Gold prices dip as December rate cut bets wane; economic data in focus

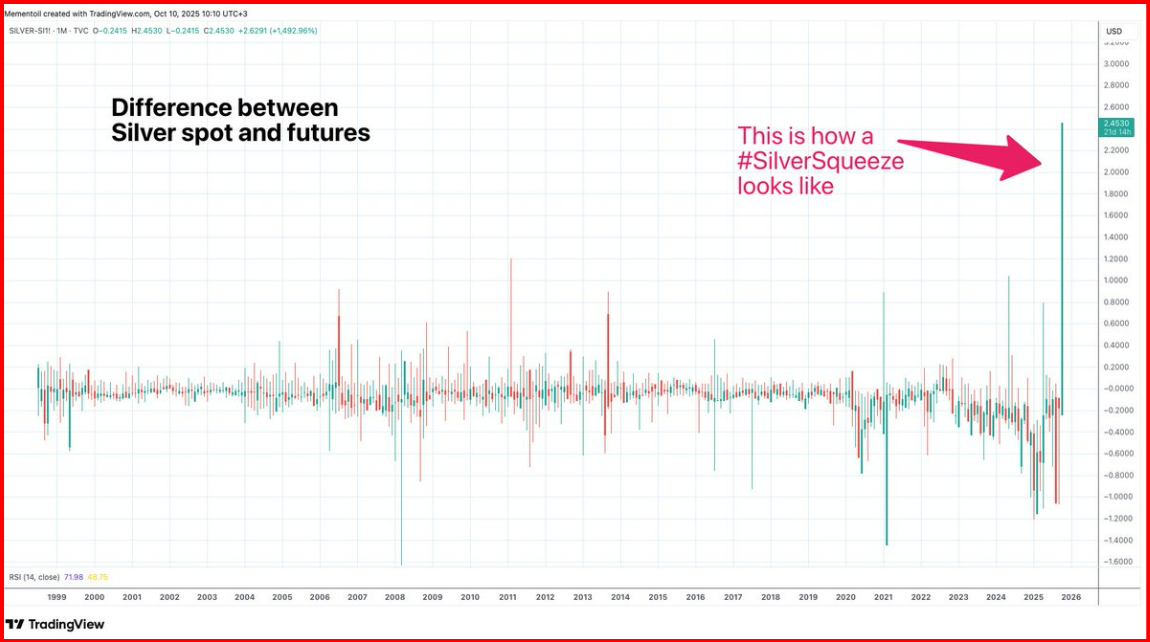

Silver futures have just inverted into a +$0.30 premium over spot, marking one of the strongest and most explosive signals the precious metals market can generate. This is not a routine fluctuation—it reflects a structural imbalance where immediate physical demand overwhelms available supply, forcing futures prices above spot in what is known as backwardation. Historically, this condition has only emerged during the most aggressive phases of silver bull markets, including the 2011 melt-up to $49 and the 2020 physical squeeze that drove spreads violently higher. Today’s inversion confirms that silver is no longer trading in a normal carry structure—the market has entered a phase where buyers must pay extra for immediate metal, signaling severe tightening beneath the surface.

From a market-microstructure standpoint, a +0.30 inversion is profound. Under normal conditions, futures trade below spot due to storage, financing, and carry costs. When that flips, it means fabricators, refiners, industrial buyers, and large speculators are competing for near-term supply. This is a direct indicator that physical inventories in COMEX and London are facing acute stress. Rising lease rates, declining registered stock, and heavy demand from ETFs or refiners typically accompany the early stages of backwardation. Once the front month goes premium, volatility accelerates and price discovery begins shifting to the futures market, typically resulting in vertical price action.

This inversion arrives at a critical moment in the silver cycle structure. The 30-day cycle is in its momentum expansion phase. The 60-day cycle is projecting an upward continuation window with no topping formation. The 90-day cycle is entering the acceleration band where trend velocity increases, not decreases. Most importantly, the 360-day cycle from the September 28, 2025 anchor continues to project upward pressure into December 2025. The inversion acts as the “spark” that ignites this synchronized cycle convergence, transforming a bullish trend into a hyperbolic trajectory.

Within the VC PMI fractal framework, today’s inversion elevates Buy 1 and Buy 2 levels from normal support to high-probability reaccumulation zones. Any correction into these zones within the next 48–72 hours should be considered part of a larger parabolic advance, not a trend reversal. The market is now in a condition where dips are shallow, volatility is structural, and breakout targets accelerate sharply.

In summary, the +0.30 inversion confirms that silver has entered a demand-driven shortage environment. Price behavior from here typically becomes disorderly to the upside, with multi-dollar daily moves becoming increasingly likely. This is the moment where long-term cycle projections and real-time market stress fully align.

***

TRADING DERIVATIVES, FINANCIAL INSTRUMENTS AND PRECIOUS METALS INVOLVES SIGNIFICANT RISK OF LOSS AND IS NOT SUITABLE FOR EVERYONE. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.