Tyson Foods to close major Nebraska beef plant amid cattle shortage - WSJ

My macro models have been suggesting a bi-modal framework to approach markets for the near future: Run It Cold Now (growth).

My Run It Cold Now theory has been increasingly vindicated by labor market data, and markets are often busy trading what’s in front of them rather than looking through a potential reacceleration in 2026.

This is why it’s vital to figure out:

- How early/late do we sit within the ‘’Run It Cold Now’’ period?

- How much has the market priced in by now?

- Consequently, is it still worth getting engaged in Run It Cold trades, or shall we look at Run It Hot Later ideas already?

As a reminder, my macro models suggest tariffs will act as a fiscal tightening mechanism until year-end.

By early 2026, the OBBB fiscal impulse will offset, and Trump’s new initiatives alongside lowered Fed Funds and private money creation should propel a Run It Hot Later period.

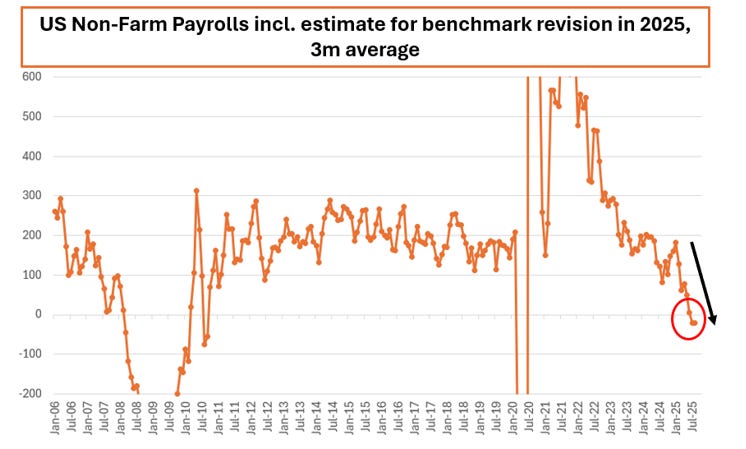

First, some evidence that US labor demand is really weak: extrapolating benchmark revisions from April 2025 onwards, the US has been consistently shedding jobs!

To get a broader perspective on the labor market, we can rely on unrevised data which incorporates demand and supply for labor: for example, unemployment rate and its important subcomponents.

The chart below shows the number of long-term (27+ weeks) unemployed Americans as a percentage of the total labor force. At 1.14%, this number is already as high as in 2002 or summer 2008 – in both cases, a recession was already visibly hitting America:

Why is US labor demand so weak?

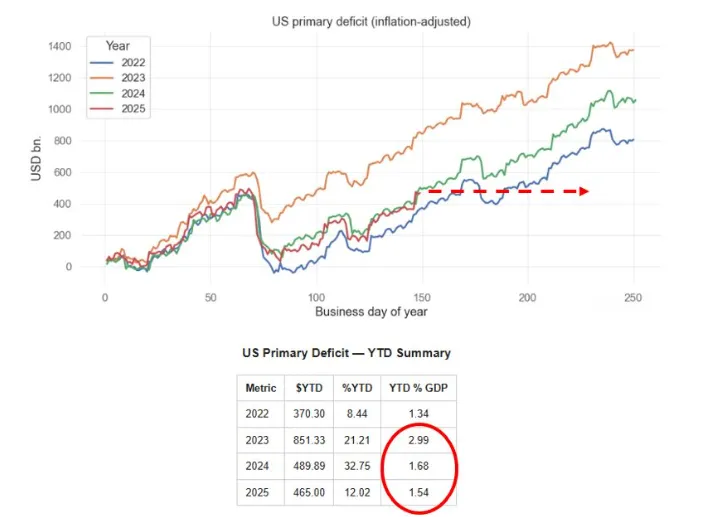

Due to tariffs, the US is going through a slowdown of its primary fiscal impulse: the 2025 primary fiscal deficit sits almost 20 bps below last year and markedly below the 2023 pace.

Tariffs are effectively acting as a tax on US companies and consumers:

This seems to be confirmed by ‘’the best economist Druckenmiller knows’‘: the internals of the stock market.

