Gold prices dip as December rate cut bets wane; economic data in focus

Silver futures continue to display an extraordinary hyperbolic advance, trading at $53.165 after reaching a spike high of $54.415 earlier in the session. The market has now entered a rare phase where both price structure and time cycles are working in synchronized alignment, producing one of the strongest multi-day moves in recent years. The advance from the low at $47.41 earlier this week has been vertical, accelerating through each Fibonacci retracement level—38.2%, 50%, 61.8%, and 78.6%—without hesitation. This type of price behavior is characteristic of a market in a runaway trend, supported by both structural and cycle-based forces.

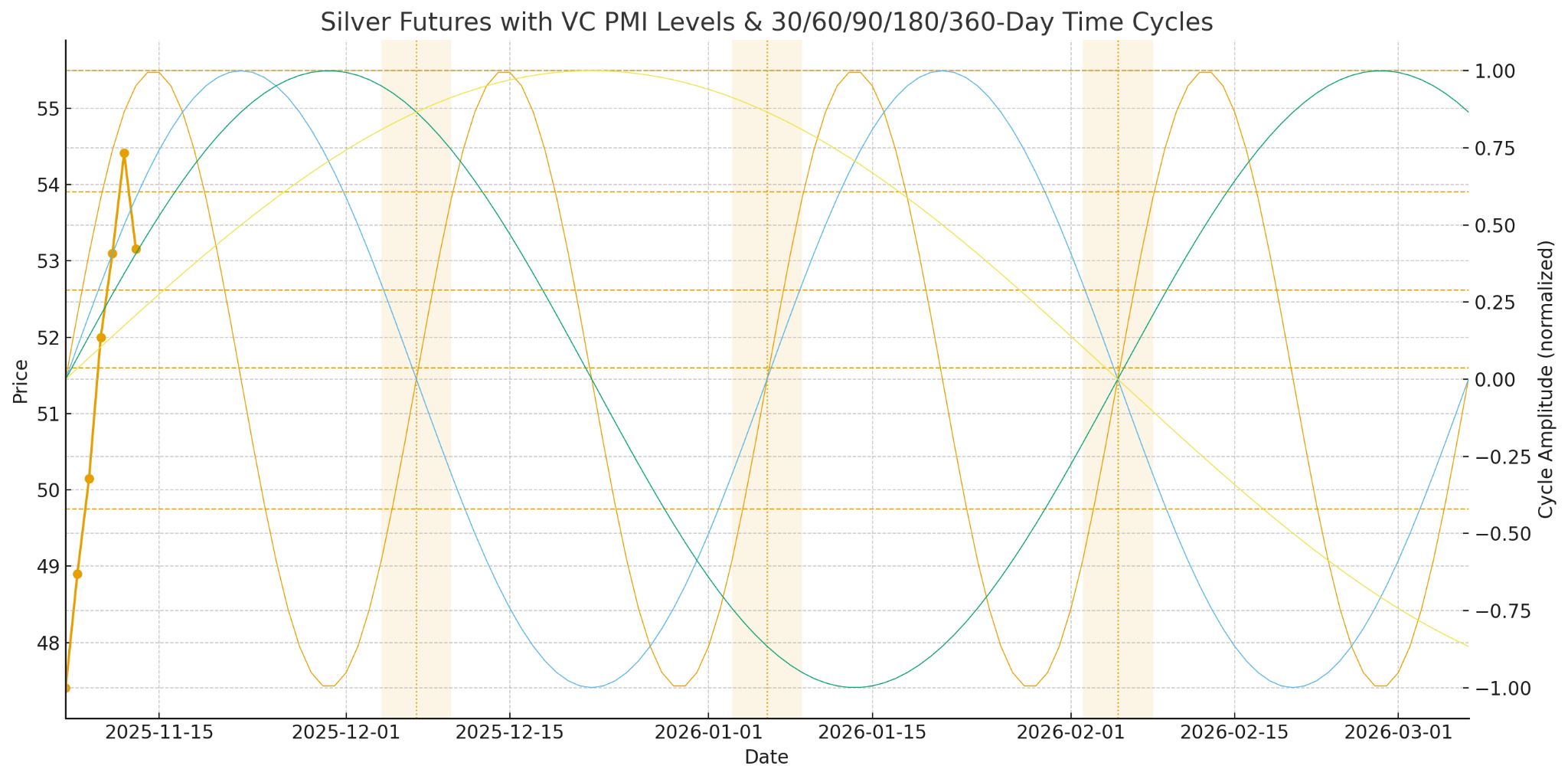

The VC PMI daily model places the mean at $52.62, which has been decisively penetrated to the upside, confirming the bullish bias. As long as the price holds above this daily equilibrium, the probability strongly favors continued momentum toward the upper fractal targets. Daily Sell 1 ($54.47) has already been reached, and the next harmonic, Daily Sell 2 ($55.49), stands as the next immediate upside objective. On the weekly level, silver has exceeded Weekly Sell 1 ($49.15) and Weekly Sell 2 ($50.15), shifting the weekly fractal into an extremely bullish configuration that aligns with the ongoing multi-cycle expansion.

Time cycles now play a critical role in validating this move. The current leg higher began precisely at the start of a new 30-day cycle, a window historically known for initiating major trend extensions. The 60-day cycle—which tends to generate sustained rallies during its first phase—supports continued acceleration toward the $55.49–$57.00 zone. The 90-day cycle is now entering its expansion stage, typically the most explosive segment of the cycle, projecting intermediate targets between $58 and $62 over the next two to three weeks. The most powerful alignment is seen in the 180-day cycle, which has just turned up and typically precedes the largest silver advances. This cycle supports the long-term hyperbolic phase, with potential upside toward $65–$72 into early 2026.

The MACD has turned higher again, confirming renewed momentum after a minor consolidation, while volume expansion signals strong institutional participation. With all cycles—30, 60, 90, and 180 days—aligned in bullish formation, silver remains in a rare window where shallow corrections are likely to be followed by strong continuation. As long as silver holds above the Daily VC PMI ($52.62), the market remains positioned for further upside extensions.

***

Disclosure: This report is for educational and informational purposes only. It does not constitute investment advice, trading recommendations, or a solicitation to buy or sell any financial instrument. Futures, options, and commodities trading involves substantial risk and may not be suitable for all investors. Past performance is not indicative of future results. All trading decisions are solely the responsibility of the individual. The VC PMI model provides probabilistic forecasts, which are not guarantees. Use proper risk management at all times.