Truist Securities reiterates Buy rating on Salesforce stock, maintains $380 price target

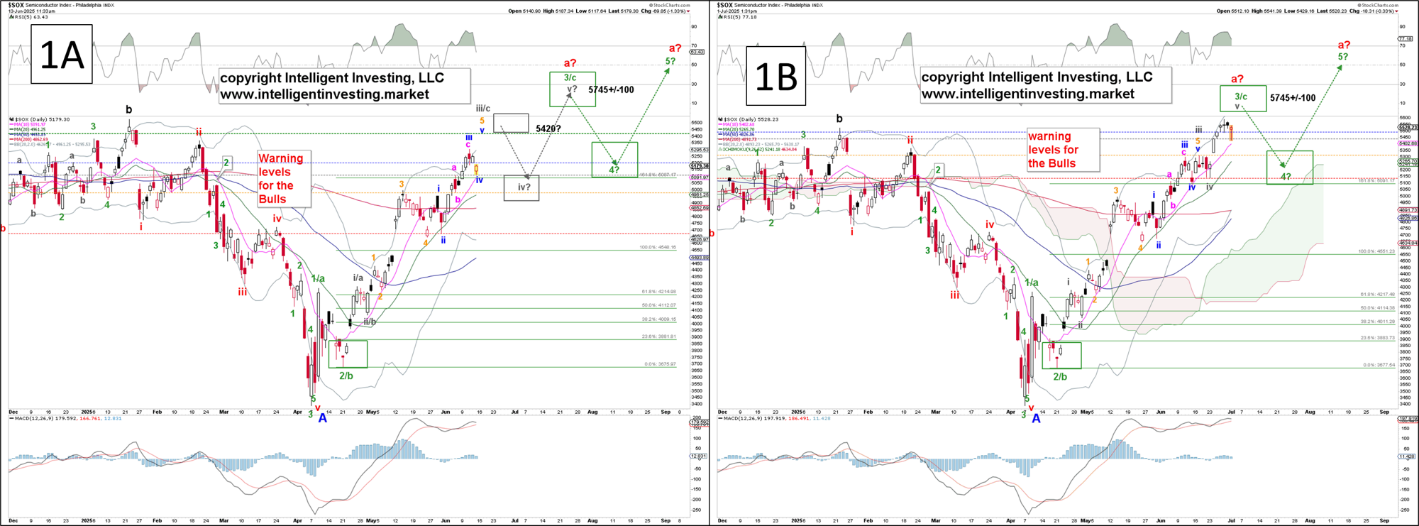

In our previous update from June 13th, we found that for the Semiconductor Index (SOX) based on the Elliott Wave (EW) Principle, a local top was due at ideally ~$5420, followed by a minor 4th wave correction (gray Wave iv?) to $5050+/-50 and a fifth wave (gray W-v) to $5745+/-100. See Figure 1A.

The index hit a high of $5311 on June 17, dropped to $5140 on June 23, and then rose to $5588 on June 27. Therefore, since our target zones were only off by up to 2%, the index followed the predicted “up->down->up” pattern, once again showing the strength of the EW. See Figure 1B.

Figure 1. Our preferred short-term EW count with several technical indicators and moving averages:

We continually review previous work to ensure that we accurately track the index and prevent it from drifting, which would necessitate adjustments. Forecasting financial markets is like predicting the weather; both are stochastic and probabilistic systems. Therefore, both need adjustments when the data changes. To that extent, we have our colored warning levels. If the index’s price stays above the orange level, there’s no real reason to suspect a, in this case, top. The blue and gray levels tell us to start paying more attention, whereas a drop below the red level guarantees us that a (local) top is in place. These warning levels are raised as the index moves higher, keeping us on the right side of the trade for as long as possible. E.g., compare the colored warning levels in Figure 1A vs. Figure 1B.

In the short term, our preferred EW count suggests that the green W-3/c is likely to complete in the ideal $5,745+/100 target zone over the next few days. The market can then determine whether it will provide us with the green W-4, -5 sequence, or if the larger bounce we have expected since early April has already been finished. Thanks to EW, we will know soon enough, as breakdowns below key price levels, which we have access to, will indicate that the green W-5 will not occur.