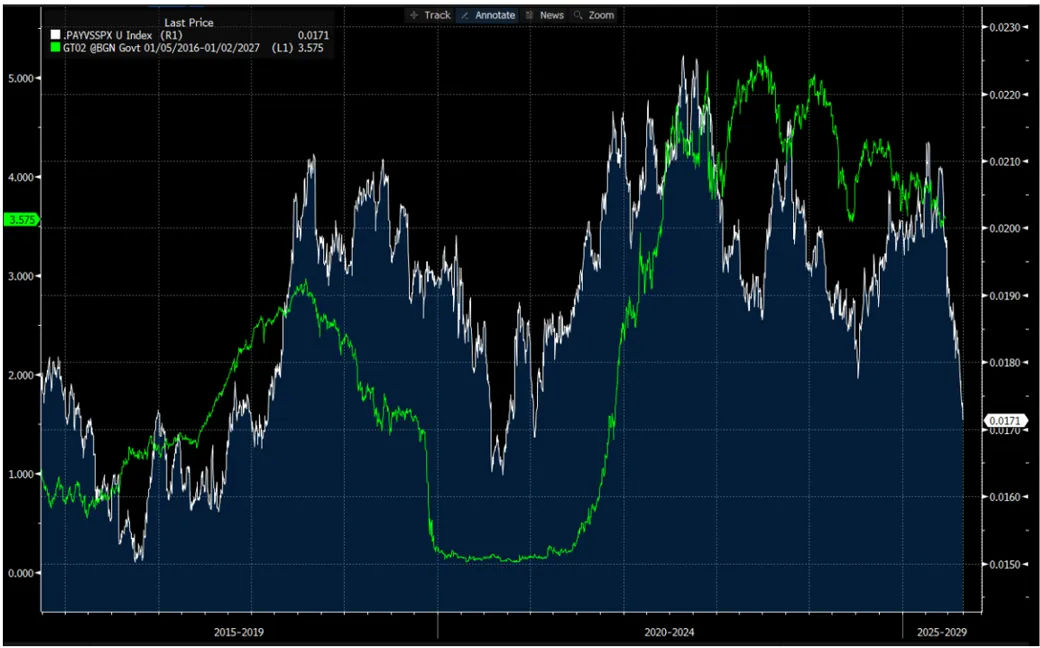

The chart below shows (in white) the ratio between an index of the 5 largest US payroll processors companies and the equal-weight SPX, plotted against 2-year Treasury yields (in green).

If there are no new jobs, the largest payroll processor companies in the US will suffer - and indeed, their stocks are trading very weak.

This is an example of how the internals of the stock market suggest the US labor market is very weak, and that the Fed will be soon called to ease more:

The US economy is ‘‘running cold’’ now, yet stock markets are roaring and risk sentiment remains very aggressive - why?

The private sector money printer is going BRRRR, led by AI.

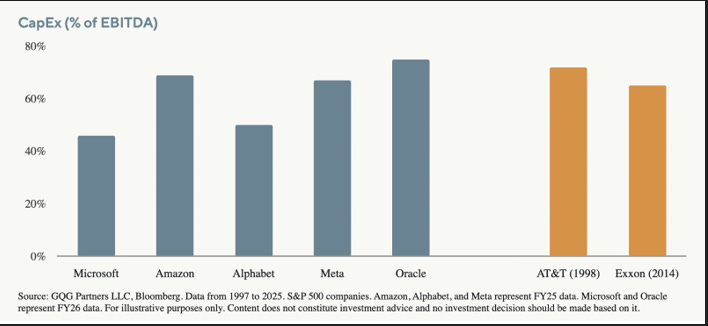

The chart below shows the big-tech announced capex spending as a % of their EBITDA – it’s already over 65% on average, exceeding the AT&T (NYSE:T) spending of 1998. To keep up this pace next year, companies will have to resort to debt-funded AI capex:

AI Capex mechanically adds to US GDP even before we get to talk about the ROI.

But the biggest issue with AI Capex is that it doesn’t really add jobs for the median American for now, and hence, we are left with two economies: a hot AI-related economy and a broader labor market struggling under the fiscal tightening induced by tariffs.

The stock market is not the economy, and the gigantic AI capex effort, coupled with large global fiscal stimulus programs, continues to support risk sentiment.

Our global real-economy money printing index is very strong.

