Bitcoin price today: sinks below $86k as mixed US jobs data dents Fed cut hopes

Silver futures are undergoing a textbook rotational correction following one of the strongest hyperbolic extensions of the year. The market reached a parabolic peak at $54.415, a level that aligned perfectly with the Daily Sell 1 band, the Fibonacci 78.6% retracement, and the apex of the accelerating upper trendline. This alignment created a high-probability exhaustion point, and the rejection that followed was immediate, symmetrical, and mathematically precise.

From that peak, silver collapsed back through the Daily VC PMI ($51.31) and descended into the upper boundary of the Daily Buy 1 zone at $49.24. The deeper Daily Buy 2 at $47.79 corresponds exactly with the low printed this week, creating a clean, quant-driven confirmation that the correction is structurally controlled. Momentum indicators—including MACD—signaled exhaustion at the top, but they have not broken the underlying daily trend, indicating that the market is resetting, not reversing.

On the weekly timeframe, the break below the Weekly VC PMI at $51.12 shifts price into the lower half of the weekly distribution curve. The market is now approaching strategic accumulation levels at Weekly Buy 1 ($47.81) and Weekly Buy 2 ($47.37). These levels overlap with the key Fibonacci retracements of the prior week’s expansion, creating a powerful clustering effect that strengthens the probability of a major buy window between $47 and $48. This is the zone where institutional mean-reversion systems, including VC PMI and Gann cycle harmonics, typically reengage.

The monthly structure remains firmly bullish despite the volatility. The Monthly VC PMI at $47.34 and Buy levels down to $44.72 define the broader accumulation range. The recent spike above Monthly Sell 2 ($53.83) confirmed statistical overbought conditions for November, and the pullback that followed is a normal, healthy mean-reversion into the long-term equilibrium. There is no evidence of long-term structural damage.

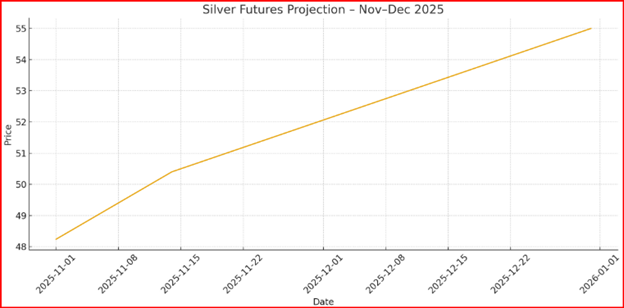

The dominant force remains the 360-day cycle, which projects upside continuation into late December and Q1 2026. With long-cycle Sell levels at $52.61 and $58.58, the recent $54.41 high fell directly within the long-cycle distribution zone, triggering an expected corrective swing. This reset strengthens the next phase rather than weakening the primary trend.

Integrated across all timeframes, silver is entering a high-probability accumulation zone between $47.00 and $49.50. Once the reset completes, the model projects an initial rebound to $52.00–$53.50, a retest of $54.41, and a long-cycle target of $58.00–$60.00 into early 2026.

TRADING DERIVATIVES, FINANCIAL INSTRUMENTS AND PRECIOUS METALS INVOLVES SIGNIFICANT RISK OF LOSS AND IS NOT SUITABLE FOR EVERYONE. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.