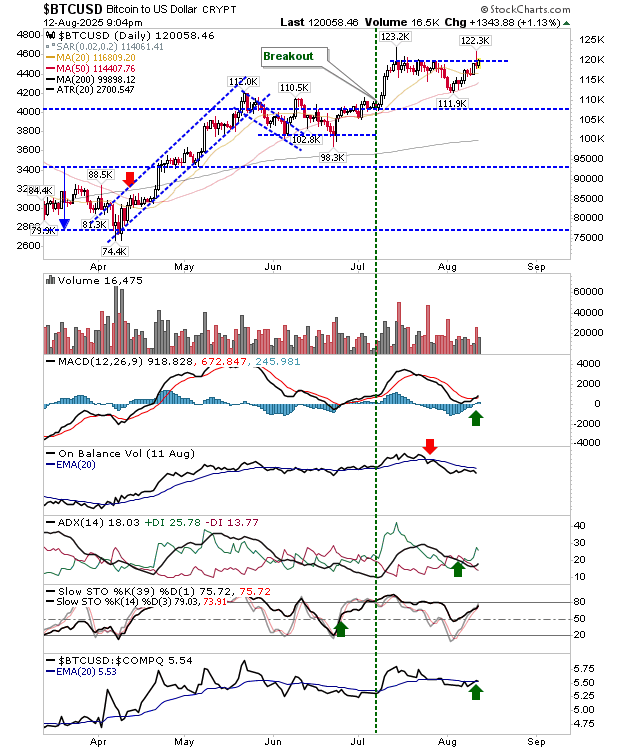

Only Bitcoin ($BTC/USD) has yet to follow the index lead. However, it’s well primed to post a breakout with technicals improving.

For now, long trades remain favored.