China’s Xi speaks with Trump by phone, discusses Taiwan and bilateral ties

Precious metals bulls rose sharply last summer into the heart of inflation headlines and Ukraine war news. Since that time, both gold and silver have moderated but remained elevated in a consolidation pattern.

But recent price action in silver could be a bullish signal for metals bulls.

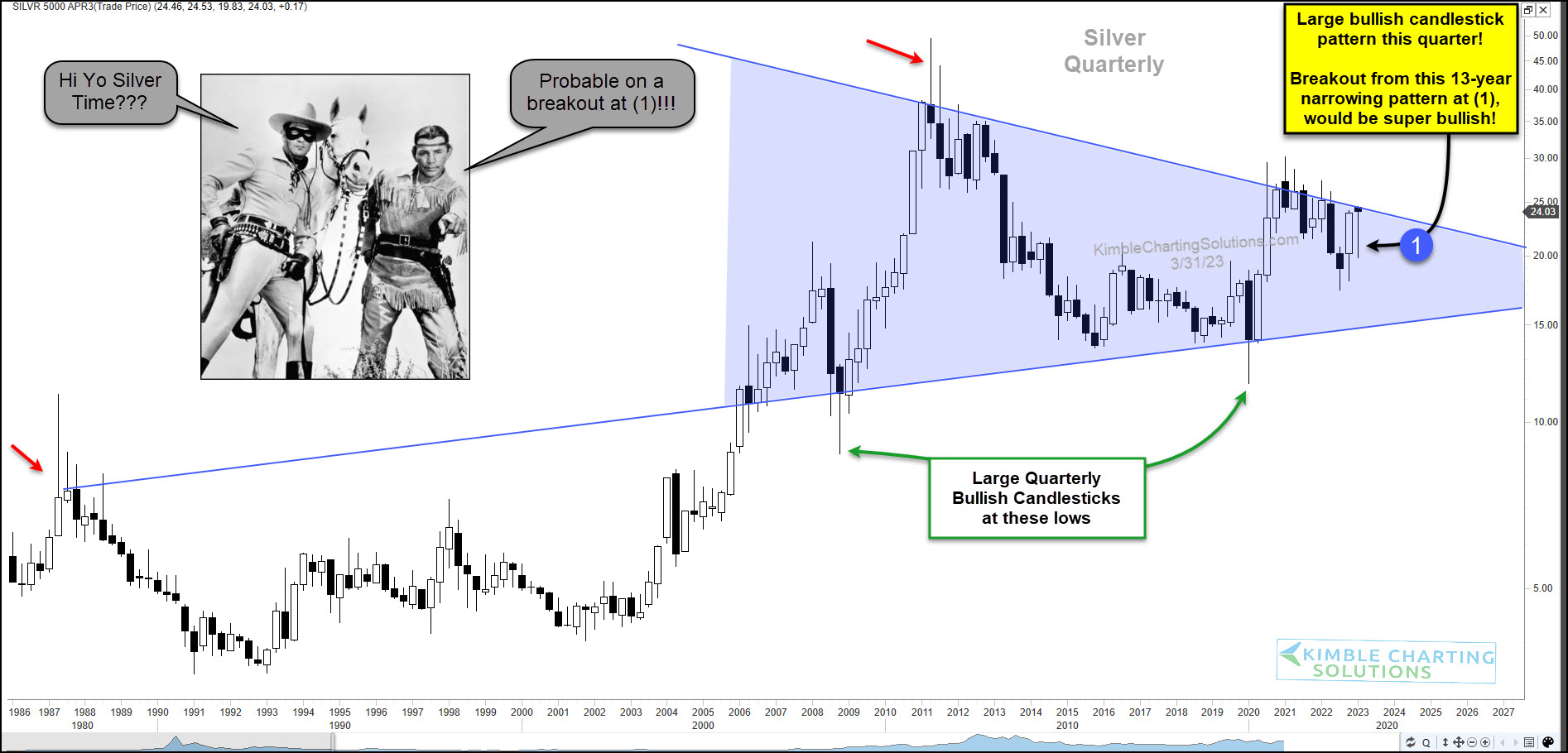

Today we look at a quarterly chart of silver. As you can see, silver has been in a long-term narrowing pattern, formed by two large quarterly bullish candlesticks and one bearish candlestick.

Within this pattern, silver formed a bullish candlestick last quarter at (1) with its price closing at the upper end of the long-term narrowing pattern. If bulls can follow through with another strong quarter, we may see a bullish breakout for silver and a “Hi Yo” celebration for metals bulls.

In an uncertain world, it pays to be aware of price patterns… especially for precious metals. Will silver break out? Stay tuned!