Gold prices drop amid waning rate cut bets; central bank demand remains

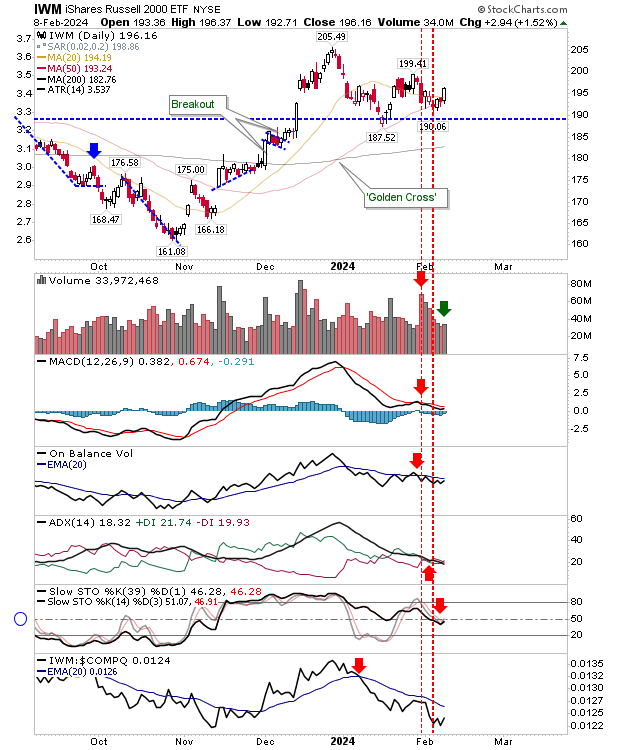

It was a real non-event for the S&P 500 and Nasdaq, so it was left to the Russell 2000 to take up the slack.

The Russell 2000 (IWM) posted a solid gain to keep the momentum going from its successful 50-day MA test.

If there was a concern it was that buying volume was a little disappointing, although yesterday's trading registered as accumulation, continuing a trend of weakening volume since the initial sell-off spike.

Technicals for the Russell 2000 are also net bearish, despite yesterday's gain.

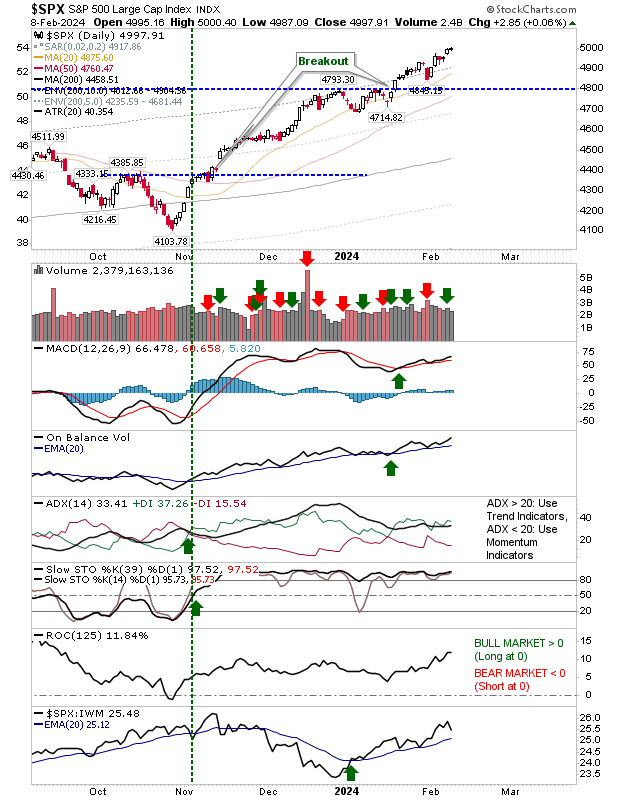

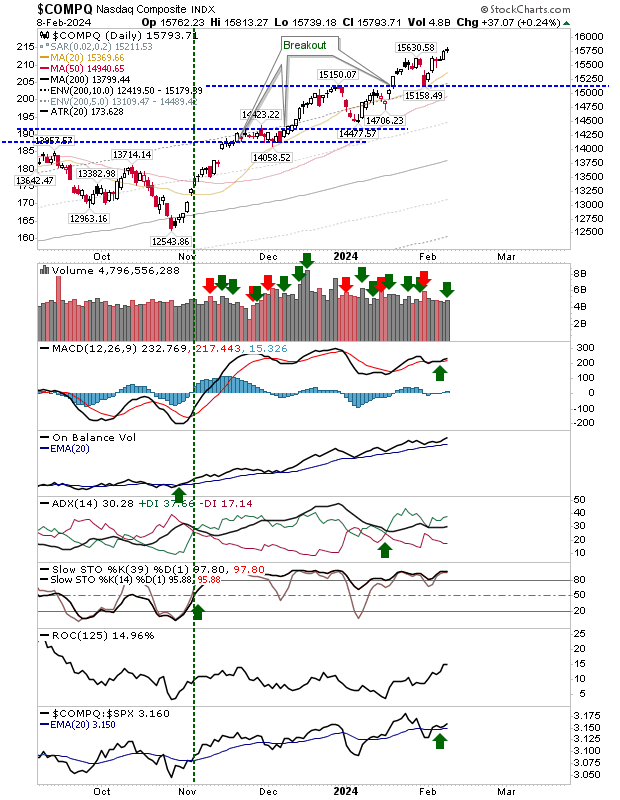

The Nasdaq and S&P 500 both finished flight with narrow doji. Technicals are net bullish and the only difference is that the Nasdaq is slightly outperforming the S&P 500.

Market breadth is negative, so a some point this weakness will be represented in the markets, but what should happen and what happens are often two different things.

Today, I would be looking for the Russell 2000 to continue its advance which would also mark a significant improvement for the weekly candlestick.

If there is any profit taking in the Nasdaq and S&P 500 I would be looking for the Russell 2000 to benefit, or at least, not suffer as much.