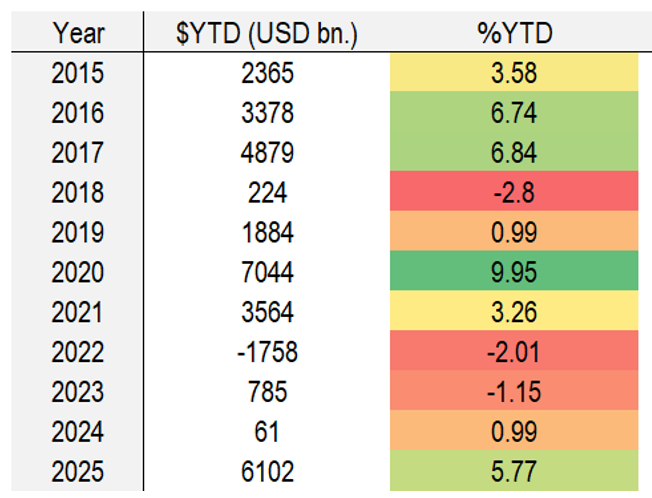

We tracked the YTD pace of inflation-adjusted $ money creation around the world, and this year we have scored an impressive 5.77% increase in real-economy money printing around the world.

This comes after 3 weak years led by the gigantic Chinese housing deleveraging, and the YTD pace in 2025 is in line with the ‘’concerted global growth’’ pace of 2017.

The global pace and acceleration are quite robust, and it’s mainly driven by China, which has restated its credit engines after 2-3 years of robust housing deleveraging.

Despite being crippled by tariffs (e.g., a large tax), US money creation is accelerating, led by the AI-related debt-funded capex spending on data centers.

And money printing is only set to accelerate going forward.

From a fiscal standpoint, we are 100% sure that from early 2026, we will see:

- Germany is adding to money creation via a large increase in primary spending.

- The US OBBB kicking in with its fiscal stimulus, offsetting tariffs and money destruction;

- Korea, Sweden, and many other countries are kick-starting deficit spending programs

We might be looking into a scenario where the Fed cuts rates, but global money printing accelerates.

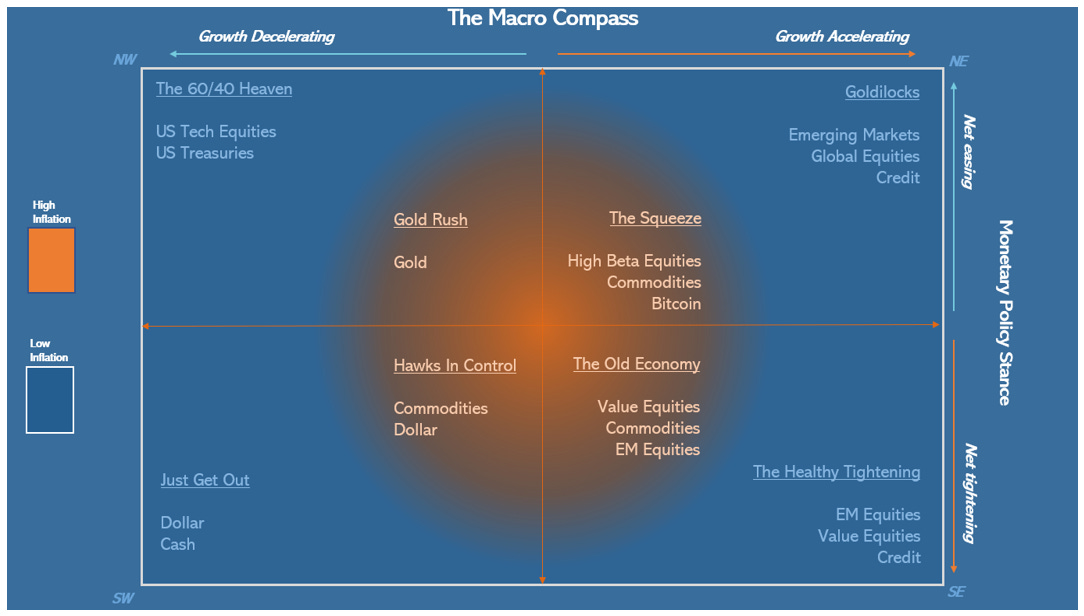

If we dust off my TMC Quadrant Asset Allocation Model, that puts us in the top-right quadrant:

In short, historically, the best asset allocation for such an environment involves selling IOUs and paper assets and buying tangible risk assets.

Basically:

-

Sell US dollar and bonds,

-

Buy stocks and assets linked to nominal growth

The most painful outcome for institutional investors would be an equity rotation towards EM/Value + a commodity rally.

These are very underowned asset classes, and they could rally right when standard portfolio hedges such as USD and bonds would fail to deliver.

And the Market Gods enjoy inflicting the proverbial Pain Trade every now and then…

Thanks for reading!

***

This article was originally published on The Macro Compass. Come join this vibrant community of macro investors, asset allocators and hedge funds - check out which subscription tier suits you the most using this link.