Nvidia shares pop as analysts dismiss AI bubble concerns

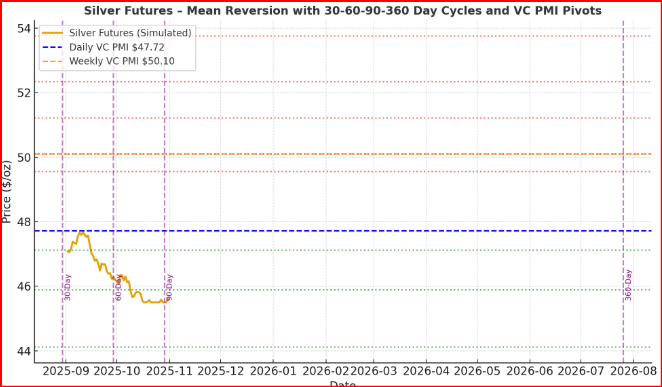

Silver futures continue to exhibit strong mean reversion behavior within both the daily and weekly VC PMI frameworks, with the current price at $49.005, reflecting a 2.78% gain on the session. The recent rebound from $46.82 marks a pivotal technical recovery from deeply oversold conditions, where both the Daily Buy Zones ($46.78–$45.89) and Weekly Buy Zone ($47.12–$44.11) were tested successfully. This validation of demand beneath the $47 level underscores the market’s capacity to absorb selling pressure and reestablish its equilibrium point near the Daily VC PMI mean at $47.7

The structure now shifts toward testing the upper resistance cluster defined between $49.55 and $50.10, where the Weekly VC PMI mean sits as the primary reversion pivot. A close above $50.14 would confirm renewed bullish momentum and activate the next price objectives at Sell 1 ($53.46) and Sell 2 ($56.78), completing a full mean reversion cycle from the weekly support levels. The price structure suggests the presence of a descending wedge pattern that has been gradually compressing volatility, and the current breakout attempt along the upper channel boundary reflects the first sign of a potential trend reversal.

From a momentum perspective, the MACD remains slightly negative at –0.14, but the histogram compression and flattening signal a transition from bearish to neutral conditions. Should price maintain above $48.80, a bullish crossover is likely, confirming a structural reversal consistent with prior mean reversion breakouts. The Fibonacci retracement from the high at $53.76 to the recent low at $46.82 highlights that silver has recovered approximately 23.6% of its prior decline, indicating the early stage of a potential multi-wave recovery.

The next key validation level resides at $49.55 (Daily Sell 2). A decisive 15-minute or hourly close above this threshold would reinforce the breakout scenario and establish a short-term momentum base targeting $50.14and $51.21. Conversely, failure to maintain support above $47.72 (Daily Mean) would likely revert the market toward the Weekly Buy Zone ($47.12–$45.89), aligning with the upcoming 30-day cycle pivot window, projected to act as the next accumulation phase before an extended advance.

Overall, silver’s market structure suggests that the mean reversion process is maturing, transitioning from stabilization to potential acceleration. A confirmed breakout above $50.10 would transform this recovery into a broader cycle reacceleration phase, possibly aligning with the 60–90-day cycle upswing leading toward the next 360-day expansion window into early 2026.

***

TRADING DERIVATIVES, FINANCIAL INSTRUMENTS AND PRECIOUS METALS INVOLVES SIGNIFICANT RISK OF LOSS AND IS NOT SUITABLE FOR EVERYONE. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.