Tyson Foods to close major Nebraska beef plant amid cattle shortage - WSJ

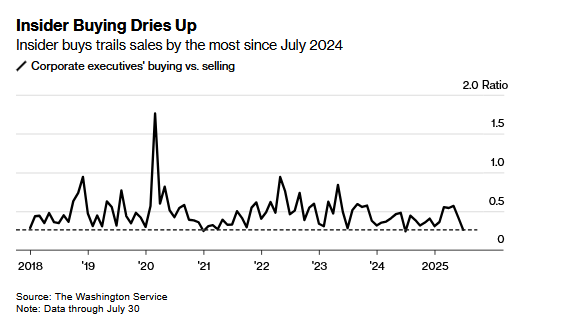

While the market steadily rose throughout June and July, corporate insiders were growing less enthusiastic about the stock market. Less than a third of S&P 500 companies saw insiders purchase stock in their own company in July. That is the lowest figure since 2018.

Moreover, the ratio of buys to sells for insiders fell to almost half of its longer-term average and now sits at its second-lowest reading in four years. Per Bloomberg’s article

“Corporate Insiders Were Dumping Stocks Into July’s Record Rally“:

“Corporate executives are behaving a lot like institutional investors right now: cautious, conservative, and valuation-sensitive,” said Dave Mazza, chief executive officer of Roundhill Investments.

“The people that know the most about companies are telling you that much of the good news is discounted,”

The logic in following the actions of corporate insiders is that they have more knowledge about their companies than other investors. Thus, their cumulative actions indicate their valuation view is different from that of the optimistic market. While the recent bout of insider selling and lack of buying is a warning, it’s not a good timing tool.

Bottom line: This data, along with high valuations, a weakening economy, and overbought technicals, provides a good reason for caution. However, we should not overreact. Insiders do have more knowledge, but their collective actions have proven at times to be poor indicators of the future. The graph below is courtesy of Bloomberg.

The Dissenters Should Get Another Rate Cut Vote For The September Meeting

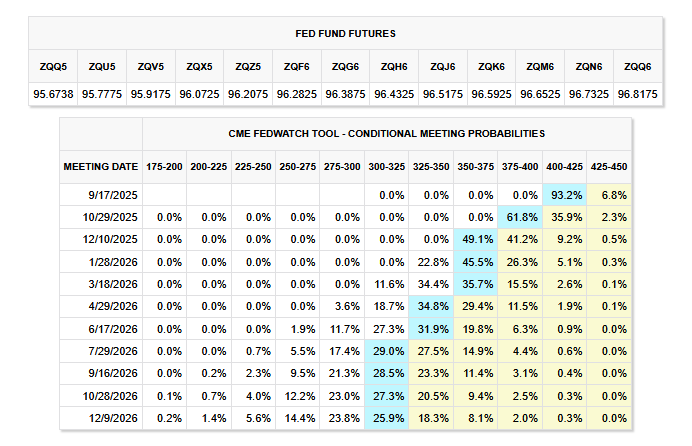

In a surprise to the markets, the Fed, and the President, Fed Governor Adriana Kugler announced that she would leave the Fed immediately, instead of waiting for her term to expire in January. Her role as Governor made her and her replacement permanent voters on the FOMC. President Trump intends to fill her position by the end of next week. This is important as the new Governor will be in place to vote at the mid-September FOMC meeting.

This new nominee will likely agree with the President and the two dissenters from the last meeting that rates should be cut immediately. Potential candidates could include those already in contention for other high-profile economic roles, such as former Fed governor Kevin Warsh or current Fed governor Christopher Waller, both of whom have been mentioned in discussions about Powell’s replacement.

While the latest employment data and its stunning revisions significantly increased the odds of a rate cut in September, Kugler’s replacement further increases those odds.

As the table below shows, the market is now priced for 25bps rate cuts at each of the next three meetings. Such would bring the Fed Funds rate down to 3.50-3.75%.

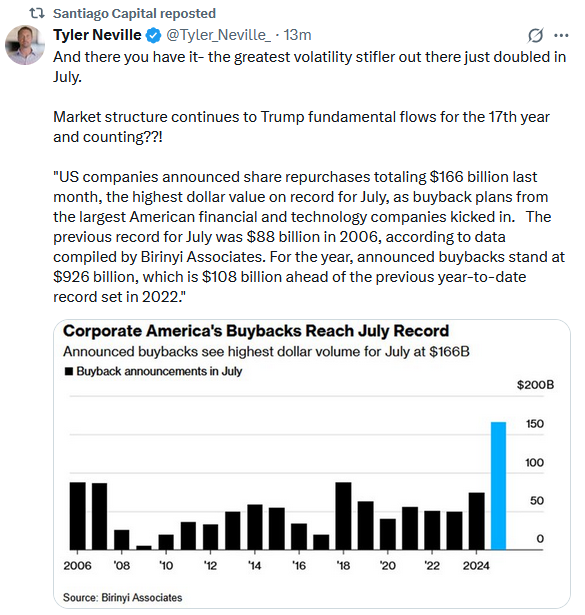

Tweet of the Day